How to save money: 54 great personal finance tips

Top pieces of financial advice — from scoring a coveted credit card to apps for bargain hunters

Saving money is hard without a plan. Below, the best tips on how to save money from experts and media around the world.

Saving for special needs

"Planning for family members with special needs can be overwhelming," said Tara Siegel Bernard at The New York Times. For starters, your retirement savings budget might need to account for an extra person. You should take precautions, for instance, "that money set aside for your child won't be consumed by long-term care expenses for you or a spouse." Medicaid can provide some help; while "it is often regarded as a program solely for the poor," it also covers "health care for people over 18 with disabilities." A new tax-advantaged plan, called ABLE or 529A accounts, allows families to contribute up to $14,000 in annual savings for a person with disabilities, without disqualifying the person from Medicaid or other government benefits. The accounts are "expected to be easier and far less costly to set up than special-needs trusts."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Choosing a college bank account

New college students should be careful about picking their bank, said Karen Damato at The Wall Street Journal. Convenience can cost you. Many schools "have an exclusive relationship with one financial institution" that offers easy-to-use benefits, such as college IDs that double as debit cards. "But easy doesn't mean cheap," and a new study says many of these accounts have serious drawbacks, like "abusive overdraft policies." Students and parents should guard against these pitfalls by shopping around at other banks and opting out of overdraft provisions, which allow customers to use debit cards to make purchases even when they don't have the funds in exchange for steep service fees.

(This article originally appeared in The Week magazine. Try 4 risk-free issues, and stay up to date with the week's most important news and commentary.)

Scoring a coveted credit card

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Great credit cards aren't just for people with perfect credit, said Gerri Detweiler at Credit.com. While consumers with top-notch credit histories typically have their pick of the cards with the most options and best perks — including rewards programs, sign-up bonuses, low interest rates, and higher spending limits — it "doesn't mean you can't get one if you don't fall into that category." Lenders have the ability "to adjust for risk by offering a range of interest rates," so while it may cost you more, you still have a chance of getting that coveted plastic. But "you don't want to waste time, or create unnecessary credit inquiries," applying for cards that are unrealistic. Instead, "do your homework" and use an online credit-card comparison tool to shop around and find the best fit.

Beware employer stock for 401(k)s

It's time to take company stock off the 401(k) menu, said Ron Lieber at The New York Times. While such arrangements are less common than they used to be, 39 percent of companies in 2013 offered their stock as an option in workers' retirement plans, and 12 percent made their matching contributions in firm stock. But peddling company shares through 401(k)s — instead of, say, offering them as stock grants or bonuses — "is incredibly risky." That's because "when you're getting your income from an employer — and your livelihood literally depends on that company — it makes little sense to make a big bet on the company stock with money that you'll need if you ever want to stop working." So, consider offloading that stock as soon as you can. That way, if the company goes under, you won't lose your paycheck and your retirement fund.

Financing a vacation house

It might be time to snap up a second home, said Anya Martin at The Wall Street Journal. Vacation-home sales jumped more than 50 percent last year and "are expected to continue climbing," because of a healthy stock market and the aging generation of Baby Boomers. Lenders are taking note. Today, many have reduced the down-payment requirement on second-home jumbo mortgages to 20 percent and offer interest rates that match those on primary homes. But buyers should know that "credit-score requirements may be higher when financing a second home," and they will need to prove they can handle both mortgage payments. Owning a second home can pay off in the long run, though, since the mortgage interest "is tax-deductible up to the first $1 million of financing."

(This article originally appeared in The Week magazine. Try 4 risk-free issues, and stay up to date with the week's most important news and commentary.)

How to resist impulse buys

It's easier than ever to spend money on the fly, said Vera Gibbons at MarketWatch, thanks to mobile payment systems and sites that store your credit card info. So if you want to "keep more money in your pocket," you have to "identify — and eliminate — triggers." Be aware of your habits, such as whether you tend to make impulse purchases when you're happy or sad. Be wary of retailers' tricks, including sales and even "how the store smells, the music that's playing, and the location of certain items." And try being patient. If you see something you like, "make yourself wait." Take a walk and see how you feel about it in 20 minutes when your "emotions have cooled and you're thinking more rationally."

Robo-trading hits the big time

Now that Charles Schwab has gone robo, said Jason Zweig at Wall Street Journal, "the fledgling industry of automated investment advice is going mainstream." The discount brokerage giant launched its Intelligent Portfolios service last week, replacing some traditional brokers with "robo-advisers" programmed to "generate and monitor a portfolio of exchange-traded funds," automatically rebalancing your investments when the market moves. It's true that "having a machine manage your money isn't for everyone," but robo-advisers do have some advantages over their human counterparts: They stick to the investment plan that you select, won't panic during a crash, and won't be tempted to try "timing or outsmarting the market." Plus, they're cheap, costing anywhere between .04 and .48 percent, compared with the 1 or 2 percent typical of a flesh-and-blood adviser.

How to claim old tax breaks

If you missed out on a tax credit last year, it might not be too late to claim it, said Kimberly Lankford at Kiplinger. "You have up to three years after the date you filed your original return to file an amended return and get a refund for the extra credit." And with some discounts — such as the American Opportunity Credit, which is worth $2,500 per student for each of the first four years of college — it's clearly "worth the effort." You need to file a 1040X form for each tax year you are amending, along with any tax forms that are affected by the change. It can take a while — up to 16 weeks — for amendments to be processed, but "reducing your federal tax bill could also lower your state income tax," so the savings are probably worth the wait.

