How do changes in interest rates, inflation and exchange rates impact on my portfolio?

Understanding how the major economic indicators work will make you better equipped to react to the big economic changes ahead

Economic forces such as interest rates, inflation and exchange rates might seem complicated terms when you're a first-time investor, but how they work and relate to one another can have a huge impact on your portfolio. Of course, it's also important to pay attention to the cash flow and underlying investments of an individual company – or pooled fund – as well, but these 'macro' economic factors can have a significant effect.

Interest rates have been in sharp focus over the past few years, since the Bank of England base rate dropped to a record low of 0.5 per cent, where it has remained since March 2009. Interest rates are often the first metric many savers and investors will look at when deciding where and when to invest – a higher base rate means savers will benefit from higher interest rates, but borrowers pay more to borrow; while a lower base rate means interest rates fall and savers suffer, while borrowers benefit from cheaper loans. However, after six years at the low level of 0.5 per cent, there are stirrings that the base rate might be lifted at some point over the next year, thanks to growth in the economy.

But why do interest rates fall or rise in the first place? Cutting interest rates is usually the first instrument in a central bank's toolkit to stimulate growth, as it encourages companies and individuals to spend more by making borrowing less expensive. In contrast, raising interest rates is the first step to try to keep a lid on rising inflation which often occurs during a period of stronger economic growth.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Inflation is the rate of increase in the price of goods – the higher inflation is, the faster prices are rising and the less your money can buy – and central banks will typically use interest rates to bring inflation under their target, to ensure it doesn't rise to an unmanageable level. Any company's share price should increase with inflation – if it doesn't, it means your investment won't have earned any money in real terms, so it's essential that the returns from your portfolio are always inflation-beating.

Recently, central banks have resorted to quantitative easing (QE) to stimulate very weak economies. This involves central banks buying up securities with electronic money and as a result, swelling bank assets and encouraging them to make more loans. The desired effect is to stimulate economic growth, although the jury's out on whether or not the Bank of England's past rounds of QE have made much difference. Some commentators also worry that QE may lead to higher inflation in the future as there is more money in the system.

