Is the U.S. insulated from the European debt crisis?

Conventional wisdom says a breakup of the euro would devastate the U.S. economy. But, arguably, America could weather the storm

Europe's monetary union continues to teeter on the edge. As Greece flirts with a euro exit, officials are scrambling to come up with a rescue plan for Spain's crumbling banks. President Obama is crossing his fingers that the Europeans can avoid a break-up of the euro, which many believe would send shockwaves through the global economy and kill the U.S.'s uneven recovery. Indeed, Europe's woes are considered one of the primary threats to Obama's re-election. But is the U.S. better protected from the European crisis than we think?

Yes. The U.S. recovery could survive: Most investors "mistakenly think that Europe's malaise will be contagious," says Jack Albin at Bloomberg. The U.S. is actually "somewhat insulated from Europe's predicament." Three central drivers of the current U.S. economy — manufacturing, energy, and housing — will be untouched by the crisis and could even benefit from Europe's troubles. Furthermore, the U.S. has effectively "decoupled" from Europe, with exports to the continent representing "only 2 percent of gross domestic product." A dip in European trade is "not enough to derail growth."

"Energy, housing, and trade shield U.S. from euro crisis"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

No. The global economy is too interconnected: The U.S. may look safe on paper, but you can't "ignore human nature and how the markets will likely respond," says Peter Tchir at Minyanville. Greece's exit from the euro would hit the global economy harder than the collapse of investment bank Lehman Brothers in 2008 and Japan's earthquake in 2011. Both trade and credit would be severely disrupted, and the contagion would quickly "spread to the rest of Europe and the U.S. and China." A collapse of the euro "will make people look at the post-Lehman collapse as the good old days."

"Why a Grexit would make Lehman look like child's play"

If the U.S. stumbles, it only has itself to blame: The U.S., whose economic problems should have been far "easier to overcome" than the euro crisis, is in a precarious position because of its government's failures, not Europe's, says Clive Crook at Bloomberg. Since the stimulus was passed in 2009, "Washington has been more or less paralyzed," failing to enact an "obvious and feasible" plan combining short-term stimulus and long-term debt reduction. It seems that for the U.S., "between now and the next crash, there's just no time in the schedule to fix the economy."

"U.S. and Europe have no excuses for next recession"

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for January 4

Political cartoons for January 4Cartoons Sunday's political cartoons include a resolution to learn a new language, and new names in Hades and on battleships

-

The ultimate films of 2025 by genre

The ultimate films of 2025 by genreThe Week Recommends From comedies to thrillers, documentaries to animations, 2025 featured some unforgettable film moments

-

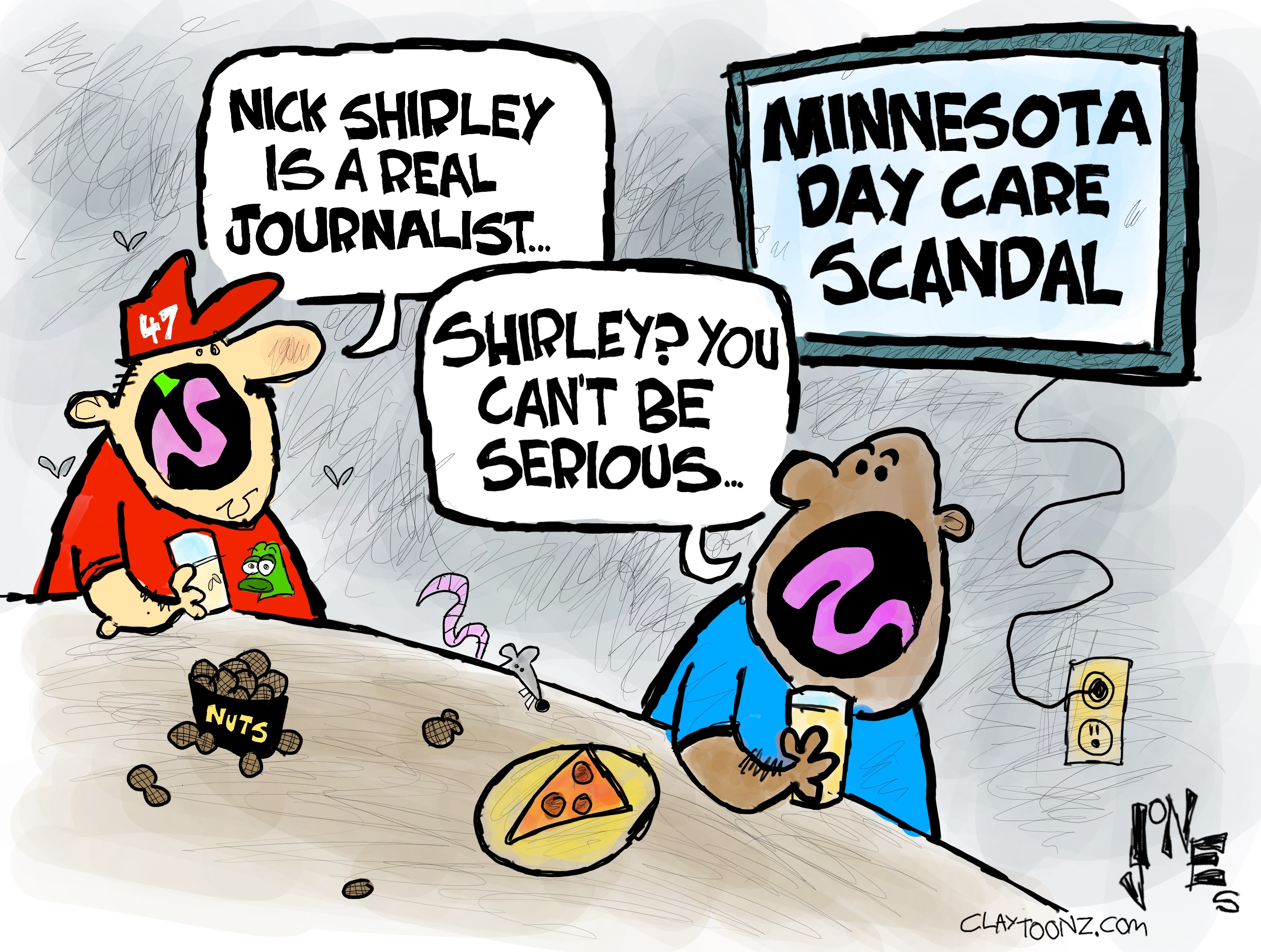

Political cartoons for January 3

Political cartoons for January 3Cartoons Saturday's political cartoons include citizen journalists, self-reflective AI, and Donald Trump's transparency