Small caps' big gains

If you want to hit it big in the market, think small, said Brett Arends at MarketWatch. A new study shows that over a 50-year period, a portfolio of "small cap, high quality" stocks has outperformed the overall market by nearly 5 percentage points a year, "an absolutely stunning performance." But not all small caps are created equal. The key, say the authors, is quality — investing only in small companies that show "balance-sheet strength, profitability, stability, and growth." Of course, coming off 50 years of gains, it's possible these stocks may soon show weaker returns, but the advantages have proven "persistent over a long period of time" both in the U.S. and abroad. "Could it really be this easy?"

Credit agencies agree to overhaul

Major changes are coming to consumers' credit reports, said Tara Siegel Bernard at The New York Times, and for once it's good news. Following a nearly three-year investigation by New York State Attorney General Eric Schneiderman, the three main credit bureaus — Experian, Equifax, and TransUnion — have agreed to overhaul the opaque, often frustrating automated system that consumers must endure to fix errors on their credit reports. "Specially trained employees" will now review all disputes. The three companies will also "establish a six-month waiting period before reporting medical debts," which will give consumers more time to resolve problems or have their insurance payments issued. The next challenge: "making sure the credit bureaus comply with the agreement."

Smart savings for seniors

Not all senior discounts are created equal, said Cameron Huddleston at Kiplinger . In fact, money-savvy seniors may sometimes be better off taking advantage of "deeper discounts for the same goods and services available to the general public." Take banking. A recent study from the Pew Charitable Trusts found that some "senior" checking accounts "actually cost more than basic accounts unless the customer maintains a high balance." And while many hotels offer attractive discounts for travelers 62 and over, simply defaulting to those discounts may lead seniors to "miss out on better rates offered by discount travel websites and apps." Retirees who really want to cash in on their senior status would be wise to look for standard discounts that "can be paired with a senior discount to score even bigger savings."

Opening an IRA for kids

Want to help your kids get ahead this summer? asked Bill Bischoff at MarketWatch . Persuade them to "use their summer earnings to invest in an IRA." I'll admit that asking teenagers to wait four or five decades to reap the rewards of their labor might be a "tough sell," but even a modest contribution now can add up to substantial savings down the line. All that's required to open an IRA is earned income, and an investment of $1,000 a year for the next three years could net nearly $40,000 — assuming a 6 percent annual return — by 2060. "Not bad for mowing a few lawns." Plus, the lifelong lessons about basic investing are much more likely to stick "when it's their hard-earned dollars on the line."

The rise of 'divorce loans'

What happens when an acrimonious separation leaves one half of a wealthy couple broke? asked Paul Sullivan at the New York Times. Increasingly, the penniless partner will turn to a so-called divorce funding company during a protracted court battle to help pay for living expenses and legal fees. The firms work by loaning less-moneyed people quick cash so they can pursue court settlements against their deep-pocketed former partners. In most cases, they "lend around 20 to 25 percent of the value of an expected settlement," which tends to be at least $1 million. Most firms charge 12 to 18 percent interest a year, while others take a double-digit percentage of the final settlement. The firms justify the high rates by arguing that they "level the playing field against the moneyed spouse who can otherwise force the one without money to settle."

The pros and cons of Helocs

Now might be the time to tap your home equity, said AnnaMaria Andriotis at The Wall Street Journal. With interest rates likely to rise in the coming months, several major banks are promoting home-equity lines of credit, known as Helocs, with temporary fixed rates. These loans can be used to finance home renovations or even unrelated expenses like college tuition, and borrowers pay interest only on the amount they withdraw. But the loans typically have rates that fluctuate, which isn't always good for borrowers "who value predictability." The latest offers have a fixed rate that can last "from 12 months to many years" and can be a money-saving option for anyone who plans "to pay back the money before the fixed-rate period ends."

A deluge of card offers

Credit card companies are clamoring for your business, said Hadley Malcolm at USA Today. A new report from credit bureau Equifax shows that in December consumer credit card debt reached its highest level in five years thanks "almost entirely" to shoppers "taking out new cards." Issuers are "taking note" — one research firm says card companies increased direct-mail offers 12 percent between November and December. If you received one of those offers, this might be a good time to sign up, since "consumers are also getting more out of rewards cards." So far this year, credit card companies have been "25 percent more generous" in handing out rewards points and frequent-flyer-mile sign-up bonuses than they were for all of last year.

Advocating for a better 401(k)

Is your company's 401(k) not cutting it? asked Liam Pleven atThe Wall Street Journal. "High fees and the absence of low-cost index funds" can be a real drag on your savings. "Yet pushing for change can put workers in the uncomfortable position of confronting their employer." So how can you lobby tactfully for better 401(k) options? First, "pick your battles." Fight for better fees or fund choices, but don't hold your breath over a more "generous match for employee contributions, because the added cost could be substantial." Once you know what you want, "be professional and diplomatic." Gauge the office culture — does the company promote "open dialogue?" — and try approaching HR with a letter or recruiting colleagues, since there can be strength in numbers.

When is political activity protected?

With campaign season coming up, you might want to check your politics at the office door, said Alina Tugend at The New York Times. In many states, private-sector employees have "no protection from being fired for something [they've] said, either in the workplace or outside of it," like on social media. Federal laws protect workers from firing because of things like race, religion, or gender, but "there is no such protection for political affiliation or activity." A few states — including New York, California, Colorado, North Dakota, and the District of Columbia — do protect private workers' political activity, and public employees and union members are generally safe. "But if you don't fall into any of those categories, you don't have a lot of rights."

AmEx upping its fees, perks

Some American Express cardholders are about to enjoy more perks — but at a price, said Ken Sweet at Associated Press. The credit card company said last week it will raise the annual fee on several of its most popular cards, including its Gold Card and Premier Rewards Gold Card, from $125 and $175 a year to $160 and $195, respectively. The new fees will take effect June 1, along with a few new benefits. Premier Rewards Gold cardholders will receive "a $100 credit for incidental airline fees such as baggage" and have their foreign transaction fees waived. AmEx also said it would be raising interest rates on a "small percentage" of its cardholders, as the lender looks for "new sources of revenue since it announced last month it would be ending" an exclusive merchant deal with Costco.

Fraudsters target TurboTax

TurboTax users should be on alert, said Laura Saunders and Liz Moyer at The Wall Street Journal. Intuit, publisher of the tax preparation software, recently suspended e-filings of state tax returns for 24 hours after a "surge of fraudulent" filings, apparently submitted to get bogus refunds. The company has advised customers, even those who haven't yet filed their taxes this year, to check that their TurboTax account information is accurate. "One red flag is a change in your direct-deposit account information." If you do find signs of fraudulent tax filings in your name, Intuit has promised to provide identity-protection services and free credit monitoring. You should also contact the three major credit-reporting firms — Equifax, Experian, and TransUnion — to place fraud alerts on your credit files.

Why flying isn't getting cheaper

Air travel is less comfortable than ever, said Steve Hargreaves at CNN, so why isn't it getting any less expensive? Blame airline consolidation. "Four carriers control 87 percent of the domestic market," says William Swelbar, a researcher with MIT's International Center for Air Transportation. "That has given the airlines pricing traction, without question." Airlines say even though they've returned to profitability, they are investing those profits in "new planes, new terminals, new runways, and better software" to make your experience more enjoyable. Just "keep that in mind the next time you're crammed in on a $500 commuter flight with no food."

Keep your 401(k) from shrinking

It's time to plug the leaks in your 401(k) account, said Emily Brandon at US News & World Report. Retirement account "leakages," like early withdrawals and loans, can cost you big-time down the road — reducing your retirement wealth by as much as 25 percent, according to a new report from Boston College. To shore up your savings, keep "an emergency fund outside of your retirement account" so you won't be tempted to dip into your 401(k) when times are tough. If you switch jobs, consider rolling the balance over into an IRA rather than cashing out. Loans "are typically the least damaging way to access your retirement savings early," since they're not taxable and must be repaid. But remember: "If you lose or leave your job, the loan suddenly becomes due" and will be considered an early withdrawal if it's not repaid.

Basic rules for financial success

"Smart money moves aren't more complicated than you think," said Brett Arends at The Wall Street Journal. "They're simpler." Just follow a few "simple, bedrock" strategies, and your finances will stay healthy. First, ignore the so-called experts. "Stocks that Wall Street experts like most generally fare no better than those they like least — or stocks picked at random." Keep your investment strategy basic; "a simple, diversified portfolio of low-cost index funds, rebalanced yearly, will do just fine — if not better" than anything a portfolio manager can do for you. Put most of your long-term portfolio into equities, because they "generally produce the best long-term returns." Invest globally. Buy insurance. Contribute as much as possible to your 401(k) plan. And "plan for a long life," which means reducing your debt and saving early — and a lot.

Apps for bargain hunters

Discount shoppers, rejoice, said Kristin Wong at Bankrate. "Couponing is now as simple as swiping your screen." Dozens of apps now help bargain hunters "navigate sales, compare prices, and even get money back on some of the items" they buy. RedLaser and ShopSavvy allow shoppers to scan an in-store item's bar code and then "tell you how much that item costs at different online retailers" or whether "there are special deals on the item at nearby stores." Coupon Sherpa lists coupons from "hundreds of retailers and restaurants," and RetailMeNot lets you know which nearby stores have deals and coupons available. PriceJump includes a feature that "tells you exactly where to find the best price in each of three categories: local, Amazon, and online."

Financing options for homebuyers

Several new programs could help cash-strapped homebuyers, said Tara Siegel Bernard at The New York Times. Fannie Mae and Freddie Mac recently introduced programs that permit middle-income borrowers to pay as little as 3 percent as a down payment, and the Federal Housing Agency, which requires at least 3.5 percent down, lowered its annual mortgage premium, making its process "a bit more competitive." Some of these programs only apply to first-time buyers, and the added mortgage-insurance fees can make putting less down up front far more expensive than a typical mortgage. Prospective buyers should crunch all the numbers, because "they may ultimately come to the realization that it actually pays to wait and save a bit more."

What to do after the Anthem hack

A major cyberattack on the nation's second-largest health insurer means consumers should take steps to safeguard their data, said Tara Siegel Bernard at The New York Times. Hackers made off last week with "names, Social Security numbers, birthdays, addresses, emails, and employment information for as many as 80 million people," including Blue Cross and Blue Shield customers. Anthem has vowed to "provide free identity repair services and credit monitoring for up to a year" for anyone whose information was compromised. But because the attackers obtained so much data, you're better off taking more steps. "Ask your financial institution (or any other account provider) to attach a secret word or code to your accounts," and consider requesting a "security freeze" on your credit reports to prevent thieves from opening new accounts.