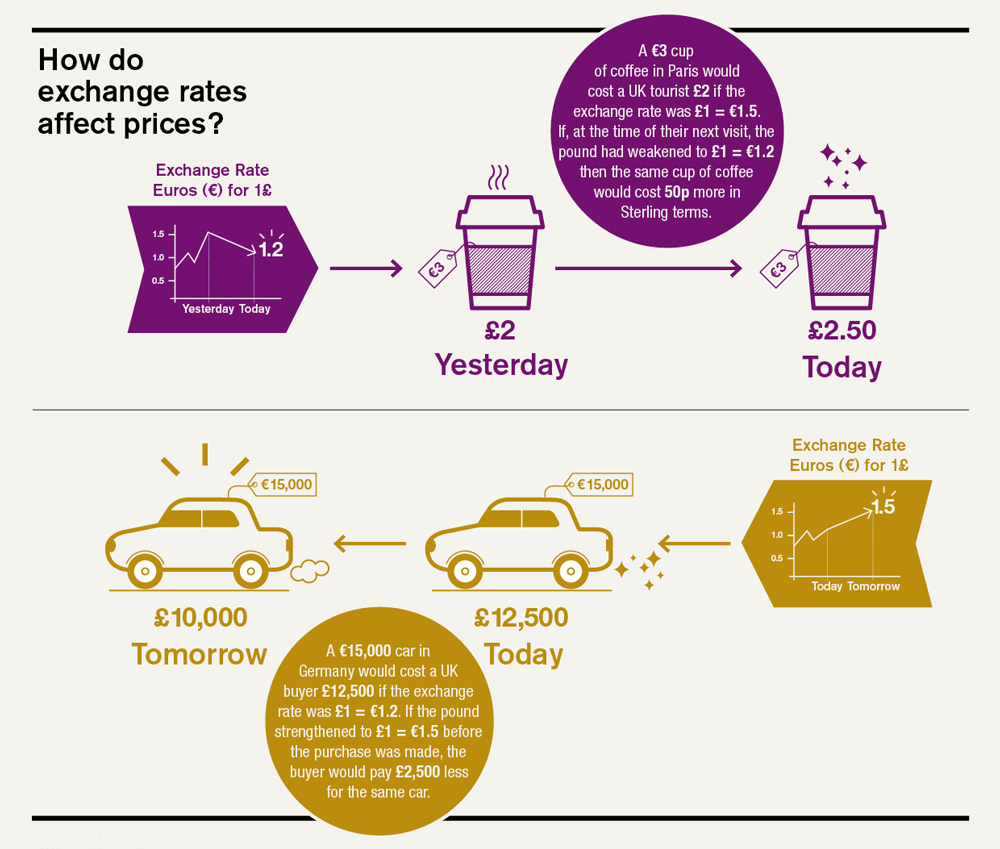

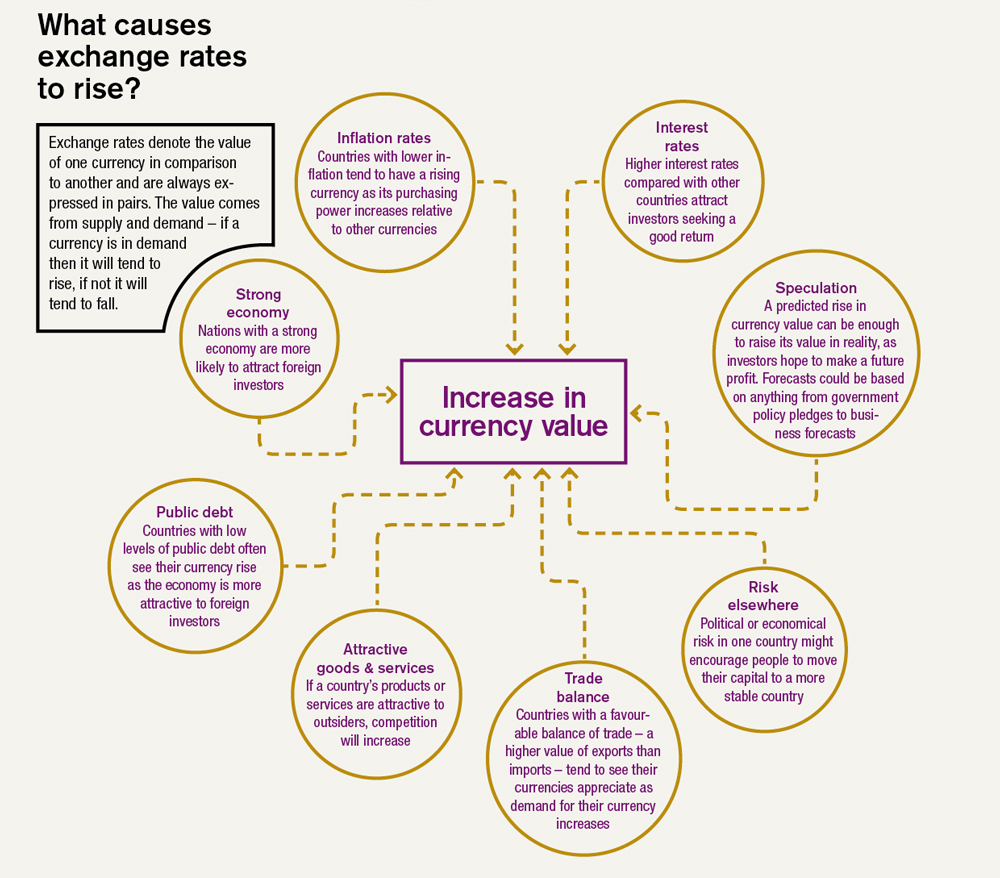

Then there's exchange rates, which denote the value of one currency in comparison to another. They are always expressed in pairs. Exchange rates are crucial to a country's health as they determine the price at which domestic companies buy and sell goods with foreign ones. A stronger currency will make exports more expensive, and imports cheaper; while a weaker currency will make exports cheaper, and imports more expensive. Earlier in April, the pound dipped to a five-year low (against US dollar amid uncertainty over the upcoming general election. This means that the UK's exports are cheaper, as foreign companies pay less for goods, but exchanging sterling for other currencies will cost more.

Click here to expand infographic

Interest rates, inflation and exchange rates have a subtle interplay, and together can make a huge difference to your portfolio. Although it's not definitive, very broadly, a reduction in interest rates is good news for an investment portfolio. This is because it acts as a stimulus to the economy, and lower interest rates encourage more borrowing and more domestic investment, which means companies are more likely to spend and grow. But, this can also lead to higher inflation, as consumers are likely to spend more, which leads to companies raising prices as demand soars.

Meanwhile, a weaker currency is generally good news for your portfolio, as it becomes cheaper to export goods, which increases demand for a company's goods overseas. Investors should also pay attention to exchange rates if investing in overseas companies, as the return will be expressed in another currency. For example, if a company's dividends are paid in dollars, and that currency strengthens over the period, investors are automatically better off when exchanging back into sterling.

It's always a good idea to keep an eye on these economic indicators so that you can understand how they impact your investment portfolio, this will mean you're better equipped to react to big economic changes going forward.

Click here to expand infographic

To find out more about investment themes and how to get started with your portfolio, check out Alliance Trust's Investment Focus, which offers insight and knowledge into all areas of investment.

Remember that the value of your investments can go down as well as up and you may get back less than you originally invested. Alliance Trust does not give advice. You need to ensure that you understand the risks and the commitments before investing. If you are unsure, do consult a financial adviser

Illustration by Sue Macartney-Snape courtesy of The Telegraph

Graphic by Carlo Apostoli

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The Indian women trawling the worst of the internet to train AI

The Indian women trawling the worst of the internet to train AIUnder the Radar Moderating AI content can empower women in rural communities – but traumatise them too

-

AI: When your financial adviser is a chatbot

AI: When your financial adviser is a chatbotFeature Would you let AI guide your 401(k)?

-

Employment: A jobs report filled with mixed signals

Employment: A jobs report filled with mixed signalsFeature Construction and home health aide jobs are on the rise