Making money: When short-term mortgages pay, and more

Three top pieces of financial advice — from the inner workings of new credit card rules to loans for forgetful travelers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

When short-term mortgages pay

Wondering which mortgage is right for you? asked Alexander E.M. Hess at USA Today. As the housing market eases into recovery, 15-year mortgages are becoming more popular, but they are "not necessarily for everyone." While they offer lower rates than the traditional 30-year mortgages, they also come "with a higher total monthly payment." Borrowers can save quite a bit on interest in the long run, but they should make sure a higher monthly payment won't strain their ability to save for a rainy day. Shorter-term mortgages may be an especially good option for older borrowers who are close to retirement. "These borrowers are often willing to pay off the balance on their mortgages faster in order to retire with little or no outstanding debt."

New credit card rules work

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So long to those hidden credit card costs, said Floyd Norris at The New York Times. It's been four years since Congress passed a law "to force down the hidden fees that credit card companies collect from their customers," and according to a new study from a University of Chicago economist, the Card Act, as it's known, actually worked. In fact, researchers say the new regulations not only "cut down the costs of credit cards, particularly for borrowers with poor credit" but also saved American consumers more than $20 billion a year. And it turns out banks didn't simply jack up interest rates to make up those losses, because they still had to compete with one another for consumers' credit-card business.

Loans for forgetful travelers

Don't fret if you forgot to pack something for your trip, said Catey Hill at Market Watch. Some hotels and airlines are flipping the script on travelers resigned to getting "nickel-and-dimed by fees" by offering them unusual loans and freebies. Southwest Airlines, for example, lends iPads on some routes, while Hyatt Hotels has rolled out a new program that lets "guests borrow beauty items, humidifiers, and more." Kimpton Hotels even lets guests borrow a goldfish, which the chain says "calms nerves, reduces anxiety, and lowers blood pressure." For hotels, lending beauty items and kitchenware has become "a way to enhance customer loyalty at a cheap price," says one analyst. Airlines, on the other hand, loan products because "it's a cost-effective way to entertain guests without having to retrofit the planes with fancy televisions."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Sergio Hernandez is business editor of The Week's print edition. He has previously worked for The Daily, ProPublica, the Village Voice, and Gawker.

-

Key Bangladesh election returns old guard to power

Key Bangladesh election returns old guard to powerSpeed Read The Bangladesh Nationalist Party claimed a decisive victory

-

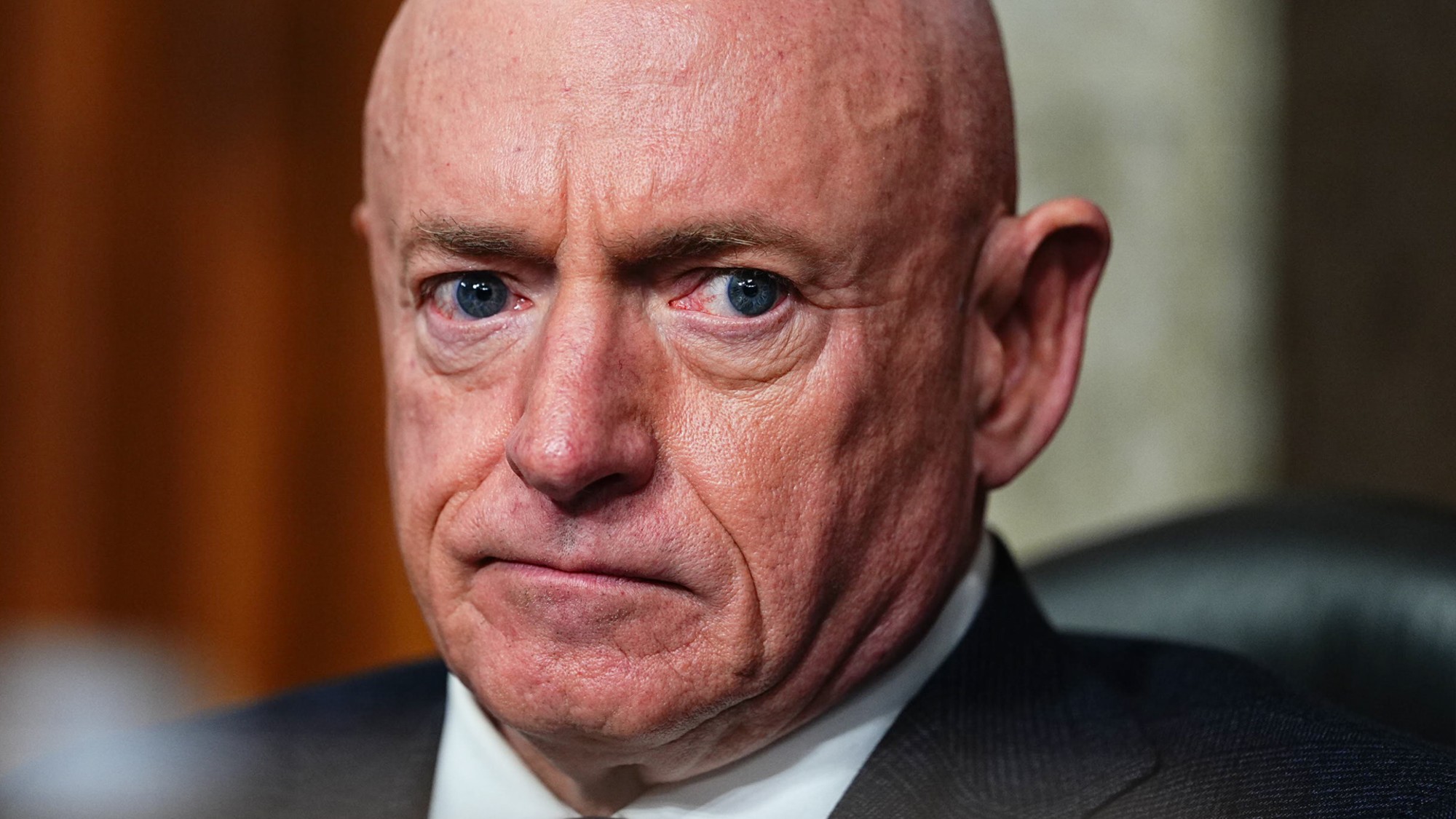

Judge blocks Hegseth from punishing Kelly over video

Judge blocks Hegseth from punishing Kelly over videoSpeed Read Defense Secretary Pete Hegseth pushed for the senator to be demoted over a video in which he reminds military officials they should refuse illegal orders

-

Trump’s EPA kills legal basis for federal climate policy

Trump’s EPA kills legal basis for federal climate policySpeed Read The government’s authority to regulate several planet-warming pollutants has been repealed