TurboTax rolls back upgrade fee

TurboTax is backtracking on a controversial change that caused an uproar among customers this year, said Laura Saunders at The Wall Street Journal. Intuit, the publisher of the tax-preparation software, apologized last week after it failed to disclose a change to TurboTax's desktop and downloadable versions that forced some users — specifically those who needed Schedule C, D, E, or F forms — to update from Turbo-Tax Deluxe to versions that cost as much as $30 more. "Intuit's reversal means that next year TurboTax Deluxe desktop software will once again include Schedules C, D, E, and F." In the meantime, Intuit has vowed to waive the upgrade fee for this year's filers and issue partial refunds to existing customers.

When to be a cheapskate

They say "you get what you pay for," said Gerri Detweiler at Credit.com, but sometimes, "going the cheap route makes perfect sense." While I wouldn't recommend skimping on toilet paper — "you really do want thicker and softer" — there "are some instances in which you can pay less without sacrificing quality." Groceries nearing their sell-by dates, for instance, are often marked "way down" and are perfectly safe as long as you freeze or cook them right away. Inexpensive dishes and glassware "hold up just as well as the expensive ones," and it's "less traumatic when they get broken." Children's clothes are another place to save, since they "will be outgrown before long" anyway, and you'll need the savings to buy more outfits.

How accidents hike premiums

Even a simple fender bender can cost you big bucks, said Karen Damato at The Wall Street Journal. A new study commissioned by Bankrate found that "a low-risk driver who injures a person or causes property damage in an accident can see her insurance bill jump more than 40 percent." A bodily-injury claim can cost more than twice that, hiking premiums more than 80 percent in states like California or Massachusetts. Drivers who have been in such accidents can end up facing high rates, typically for three to five years. "One option when hit with a rate hike is to shop around," since competing insurers will often offer a lower rate even in the wake of an accident.

Lenders offer free FICO scores

Several lenders will now make it easier for you to whip your credit back into shape, said Michelle Singletary at The Washington Post. Credit card issuers including JPMorgan Chase, Bank of America, USAA, the State Employees' Credit Union, Ally Financial, and Discover are slowly rolling out programs to provide free FICO scores to their customers. "The move by these companies and others is a monumental one," since it will help consumers assess their own creditworthiness — a key metric when applying for loans or credit cards. But be careful. If your lender starts offering free credit scores, keep in mind that not all scores are created equal. "Even the scores under the FICO brand can vary," since the California credit rating giant has "updated its scoring model several times," and not all lenders are using the latest versions.

Talk to your kids about money

Quit protecting your kids from the reality of your paycheck, said Ron Lieber at The New York Times. It's not uncommon for parents to "push our children's money questions aside, sometimes telling them that their queries are impolite" or perhaps shielding them "from a topic many of us find stressful or baffling." But trying to protect kids "from the realities of everyday financial life makes little sense anymore, given the responsibilities their generation will face." Financial transparency doesn't mean you need to overwhelm your offspring with copies of your tax return, but "coming clean about income and assets" and teaching children about household budgets is one way to start "building their knowledge" and fostering financial responsibility.

Beware phony IRS calls

An "alarming" number of Americans are being targeted by a dangerous tax scam, said Brianna Ehley at The Fiscal Times. The Treasury Department says nearly 300,000 people in the past two years have been contacted over the phone by callers claiming to be agents of the IRS. The agent says you owe unpaid taxes and you must pay now, through a prepaid debit card or payment voucher, or face arrest, deportation, or the loss of your driver's license. Around 3,000 taxpayers have fallen prey to the scam calls, paying a collective $14 million. Remember: "The IRS always contacts people by mail if they owe taxes" and "never asks taxpayers to pay using a prepaid debit card or wire transfer."

Negotiating your first salary

"Asking for more money when you're just starting out can be intimidating," said Kristin Wong at Lifehacker. But negotiating your first salary is crucial, because future employers will use that figure "as a benchmark." One tip to ensure a successful negotiation is to "think like an employer," especially when your work experience is thin. "Without a proven track record of your abilities, you'll have to work harder to show the potential employer that you can provide value." Emphasize your skills, and do some research to know how much you should ask for and what the company can afford. If it can't match your dollar figure, "think beyond salary." Cash is just one part of your compensation package, so consider negotiating over title, schedule, time off, and other benefits.

Weighing your nest egg

When should you start shifting your retirement accounts out of stocks? asked William J. Bernstein at The Wall Street Journal. A series of bull markets over the past two decades led Americans to grow "ever more comfortable with stock-heavy portfolios." But if recent history tells us anything, it's that these market runs will end. So when should you "stop playing" the stock game with your nest egg? Simple: "When you've acquired enough assets to provide your basic living expenses for the rest of your life." Add up your basic annual expenses plus taxes you'll owe, and then subtract Social Security and, "if you're lucky, pension checks." The amount left over is your residual living expenses (RLE). "A good rule of thumb is to have, at the very least, 25 years of RLE saved up to retire at 60, 20 years to retire at 65, and 17 years to retire at 70."

Get approved for the cards you want

"Rejection stings," said Jason Steele at Credit.com, not least when it's for a new credit card. Luckily, there are a few tricks to maximize your chances of getting approved. The "single most important factor," of course, is maintaining a high credit score by paying your bills on time and carrying as little debt as possible. You also want to "space out your credit applications." Lenders "view multiple recent applications for new credit cards as a warning sign of financial trouble." If you are rejected, call and ask for your application to be "reconsidered," and if that doesn't work, take the lesson to heart. Creditors often send a rejection letter that will explain why you were denied, so "you can take targeted steps to remedy the problem" next time.

(This article originally appeared in The Week magazine. Try 4 risk-free issues, and stay up to date with the week's most important news and commentary.)

Paid family leave for federal workers

The White House is making a big push for more parental leave, said Steven Mufson and Juliet Eilperin at The Washington Post. President Obama signed an order last week instructing federal agencies to give workers six weeks of paid family leave to care for a new child or ill family members. In an article posted on career site LinkedIn, Obama senior adviser Valerie Jarrett said the president will also call on cities and states to adopt similar paid leave policies and will provide funds to conduct feasibility studies. "Only three states — California, New Jersey, and Rhode Island — offer paid family and medical leave," Jarrett wrote, even though studies have found that providing paid sick and parental leave improves workplaces without hurting companies' economic output.

The case for online savings accounts

"Americans are not known as great savers," said Ann Carrns at The New York Times, but 2015 offers the chance to turn over a new leaf. This year, "an improving job market and plunging fuel prices" may allow consumers to start saving more. Unfortunately, "anemic interest rates" don't appear likely to budge soon; the average annual yield for a savings account hovers around 0.17 percent, meaning you'd earn just $1.70 this year on $1,000. A better option is to save your money with online banks, which typically "offer better interest rates and charge lower fees" because they don't have the cost of maintaining physical branches. GE Capital Bank's online savings account and MySavingsDirect both offer 1.05 percent. That's "hardly a life-changing" yield, but it's better than nothing.

The case for leasing a car

If you're looking for a new set of wheels, consider leasing, said Jessica Anderson at Kiplinger's Personal Finance. Some drivers who own their cars outright can "come out ahead financially," especially if they pay cash or keep their car past the loan payoff date. But for those who always have a car payment — because they trade in their cars often or finance with long-term loans — "leasing is a good choice." Your payments will be lower, since "you're paying for a car's depreciation only over the term of the lease." And since "the majority of leases are written for three years," a leased car "is almost always under warranty." Take the 2015 Chevy Malibu. Leasing for three years will leave you "more than $4,600 richer" than if you bought the car with a five-year loan and sold it after 36 months.

In Illinois, a push to save

A new law in Illinois aims to help residents save for retirement, said Josh Barro at The New York Times. Employed residents who don't already have a retirement plan at work will be automatically enrolled in individual retirement accounts, which will be funded through a 3 percent deduction from their paychecks. The program, called Secure Choice, is voluntary — workers can opt out or adjust their deductions to save more than 3 percent. The program aims to fill the gap for workers who lack access to employer-based savings plans, which "is one of the reasons middle-income Americans tend to have not saved enough for retirement." If the program is successful, "it may end up being a model for other states and the federal government."

Beat the post-holiday shopping trap

Beware of the post-holiday sales season, said Liz Weston at Bankrate. Though after-holiday clearances can be tempting, you don't want to blow your budget before the year has really begun. Since quitting cold turkey after the holiday spree can be tough, "set aside some cash or set a dollar limit to take advantage of a sale or two." But "once the money's gone, shopping stops." You might also make "a no-spend pledge" and limit your purchases to nonessentials, such as groceries or gas, for a certain period. Consider unsubscribing from deal sites and retailers' newsletters to remove temptations. And before purchasing what you think is a must-have item, try "giving yourself at least a three-day ‘cooling-off period.'" That can "help you figure out if the purchase is worthwhile or just a passing fancy."

A pre-retirement checklist

Is 2015 your retirement year? asked Tom Lauricella at The Wall Street Journal. Before you pack up your desk, get to work on making sure your finances will run smoothly. First, seriously consider putting off claiming Social Security. "Waiting until age 70 will bring monthly payouts equal to 132 percent of the regular monthly benefit" available at 66. But don't delay in signing up for Medicare at 65, even if you are still working, or you'll "risk higher premiums" down the road. Finally, assemble a budget. Some retirees may "have to tighten their belts," while others "are in better shape than they thought." Consider taking your retirement budget for a test drive and living on it for at least six months before you leave work "to see if it's realistic."

Making airline miles count

Frequent fliers, beware, said Allison Schrager at BloombergBusinessweek. Thanks to ever-changing rules about how and when you can redeem air miles, "reward points, it turns out, are a lousy investment." Fortunately, there are a few ways to get the most mileage out of your miles. First, "stop hoarding." As airlines consolidate and offer fewer flights, the value of your points will only dwindle over time. Avoid airline-branded credit cards, which offer huge sign-up bonuses but can be used only on that carrier. Instead, use cards or rewards programs that let you transfer or convert points more freely. Also, "watch the exchange rate." Spending points on airfare will typically give you a better deal than exchanging them for cash. And finally, like any investment, check your goals. If you fly frequently, racking up points for upgrades may be worth it. But once your habits change, it may be time to switch up your strategy.

The savvy way to return a rental

Avoid getting dinged on your next car rental, said Christopher Elliott at DailyFinance. For travelers in a hurry, it's not uncommon to drop off a rental after hours. Usually, the vehicle "sits on the lot without incident," but there are cases where renters can get slapped with hefty fees "for damage that may have occurred after the drop-off." To be on the safe side, renters should "avoid returning a car when a car rental location is closed." It's critical to document the car's condition before you even take it off the lot. That means conducting a walk-through inspection and taking several "before" and "after" pictures to prove any dings and dents didn't come from you.

A new way to measure your 401(k)

The way we evaluate retirement savings "is about to be turned on its head," said Liz Moyer at The Wall Street Journal. The conventional method of assessing your 401(k), by looking at the lump-sum balance, doesn't tell you much beyond how much you have saved and how well the market has treated your portfolio. But a new approach, called projected income, is beginning to catch on among retirement plan companies; it shows what your current balance "would pay out as income beginning at a certain age." Supporters of the new method say it gives investors a "more concrete way to look at their savings" and could help people think twice before tapping their retirement funds early. After all, if someone who is considering cashing out a 401(k) sees how much income he can expect at 65, he might "leave the money to grow in the plan instead."

Deciding between debit or credit

Does "debit or credit?" leave you stumped? asked Jeffrey Weber at DailyFinance.com. The common checkout question should be a no-brainer for responsible credit card users, who pay off their balances and earn rewards. But "for those who alternate between credit and debit cards," there are some situations "when you should always choose credit." That includes online purchases, since credit card fraud is easier to deal with than debit card fraud; paying for gas or hotels, where using a debit card can cause "a short-term monetary hold" that can trigger overdrafts or prevent additional purchases if your balance is low; large purchases, where credit card holders can place a stop payment on defective items; and "dubious places," where using a debit card might risk that your data will be stolen.

Tipping for the holidays

"December is prime tipping time," said Jillian Eugenios at CNN. But who should get what? Given how many people we rely on, the list can get quite long, with house cleaners, nannies, hairstylists, building superintendents, dog walkers, personal trainers, and school-bus drivers typical recipients. "For nannies, the recommended holiday tip is one to two weeks' pay. For day-care workers, it's $25-$50, plus a small gift from your child." If you are wondering where to draw the line, "it's simple: If you wouldn't gift that person, don't tip them." And if "a cash tip isn't possible, send a handwritten note or a homemade food item" to show your appreciation instead.

Sprint's half-off bills

Sprint has "kicked the wireless industry's price war up a notch," said Ryan Knutson at The Wall Street Journal. The carrier said last week it will let AT&T and Verizon subscribers pay half what they currently pay "in perpetuity if they switch from those carriers." The half-off Sprint plans "would offer unlimited text and talk and however much data the subscribers were buying" from the rival telecoms. While there's plenty of fine print — customers must turn in their old phones and buy new ones, for example — the move signals how desperate the country's third-largest carrier is to "add subscribers after years of losing customers and money." It also "ratchets up the pressure" on other carriers to slash prices and offer promotions of their own.

(Keep your finances healthy with help from The Week magazine: Try 4 risk-free issues today.)

Resisting retailers' credit cards

Don't let yourself get bullied into opening a store-branded credit card you don't need this holiday season, said John Wasik at Forbes. Retailers push these deals a lot this time of year and sweeten the sign-ups with discounts, betting that "many of us can't resist this chance to save money." But nearly half of consumers say they later regret their decision to open store cards. That's no surprise, since the cards carry fees and interest rates that are often higher than those of ordinary credit cards, "so whatever money you would've saved on a purchase is consumed in interest on your monthly balance." When considering a store card, stick to retailers where you shop "on a regular basis" and don't open one if you plan to apply for a mortgage or car loan in the next six months. You can also compare retailers' offers at Credit.com.

The drawbacks of mobile deposits

Depositing a paper check via a smartphone has become "one of the most popular features of mobile banking," said Ann Carrns at The New York Times, but there are a few downsides. Some banks, for instance, don't allow immediate access to the funds or cap how much you can deposit as a way to limit fraud. While such fraud is rare, it can be a headache. Consider endorsing your checks with the phrase "for mobile deposit only," which "helps reduce the chance that someone could — intentionally or by accident — try to cash or redeposit the check." Be careful with the leftover paper checks, too: Consult your bank's rules about how long to keep them after making a mobile deposit, and put them in a safe place to guard against loss or theft.

Save money on winter heating

"Americans could save a fortune this winter, if only they understood their thermostats," said Chris Mooney at The Washington Post. Residential thermostats control an incredible 9 percent of all U.S. energy use, but even though money-saving programmable thermostats have been available for decades, only about 3 in 10 households have them installed. And many of those consumers "just don't understand how to use" them. Thankfully, the latest generation of smart thermostats moves "beyond the realm of merely 'programmable,'" automatically adjusting to a homeowner's location. Honeywell's Lyric thermostat, for instance, can be operated remotely from your phone, and Google's Nest "'learns' your behavioral patterns — and self-programs to save you energy."

Year-end tips for retirement savers

Before we ring in the New Year, "retirement savers of all ages need to check their to-do lists," said Mark Miller at Reuters. If you've already retired, make sure you take your required minimum distribution, which must be taken from all retirement accounts starting at age 70 and a half. "It's important to get this right: Failure to take the correct distribution results in an onerous 50 percent tax — plus interest — on any required withdrawals you fail to take." If you are near retirement, "consider moving part of your annual contribution" to a Roth IRA. Your after-tax savings will then grow tax free. And if you are young, make a resolution to increase your 401(k) savings for 2015. "Getting an early start is the single best thing you can do" for your future.

