Are we on the cusp of a solar energy boom?

Solar power is getting much easier to store — and at a much cheaper price

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The total solar energy hitting Earth each year is equivalent to 12.2 trillion watt-hours. That's over 20,000 times more than the total energy all of humanity consumes each year.

And yet photovoltaic solar panels, the instruments that convert solar radiation into electricity, produce only 0.7 percent of the energy the world uses.

So what gives?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

For one, cost: The U.S. Department of Energy estimates an average cost of $156.90 per megawatt-hour for solar, while conventional coal costs an average of $99.60 per MW/h, nuclear costs an average of $112.70 per MW/h, and various forms of natural gas cost between $65.50 and $132 per MW/h. So from an economic standpoint, solar is still uncompetitive.

And from a technical standpoint, solar is still tough to store. "A major conundrum with solar panels has always been how to keep the lights on when the sun isn't shining," says Christoph Steitz and Stephen Jewkes at Reuters.

But thanks to huge advances, solar's cost and technology problems are increasingly closer to being solved.

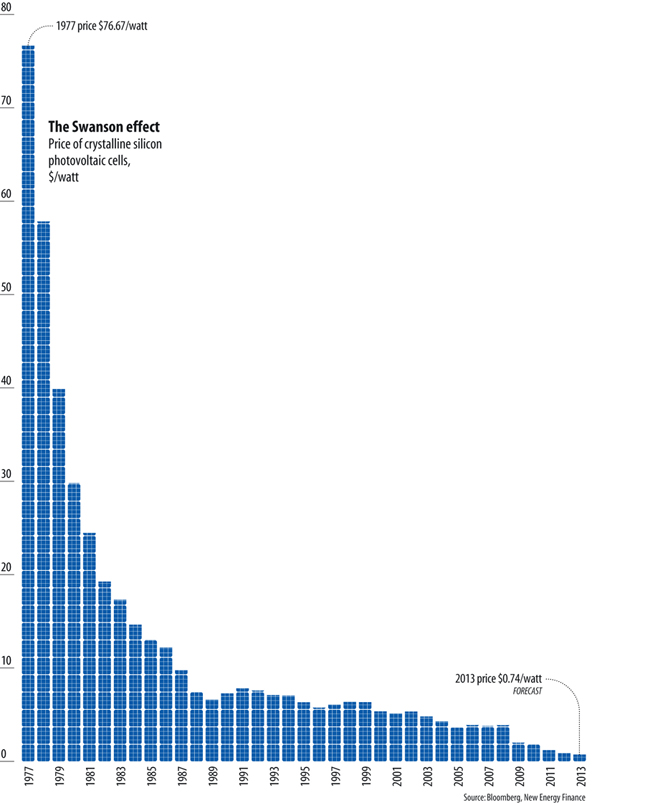

The percentage of light turned into electricity by a photovoltaic cell has increased from 8 percent in the first Cadmium-Telluride cells in the mid-1970s to up to 44 percent in the most efficient cells today, with some new designs theoretically having up to 51 percent efficiency. That means you get a lot more bang for your buck. And manufacturing costs have plunged as more companies have entered the market, particularly in China. Prices have fallen from around $4 per watt in 2008 to just $0.75 per watt last year to just $0.58 per watt today.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

If the trend stays on track for another eight to 10 years, solar generated electricity in the U.S. will descend to a level of $120 per MW/h — competitive with coal and nuclear — by 2020, or even 2015 for the sunniest parts of America. If prices continue to fall over the next 20 years, solar costs will be half that of coal (and have the added benefits of zero carbon emissions, zero mining costs, and zero scarcity).

Scientists have made huge advances in thermal storage as well, finding vastly more efficient ways to store solar energy. (In one example, solar energy is captured and then stored in beds of packed rocks.)

Lower costs and better storage capacity would mean cheap, decentralized, plentiful, sustainable energy production — and massive relief to global markets that have been squeezed in recent years by the rising cost of fossil fuel extraction, a burden passed on to the consumer. All else being equal, falling energy prices mean more disposable income to save and invest, or to spend.

The prospect of widespread falling energy costs could be a basis for a period of strong economic growth. It could help us replace our dependence on foreign oil with a robust, decentralized electric grid, where energy is generated closer to the point of use. This would mean a sustainable energy supercycle — and new growth in other industries that benefit from falling energy costs.

Indeed, a solar boom could prove wrong those who claim that humanity has over-extended itself and that the era of growth is over.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

How to Get to Heaven from Belfast: a ‘highly entertaining ride’

How to Get to Heaven from Belfast: a ‘highly entertaining ride’The Week Recommends Mystery-comedy from the creator of Derry Girls should be ‘your new binge-watch’

-

The 8 best TV shows of the 1960s

The 8 best TV shows of the 1960sThe standout shows of this decade take viewers from outer space to the Wild West

-

Microdramas are booming

Microdramas are boomingUnder the radar Scroll to watch a whole movie