Making money: Flying for cheap, and more

3 top pieces of financial advice — from curbing impulse e-shopping to secret credit scores

Curbing impulse e-shopping

Shopping online can bring out the impulse buyer in all of us, said Trent Hamm at Christian Science Monitor. Online vendors like Amazon do their best to make the purchasing process as painless — and quick — as possible. They know that "the longer you have to wait to fulfill your impulse, the less likely you are to just buy something to scratch that itch." To curb your inner shopaholic, start by clearing your browsing history — that way, vendors can't tempt you with item recommendations. And turn off shopping sites' "one-click" settings. This forces you to retype your credit card and address information each time you make a new purchase. Yes, it's a hassle. But the extra minute might make you rethink the purchase.

Flying for cheap

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Some simple tips can help you snag the cheapest airfares, said Jennifer Waters at MarketWatch. A recent study looked at shifting fares and determined the most likely "sweet spot" for getting a good price. The short answer: 49 days before your departure for domestic flights, and 81 for international flights. Try to travel during "shoulder season," in the spring and fall, and remember that "Sunday and Friday flights are going to cost you more than a Tuesday or Wednesday." Online tools like Kayak.com, Airfarewatchdog.com, and TripAdvisor.com let you plot itineraries and get a feel for market conditions.

Secret credit scores

FICO scores aren't the only way credit card companies keep an eye on customers, said Mandi Woodruff at Business Insider. Lenders use several other "scores," based on customers' spending and repayment patterns, to size up customers. "If you normally shop at high-end stores and regularly pay off your card, and then suddenly start shopping at discount stores and carrying a balance, the lender could use this data as an indicator that you have become higher risk," said Adrian Nazari, CEO of CreditSesame.com. Lenders also use a "carefully formulated algorithm," based on debt balances and payment histories, to predict how likely a customer is to go bankrupt. "This score helps creditors assess and minimize their risk in advance," said Nazari. Creditors also use what's called a "Wandering Eye" score, which sizes up how likely you are to be using a card issued by a competing lender. "When this score is high, it tells lenders they may need to sweeten the pot and offer you various perks."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