A safe, global portfolio

"Foreign stocks are in the red this year," said Jason Zweig at the Wall Street Journal, so it's no surprise that many investors have pulled their money out of international-stock mutual funds in recent months. But "there are plenty of reasons for U.S. investors to hold foreign stocks." For one, they can be "an effective hedge against a rise in U.S. interest rates." You'll also get more bang for your buck overseas, since "U.S. stocks have become much more expensive than those in the rest of the world." For a safe international exposure, consider an exchange-traded fund like Schwab International Equity or Vanguard Total International Stock, both of which charge low fees. "Or you can opt for a low-cost mutual fund that also spreads its bets widely outside the U.S., such as Fidelity Diversified International."

Skip the holiday gift card

If you're shopping for stocking stuffers, steer clear of gift cards, said Anthony Giorgianni at Consumer Reports. Recent regulations "have made gift cards safer," but there are still "many drawbacks." Just think of gift cards "as cash with lots of strings attached." Some cards carry hefty fees, including purchase fees and dormancy fees. And unlike traditional debit and credit cards, gift cards carry "no right to dispute purchases made with gift cards, even if there's an error or fraud." Finally, if the card's retailer goes belly up, you could end up "holding worthless plastic." If you can't come up with a traditional gift, "just give a check or cash, which can be used anywhere."

When flying, watch out for extra fees

JetBlue is joining the baggage fee club, said David Koenig at The Associated Press. The airline announced last week it will create three ticket classes beginning next year and charge passengers in the cheapest class to check a bag. The two highest classes will include at least one free checked bag, with fees for additional luggage. JetBlue "declined to give a price for the bag fee," though the carrier said pricing "would fluctuate with demand." The move leaves Southwest as the only large U.S. airline that allows all passengers to check at least one bag for free. JetBlue will also add 15 seats to its Airbus A320 planes, increasing flight capacity to 165 from 150, and reduce average legroom from more than 34 inches between rows to 33 inches.

A budget for holiday spending

Don't get stuck "with a week or two of ramen noodle dinners" in January because you overspent your holiday budget, said Maryalene LaPonsie at Money Talks News. The average consumer will spend $804 during this year's holiday season, according to the National Retail Foundation, and more than a third of shoppers will go over their budget. In order to stay within your means, write down each of your holiday expenses in advance, including food costs, "the white elephant gift for the family party, the office Secret Santa exchange, and all the service workers you tip extra." To save some dough, think of giving presents that "cost more time than money," like knitted scarves, baking mixes, or even chores you can offer friends and family. Finally, embrace your inner Scrooge. Once you have crossed someone off your list, "it's time to stop shopping for them."

-

Abrego García freed from jail on judge’s order

Abrego García freed from jail on judge’s orderSpeed Read The wrongfully deported man has been released from an ICE detention center

