Would Greece's exit strengthen the euro?

Markets are jittery over the possibility that Greece will leave the euro. But the much-feared move could actually benefit the currency bloc

The European debt crisis is reaching a boiling point. Greece is flirting with an exit from the euro currency, and European leaders are at an impasse over how to resolve the continent's economic woes. Many analysts say debt-plagued Greece's potential exit from the eurozone — an unprecedented scenario full of unknowns — could wreak havoc on the global economy by sparking a financial panic that spreads to other debt-saddled countries like Spain and Italy, effectively disintegrating the euro currency. But could a Greek exit actually benefit the euro?

Yes. A Greek exit could make the euro stronger: Greece's departure from the euro could "be one of the best things that ever happened to the currency union," says Jacob Kirkegaard at Bloomberg. Germany and other creditworthy members of the eurozone are hesitating to take necessary steps toward financial integration — such as issuing joint bonds and launching a pan-euro guarantee on bank deposits — because debt-burdened Greece is "too out of sync to share a common monetary policy." But with Greece gone, the remaining members could band together and create a much stronger union than the current one.

"A Greek exit could make the euro area stronger"

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

No. This could reveal even more euro flaws: The currency bloc would suffer if "Greece abandons the euro and bounces back surprisingly fast," says Michael Sivy at TIME. After all, countries like Argentina and Iceland "suffered currency collapses, but after a horrible year or two, they each rebounded and were better off than if they had fought to save a failing currency." If Greece were to experience a similar comeback, remaining eurozone members would find all the strings that come attached to euro membership even more burdensome. "Result: The entire European Union might unravel."

"Euro crisis: Why a Greek exit could be much worse than expected"

Before Greece exits, the eurozone should strengthen itself: The stalemate over financial integration, which is largely being played out between anti-austerity France and pro-austerity Germany, is helping no one, says The Economist. Germany has so far balked at the idea of taking on even more of Greece's burden, but "greater risk-sharing will not amount to handing its credit card to profligate governments." In fact, strengthening the euro compact with strict budgetary conditions "will make it easier to threaten Greece or others with expulsion," while creating "incentives for countries to keep to the path of reform."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

5 hilariously slippery cartoons about Trump’s grab for Venezuelan oil

5 hilariously slippery cartoons about Trump’s grab for Venezuelan oilCartoons Artists take on a big threat, the FIFA Peace Prize, and more

-

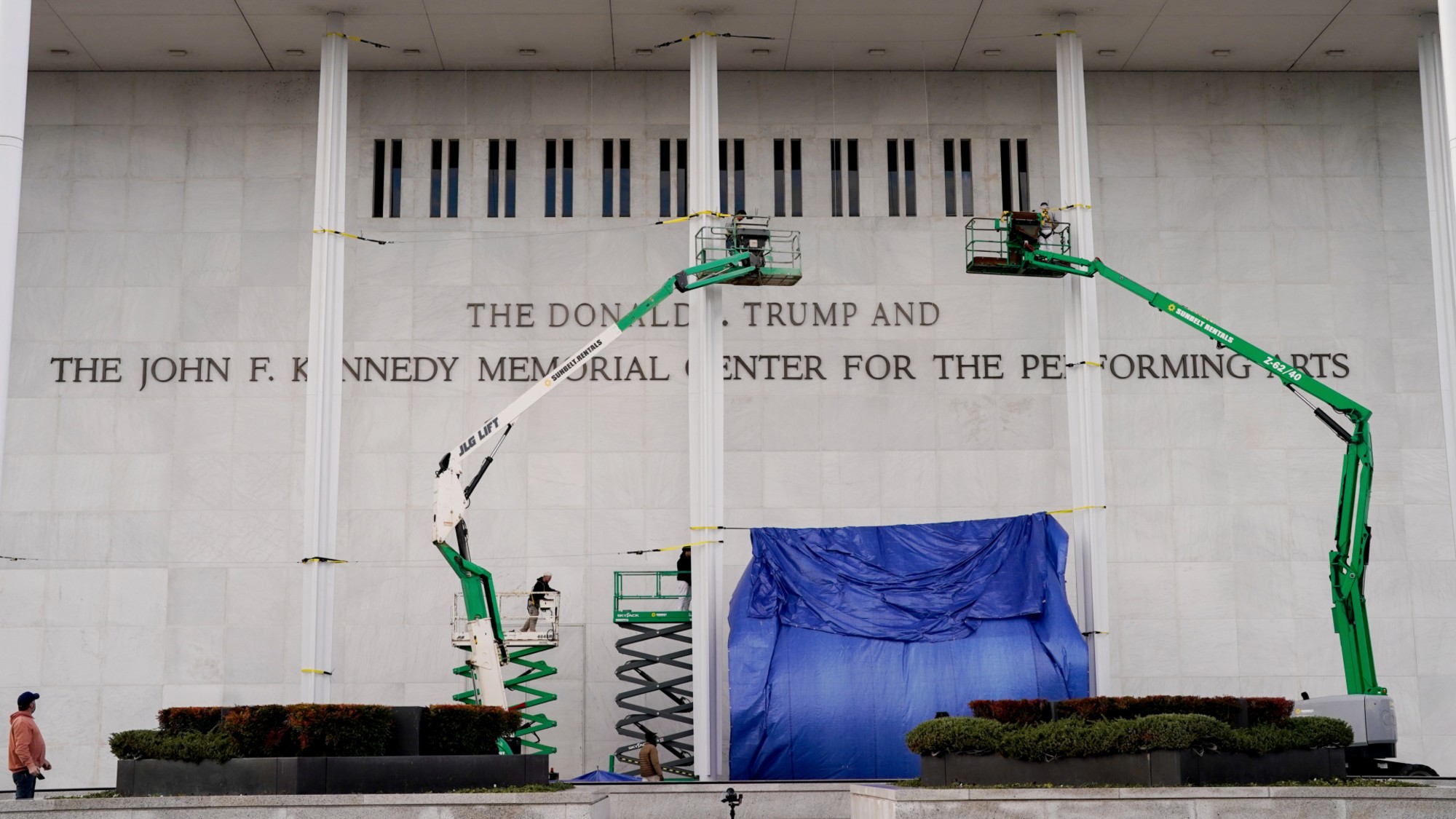

A running list of everything Trump has named or renamed after himself

A running list of everything Trump has named or renamed after himselfIn Depth The Kennedy Center is the latest thing to be slapped with Trump’s name

-

Do oil companies really want to invest in Venezuela?

Do oil companies really want to invest in Venezuela?Today’s Big Question Trump claims control over crude reserves, but challenges loom