Personal finance tips: Outsmarting car repair cheats, and more

Three top pieces of financial advice — from how much retirees should spend to when filing separately makes sense

Outsmarting car repair cheats

Don't get conned by your mechanic, said Charles Passy at MarketWatch. If you feel you've been hit by one car repair "horror story after another," you're hardly alone: 27 percent of Americans have some gripes with their mechanics, according to Consumer Reports. But there are ways to "get repair work done for less (and done right, I should add)." Recommendations from friends, colleagues, or relatives are best, and the Better Business Bureau and reviews on sites like Yelp.com can also offer important clues. If you get a dubious charge, don't be afraid to question it. Mechanics who work on commission have "a strong incentive" to upsell services. "Materials" and "miscellaneous" fees, for instance, "can often be successfully challenged." There should be no surprises: Pros say that "a reputable repair shop will often fold the fees into any estimate they provide."

How much to withdraw?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Once you quit working, how much can you afford to spend? asked Adam J. Wiederman at DailyFinance. "It's been a long-held rule of thumb among retirement experts" that retirees should withdraw up to 4 percent of their portfolio each year. "But the times, as they say, are a-changin'." With low interest rates and the specter of a stock market that could stop rallying, a 4 percent withdrawal rate may be "too aggressive." These days, it's still "a good starting point," but "there are many variables at play in determining what works for you," such as the size of your nest egg, your life expectancy, and your portfolio's growth rate. The best way to plan is to "start running different growth and withdrawal scenarios," giving yourself time to adjust your plan for your twilight years.

When filing separately makes sense

For married couples, "picking the best filing status can be tricky," said Tom Herman at The Wall Street Journal. Filing jointly is the best option for most couples, but there are some situations "where it may pay to file separately." One is when a lower-earning spouse has big medical expenses, which can trigger a larger deduction on a separate filing. If one spouse may be "hiding taxable income, fabricating deductions or credits, or somehow lying about his/her tax situation," the other should file separately to avoid being on the hook. And if a couple is in the process of divorcing, filing separately will help "avoid post-divorce complications with the IRS."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

Trump’s ‘Board of Peace’ comes into confounding focus

Trump’s ‘Board of Peace’ comes into confounding focusIn the Spotlight What began as a plan to redevelop the Gaza Strip is quickly emerging as a new lever of global power for a president intent on upending the standing world order

-

‘It’s good for the animals, their humans — and the veterinarians themselves’

‘It’s good for the animals, their humans — and the veterinarians themselves’Instant Opinion Opinion, comment and editorials of the day

-

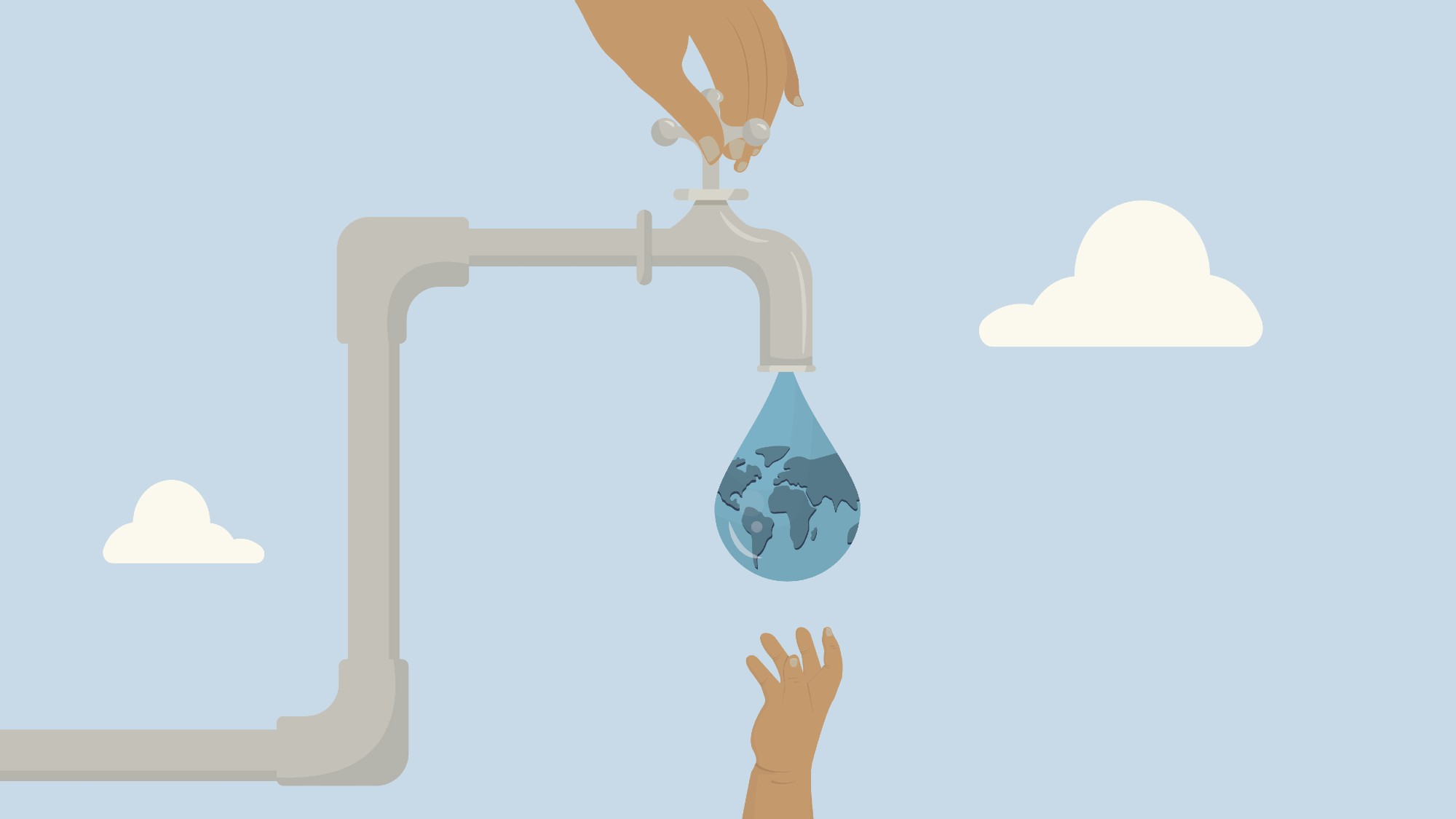

The world is entering an era of ‘water bankruptcy’

The world is entering an era of ‘water bankruptcy’The explainer Water might soon be more valuable than gold