-

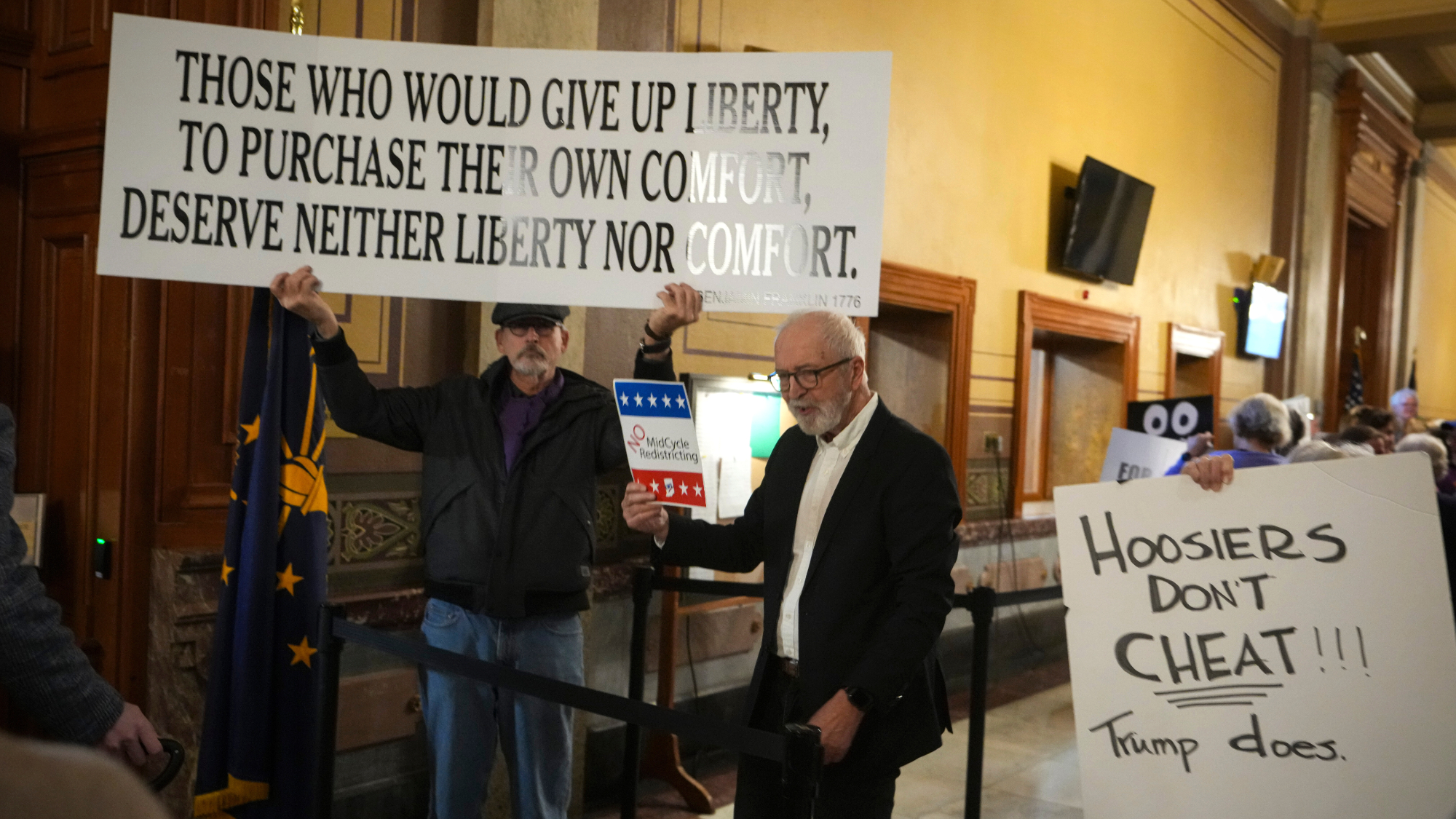

Indiana Senate rejects Trump’s gerrymander push

Indiana Senate rejects Trump’s gerrymander pushSpeed Read The proposed gerrymander would have likely flipped the state’s two Democratic-held US House seats

-

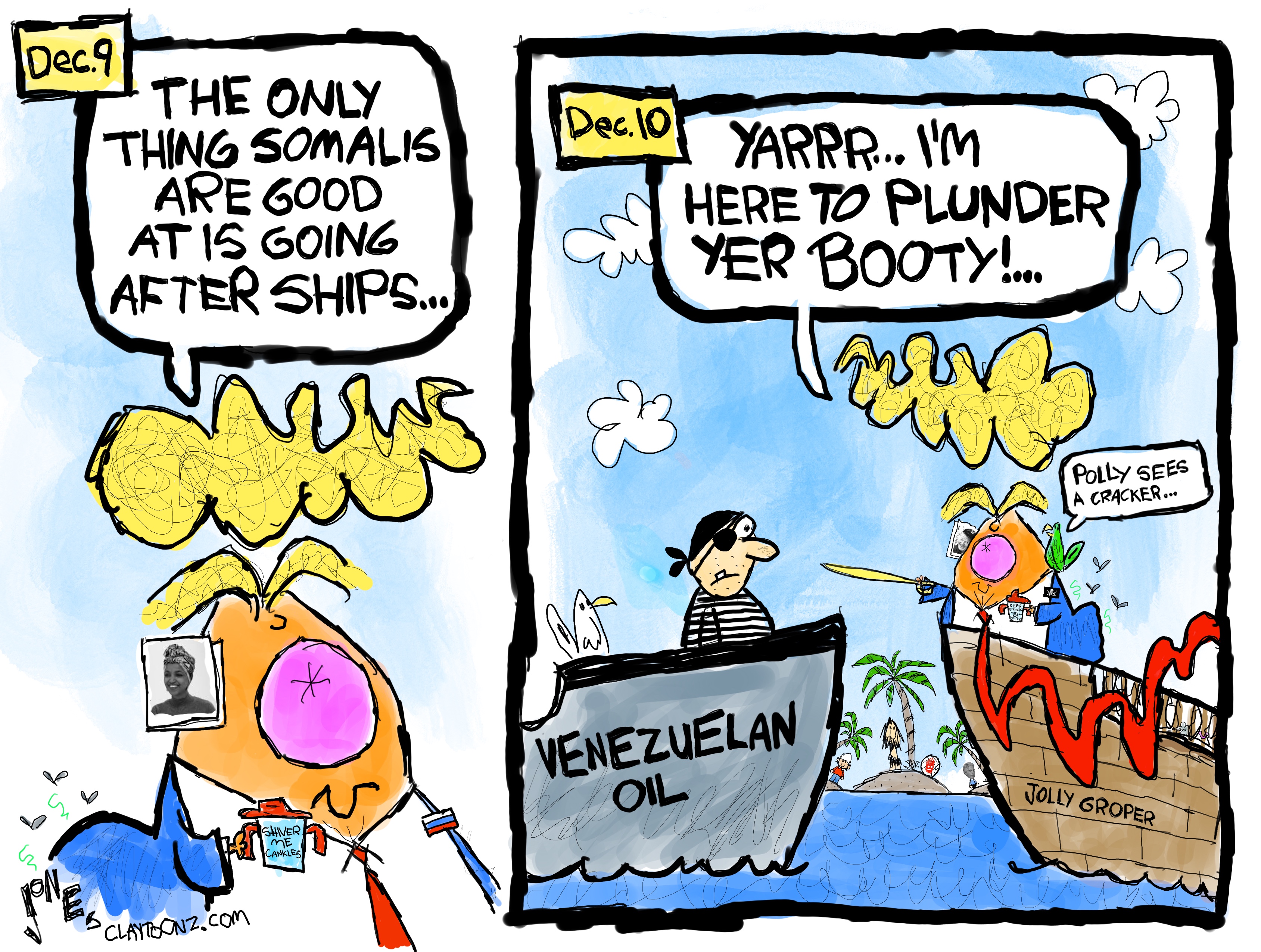

Political cartoons for December 12

Political cartoons for December 12Cartoons Friday's political cartoons include presidential piracy, emissions capping, and the Argentina bailout