Time for the government to sell its stake in GM?

The automaker is reportedly pushing the Obama administration to give up its hefty stake in the company — a move that could cost taxpayers billions of dollars

General Motors, sick and tired of being mocked as Government Motors, is putting pressure on the Obama administration to sell its 26.5 percent stake in the car company, say Jeff Bennett and Sharon Terlep at The Wall Street Journal. GM says the government's ownership stake, part of a $50 billion bailout in 2009, "is a drag on its reputation and hurts the company's ability to recruit talent because of pay restrictions." In addition, GM executives aren't happy about government rules that limit their use of corporate jets. Mitt Romney has pledged to immediately sell the government's GM shares if he wins the presidential election. Should President Obama beat him to the punch and sell now?

No. The government would incur a huge loss: The government's main objection to selling is that taxpayers would book a $15 billion loss on their investment in GM, says Jim Jelter at MarketWatch. GM is "currently trading at just under $24 a share, well below its $33 post-bankruptcy" return to the stock market in late 2010. And "the share price needs to reach $53 for the government to extract itself from GM without a loss." It's "going to take awhile" for GM's share price to claw up to $53, and the government will have to hold on to its stake if it wants to exit the company with honor.

"Obama's wistful GM exit strategy"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And GM is not ready to be independent: After years of short-sighted decisions that pushed the company to the brink of failure, the government "was the only entity that could get GM to change" says Micheline Maynard at Forbes. If Uncle Sam "pulls out now, there is no guarantee that GM won't revert to the behavior that sent it looking for a government bailout." The Obama administration "largely shaped the GM that emerged" from bankruptcy in 2009, and the new, forward-looking company is one that can succeed. The government "needs to be a presence, even a silent one, until it's clear that GM can chart its own path."

"Why Treasury should hang onto its GM shares"

Well, this is proof the auto bailout isn't working: Voters have heard over and over that GM "is 'alive' and that President Obama is more or less solely responsible," says The Wall Street Journal in an editorial. But if GM has really roared back, "why not formalize the achievement by unwinding the taxpayer stake" in the company? The government's refusal to sell is evidence of the "ongoing damage" the auto bailout is doing to the American taxpayer, who is now stuck with a company whose "future profitability is far from guaranteed."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

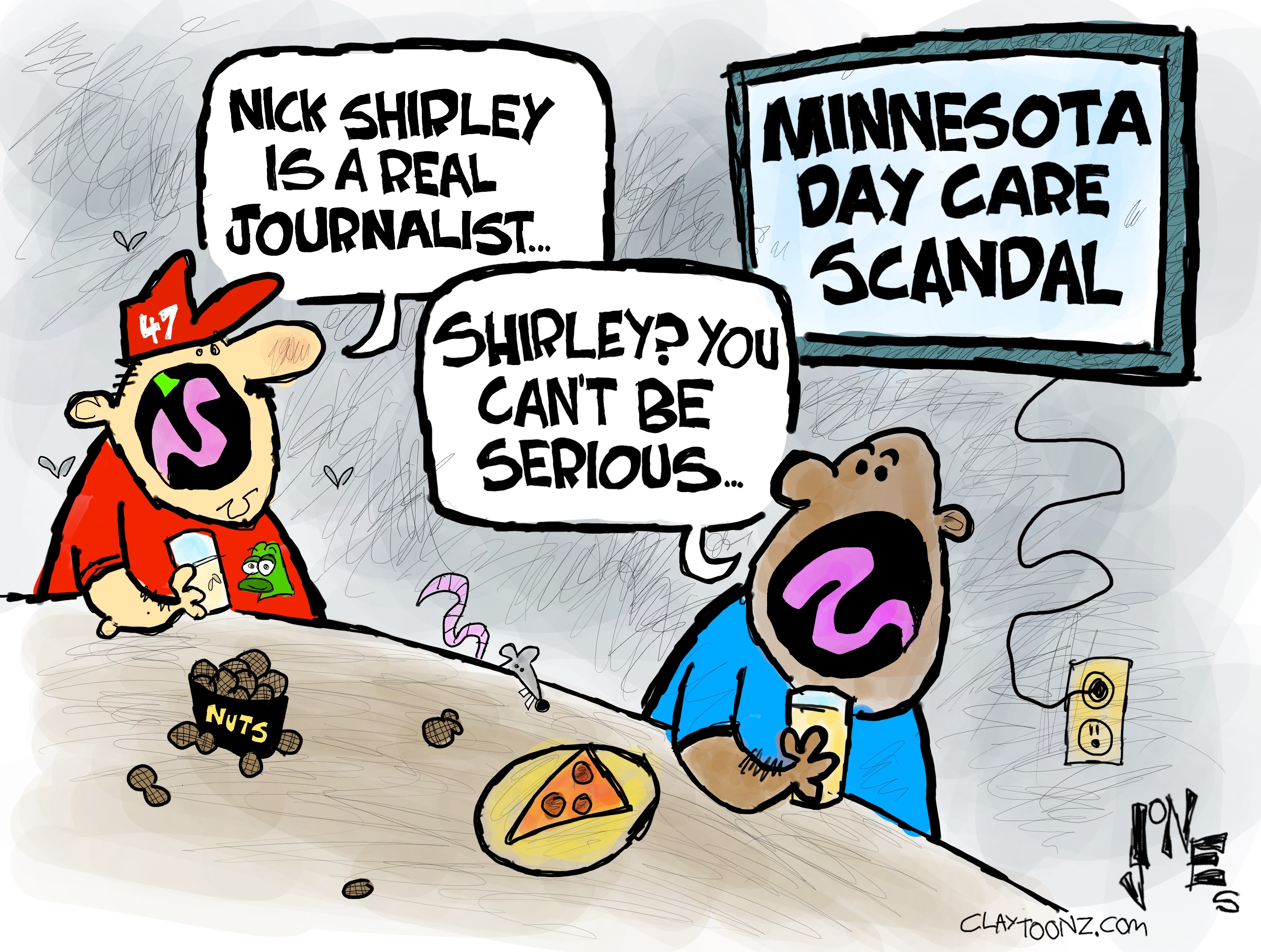

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency