Biggest trends in British trade

Richard Lowe, Head of Retail and Wholesale, Corporate Banking, Barclays casts an expert eye over some of the biggest trends in British trade

According to the latest official figures, the gap between UK exports and imports narrowed in August, with the Office for National Statistics (ONS) confirming that the UK's trade deficit in goods and services had decreased from £3.1bn in July to £1.9bn.

While on the surface the figures may seem positive, many analysts and CFOs have expressed concern over the health of the Eurozone, and the impact that is having on UK exports. Some also attribute the narrowing of the trade deficit more to a fall in imports rather than a huge surge in exports, as many in the UK may have hoped.

So where do the most recent shifts fit in the story of trade to and from the UK? And, crucially, what does this mean for UK businesses?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The long view

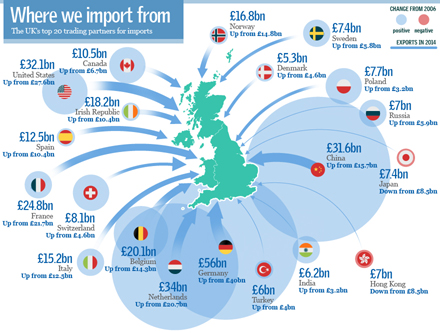

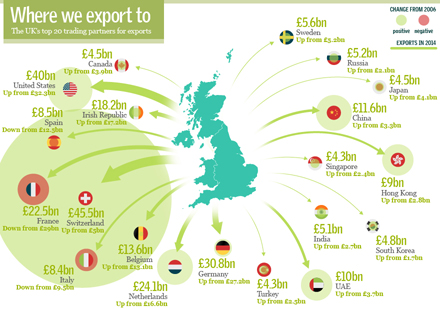

The two infographics below show the UK’s top 20 trade partners and how their custom has grown and shrunk since 2006.

While the UK has some very reliable trade partners, including the US, Germany and France, the latest figures from HM Revenue and Customs show that some traditionally strong partners have gradually diminished, while others have slowly grown.

Historically, the European Union has dominated in both exports and as a source of imports, but gradually this trend is changing. Growth is increasingly being driven less by Britain’s traditional partners in Europe and other advanced economies around the world and more by emerging and developing nations.

New partners

Richard Lowe, Head of Retail and Wholesale, Corporate Banking, Barclays, says that overall it has been an era of solid growth, as can be seen in Figure 1: Where we import from. “This is a story about increasing trade. We have not merely swapped one country out for another, but we have increased the number of countries with whom we do business and we have increased how much we trade with them. It always helps to have a range of different countries with different ideas to trade with. As a nation, you need choice and you do need multiple partners.”

For UK businesses, this change has meant looking beyond traditional markets and opening up trade with new high-growth areas.

Diversification

Britain’s wealth of trading partners is mirrored by a similar diversity of products the nation trades. So how will this change as Britain looks towards the future?

“While we are unlikely to see very large growth in the UK economy in terms of GDP, what we are likely to see is an increasing diversity of products that we trade,” Lowe says.

He adds: “The greatest shift will be where trade is coming from. One of the regions British businesses are starting to look more towards is Africa. People have naturally looked to the US, Europe and the Far East, but I think that there is more to do on the whole African continent, over the next few years.”

Lowe is equally confident about the impact that China will have on British trade: “It is a phenomenally huge market that is ripe for expansion,” he says.

Importing growth

The UK’s top 20 import countries remain very Euro-dominated, although China has been by far the strongest player in the top 20 in terms of its compound annual growth rate.

Figure 1: Where we import from (click to expand)

The shifts in UK imports shown in Figure 1: Where we import from, can be accounted for through a number of explanations. “The increases in trade both to and from China relate largely to the clothing and electronics industries,” Lowe says. “As well as China, we are starting to see imports from India pick up, but the reductions in trade from Japan relate to electronics. Increasing numbers of electronics such as iPhones and other telecommunications devices are now coming from China.”

Exporting success

As for the UK's exports, Lowe believes that the most encouraging signs relate to the country's export of motor vehicles, and more broadly, the rejuvenation of Britain's manufacturing base. “If you analyse the numbers overall, we might be slightly down, but are still in a strong place, which may be attributed to the solidity of our core manufacturing base.”

Figure 2: Where we export to (click to expand)

The export of petrol, the UK’s top export product for 2014 in Figure 2: Where we export to, is accounted for by the deep wells of North Sea oil, but the most interesting change in UK exports for Lowe is the export of medicines and pharmaceuticals. “In this area, the UK is showing a true specialism.”

Another area that the UK shows strength is in telecoms. “I know it is not a huge number, but that is an area where the UK is actually quite strong,” Lowe says.

As can be seen in Figure 2: Where we export to, the UK’s top 20 export nations include 10 European countries. Europe remains an important market for British imports, however in terms of growth, the fastest growth since 2006 has been exports to China and, interestingly, Switzerland.

Looking towards 2020

It remains to be seen whether UK exporters will be able to meet the ambition set down by the government to double exports of goods and services to reach a trillion pounds sterling by 2020. However, a rise in confidence since many world economies began to emerge from the financial crisis means that more businesses are either already exporting to more countries than ever before, or they are planning to, particularly the nation’s SMEs, The Guardian reports.

Overall, Lowe believes that Britain’s trade deficit is something that needs to be monitored and attended to. As he says: “To achieve long term success, businesses will increasingly need to focus on expansion outside domestic markets. Banks are well placed to provide financial assistance and support, and to facilitate access to trade corridors.” But overall, as the financial crisis diminishes, signs seem to indicate that imports to and exports from the UK are in a secure place. />

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

6 exquisite homes with vast acreage

6 exquisite homes with vast acreageFeature Featuring an off-the-grid contemporary home in New Mexico and lakefront farmhouse in Massachusetts

-

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’

Film reviews: ‘Wuthering Heights,’ ‘Good Luck, Have Fun, Don’t Die,’ and ‘Sirat’Feature An inconvenient love torments a would-be couple, a gonzo time traveler seeks to save humanity from AI, and a father’s desperate search goes deeply sideways

-

Political cartoons for February 16

Political cartoons for February 16Cartoons Monday’s political cartoons include President's Day, a valentine from the Epstein files, and more