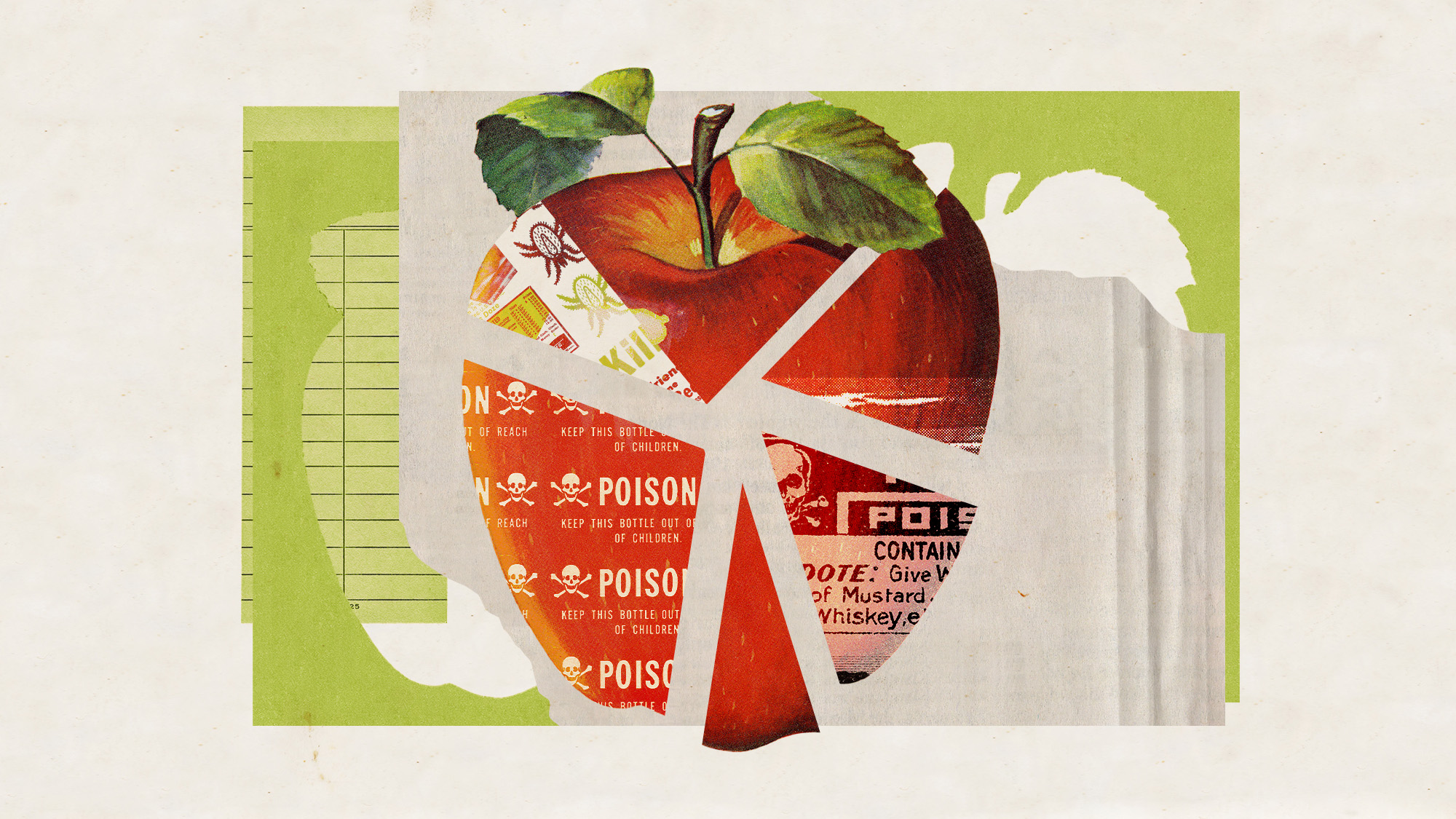

Europe’s apples are peppered with toxic pesticides

Europe’s apples are peppered with toxic pesticidesUnder the Radar Campaign groups say existing EU regulations don’t account for risk of ‘cocktail effect’

-

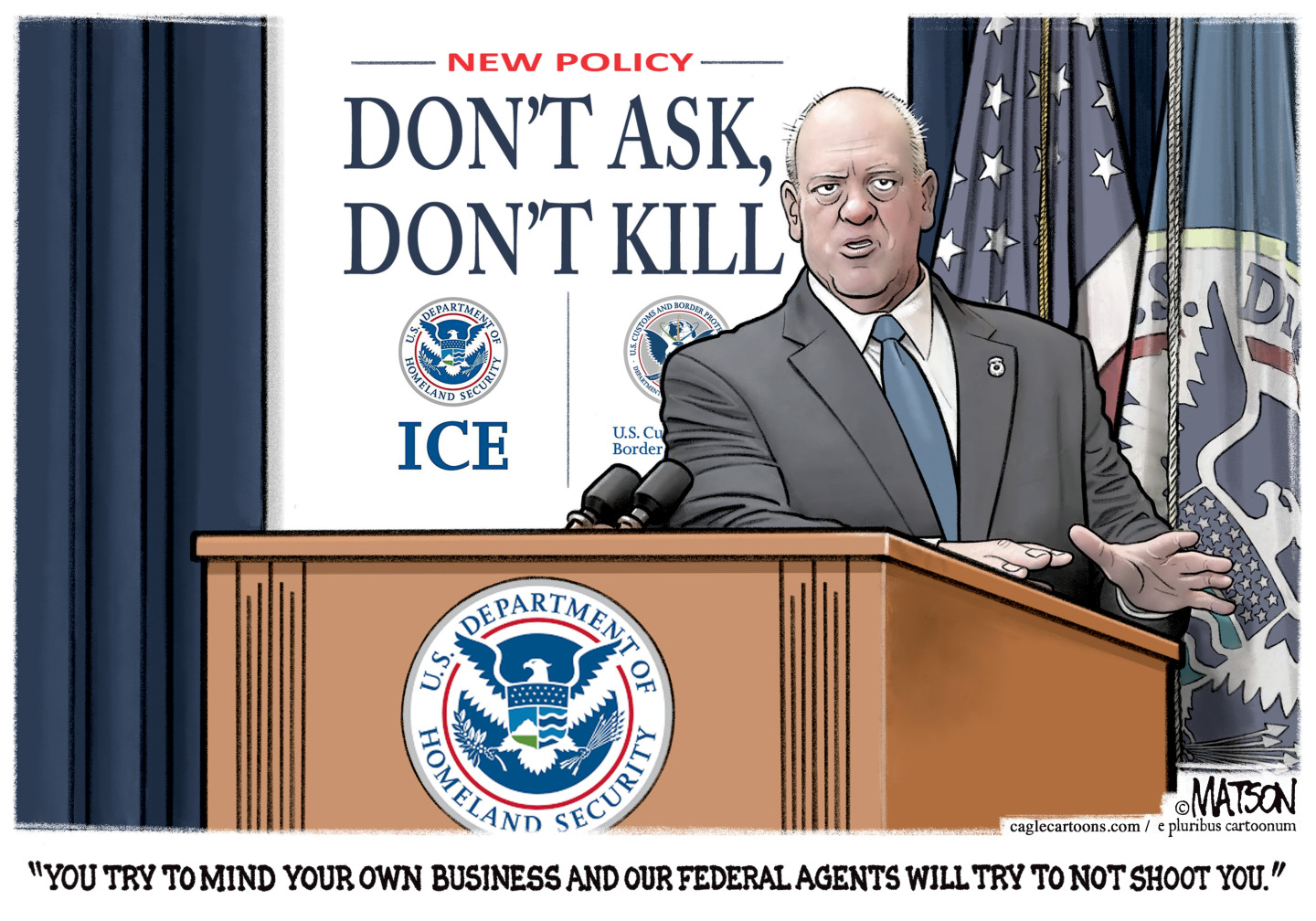

Political cartoons for February 1

Political cartoons for February 1Cartoons Sunday's political cartoons include Tom Homan's offer, the Fox News filter, and more

-

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?

Will SpaceX, OpenAI and Anthropic make 2026 the year of mega tech listings?In Depth SpaceX float may come as soon as this year, and would be the largest IPO in history