Invest in your children

It's important for parents to foster the right investment skills in their children from a young age - here's how to get started

When it comes to investment, it's never too early to teach your children about the best ways to save for the future. As for the best home for savings for children, there are a myriad of options to choose from, with the most popular being a child savings account, Junior ISAs (JISAs for short) or Child Trust Funds (which were scrapped in 2011, read on for more information). Another option which isn't so widely recognised is Child pensions.

Child savings accounts can be a good starting point. Banks and building societies will offer cash savings plans, and they will typically accrue interest tax-free, but with interest rates at a record low, there are other options to help grow your child's savings from a young age.

Then there's JISAs. Much like their parent (the ISA), JISAs offer a tax-efficient way to save. Similarly, there are two types – cash JISAs and stocks and shares JISAs. Until 5 April 2015, you can save £4,000 into a JISA, and from the 6 April 2015 this rises to £4,080, and this can be split between cash and stocks and shares. The child can't touch the money until he or she is 18, but it's worth remembering that once they reach that age, the money is theirs and they can do whatever they want with it – regardless of their parents' wishes for it to be spent on university or a house deposit. And as adult ISAs are available to those aged 16 and over, children aged 16 or 17 can actually benefit from investing in both an ISA and a JISA at the same time.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Many investment platforms offer DIY JISA plans, offering a big fund and stocks and shares universe to choose the right investment for your child. But, remember it is them – and not you – that you are saving for, and tailor the investment portfolio accordingly.

However, not all under-18s are eligible for a JISA. If your child was born between 1 September 2002 and 2 January 2011, he or she will have a Child Trust Fund (CTF) instead, which were scrapped for new savers in January 2011 and replaced with JISAs. The CTF scheme included added government contributions – which have now stopped, but they can still be topped up with £4,000 tax-free each year. Initially there were no transfers allowed between CTFs and JISAs, but following a government consultation, transfers will be allowed from April – meaning millions of children can benefit from the superior interest rates on offer with JISAs.

Junior SIPPs work in the same way as adult SIPPs – they're a self-invested personal pension, where you can add investments to a DIY portfolio. Starting a pension for a young child might seem a bizarre idea, given that they can't access it until they're 55, (this is likely to be higher by the time they retire) but invest sensibly and you can set your offspring up for retirement.

Junior SIPPs allow a great deal of flexibility when it comes to choosing investments – everything from stocks and bonds to property and cash is permitted – but thanks to the wide investment universe, they involve time and research to work out exactly what you'd like to include in it. The Junior SIPP will attract tax relief in the same way as an adult pension, provided that the net contribution is below £2,880 a year.

Additionally, investment platforms such as Alliance Trust Savings will offer investment accounts for children, allowing parents to put money into all kinds of investments on their behalf.

After deciding which savings vehicle is right for your child, it's worth talking to them about the different kinds of investments when they're old enough, and how to save sensibly and efficiently throughout their young life.

Stocks and shares are riskier than cash as you might not get back the same amount you invested. However, as you're investing for the long term for your child, the rises and falls of the stock market will usually iron themselves out, as historically the stock market has outperformed cash. You can invest directly in stocks and shares, or indirectly through a collective fund that will invest in many different companies through one vehicle.

It's important to instil the notion of investing for the future from a young age. Choosing sustainable investments – companies that promote environmental factors, education or sustainable development – ensures that your child's investment will benefit both them and the wider world they grow up in. Investment firms that offer these kinds of sustainable funds will usually use a screening process to decide on an investment universe, which will typically include 'good' companies involved with tackling climate change, energy efficiency, education and sustainable consumption.

So why get started early? A study by the Money Advice Service and behaviour experts at Cambridge University showed that savings habits are set in stone by the age of seven. The study also showed that by seven years old, children understood the importance of planning ahead, and also grasped the notion that some choices are irreversible.

This means it's more important than ever for parents to foster the right investment skills from a young age, and to make the right decisions for the future.

Investments can go down as well as up. Investors may get back less than they originally invested. Alliance Trust does not give advice. You need to ensure you understand the risks and commitments before investing. If you are unsure you should consult a Financial Adviser before investing.

Laws and tax rules may change in the future without notice. The information here is our understanding in March 2015. This information takes no account of your personal circumstances which may have an impact on tax treatment.

For more on saving for your children, click here.

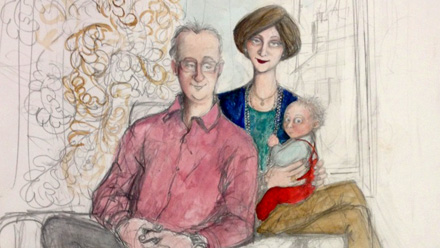

Illustration by Sue Macartney-Snape for the Daily Telegraph.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

American universities are losing ground to their foreign counterparts

American universities are losing ground to their foreign counterpartsThe Explainer While Harvard is still near the top, other colleges have slipped

-

How to navigate dating apps to find ‘the one’

How to navigate dating apps to find ‘the one’The Week Recommends Put an end to endless swiping and make real romantic connections

-

Elon Musk’s pivot from Mars to the moon

Elon Musk’s pivot from Mars to the moonIn the Spotlight SpaceX shifts focus with IPO approaching