Is the economy on the cusp of a buyout boom?

After years of hibernation, the mergers market is seeing a burst of activity

With a spate of blockbuster mergers and acquisitions in recent days, analysts far and wide are proclaiming the dawn of a new age of mega-buyouts. On Thursday alone, $40 billion worth of deals were announced, including the purchase of Heinz by Berkshire Hathaway and 3G, and the merger of American Airlines and US Airways. That followed a $24 billion private takeover of Dell, a $16 billion acquisition of British cable business Virgin Media by Liberty Global, and an agreement for Comcast to take sole ownership of NBCUniversal in an $18 billion deal with General Electric. Overall, $160 billion worth of M&A transactions have taken place since January, the hottest start to a year since 2005.

The burst of activity recalled the heady days that directly preceded the financial crisis, when private equity groups leveraged vast sums of borrowed money to buy companies left and right. Since then, however, the M&A market has been largely moribund, with cautious companies laying low and banks withdrawing their credit lines. Are we now headed toward a buyout boom?

Well, after years of shoring up their finances and cutting costs, it appears cash-rich companies are willing to take more risks. And we should credit an improving climate for corporations, according to Peter Lattman at The New York Times:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A confluence of factors has driven the recent deals. Most visibly, the stock market has been on a tear, with the Standard & Poor's 500-stock index this week briefly hitting its highest levels since November 2007. Higher share prices have buoyed the confidence of chief executives, who now, instead of retrenching, are looking for ways to expand their businesses.

A number of clouds that hovered over the markets last year have also been removed, eliminating the uncertainty that hampered deal making. Mergers and acquisitions activity in 2012 remained tepid as companies took a wait-and-see approach over the outcome of the presidential election and negotiations over the fiscal cliff. The problems in Europe, which began in earnest in 2011, shut down a lot of potential transactions, but the region has since stabilized. [The New York Times]

Furthermore, banks knee-capped by the crisis have recovered, and are opening up spigots of credit. As Neil Irwin at The Washington Post explains:

But what many of the deals have in common is that they are being unleashed by a surge in corporate credit. The markets for bonds in even risky companies are becoming unfrozen to a degree they haven’t been in half a decade, and there seems to be some pent-up eagerness to do big deals. It's a lot easier to make a buyout or merger work when bankers and bond investors are so eager to lend you the money to make them happen. [The Washington Post]

And a lot of people on Wall Street are really excited, none more so than James B. Lee, a vice chairman at JPMorgan Chase who has a talent for coming up with new analogies for every newspaper he talks to. "Since the crisis, one by one, the stars came into alignment," Lee told The Times. "The dam is burst," Lee told The Wall Street Journal. "The Goldilocks era of post-crisis M&A has never been an if, but a when," Lee told Bloomberg. "CEOs are declaring that day has come."

Of course, a frenzy of M&A activity is not always a positive development for the economy. Some of the blockbusters deals in the pre-crisis era went sour for investors, not to mention in the 1990s tech boom. For now, analysts say Wall Street has learned its lesson, say Francesco Guerrera and Dennis K. Berman at the Journal:

Few expect a return to the swashbuckling transactions of the late 1990s or mid-2000s, when cheap money, lavish lending by banks and aggressive private equity groups led to some poor acquisition choices.

Since then, activist investors have gained greater sway inside board rooms, often enforcing a sharp discipline on company executives, especially those with a taste for creative deal-making. [The Wall Street Journal]

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Ryu Spaeth is deputy editor at TheWeek.com. Follow him on Twitter.

-

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

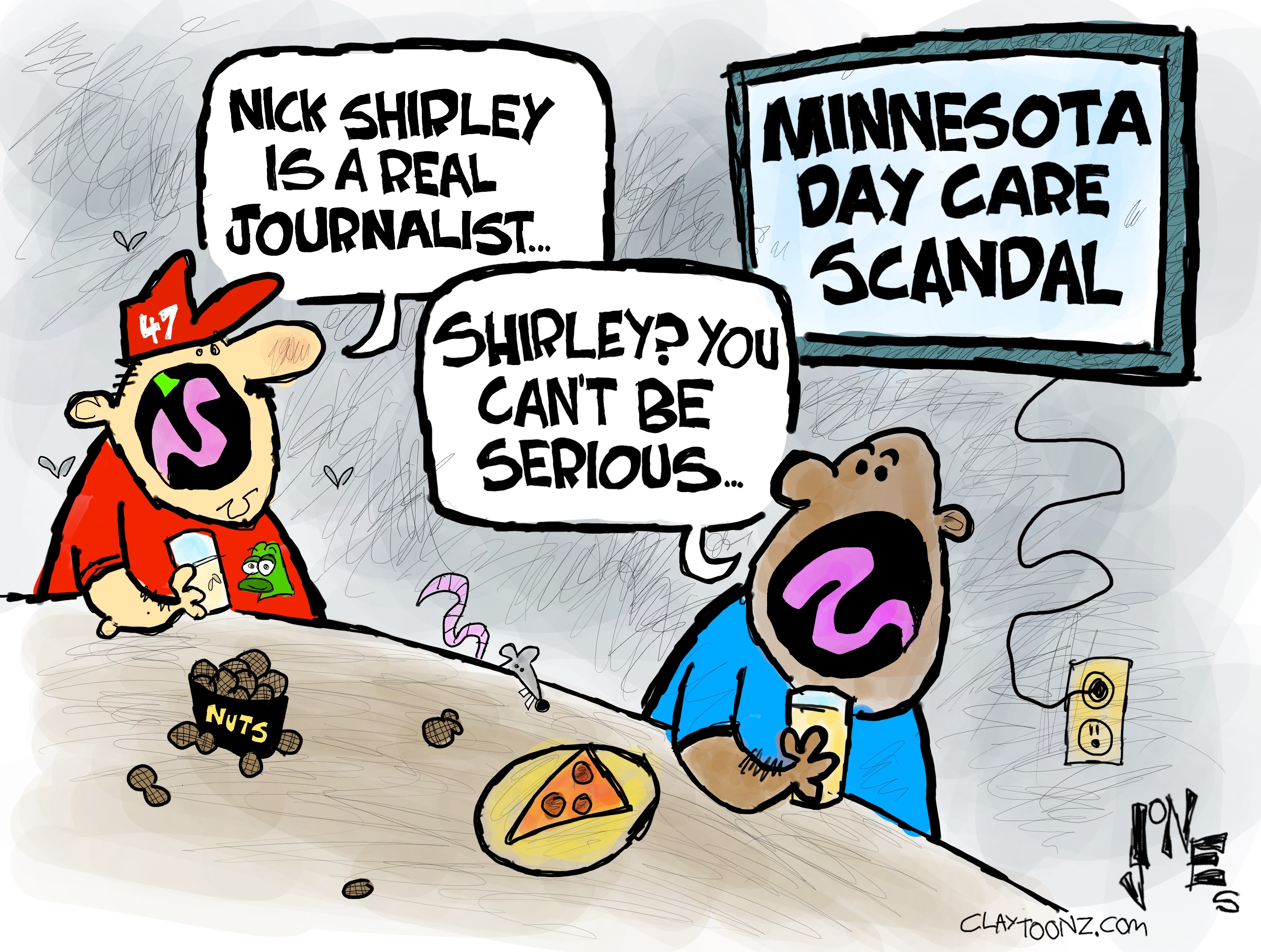

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency