Issue of the week: Hammering out financial reform

Now that the Senate has passed its version of a financial reform bill, legislators will move into “the proverbial smoke-filled back room” to reconcile the Senate bill with the measure the House passed last December.

Let the sausage-making begin, said David Reilly in The Wall Street Journal. The Senate last week passed its version of a financial reform bill that would usher in the biggest change in Wall Street and bank regulation in decades. Now, House and Senate legislators will move into “the proverbial smoke-filled back room” to reconcile the Senate bill with the measure the House passed last December. Their focus will be on a handful of major unresolved issues, said Eric Dash and Nelson Schwartz in The New York Times, and none is hotter than whether banks should be allowed to trade in derivatives. Derivatives, lest we forget, are “the complex instruments considered to be among the main culprits of the financial crisis.” A Senate provision would force commercial banks and Wall Street firms to “wall off” their derivatives trading in separate subsidiaries and put up additional capital to cover potential losses; the House does not address the issue. Derivatives trading is enormously profitable for big banks, and the financial industry is pulling out all the stops to kill or water down any new limits.

Wall Street can also be expected to try to gut another far-reaching reform, the so-called Volcker rule, said Colin Barr in Fortune.com. Named for Paul Volcker, the former Federal Reserve chairman and current economic advisor to President Obama, the rule would bar banks from trading securities for their own accounts, rather than on behalf of customers. Both chambers include some limits on risky trading, but the final bill will likely contain watered-down language that will allow regulators to override the ban. The law will probably place few limits on the amount banks can borrow for trading purposes. The big trading firms, which got into trouble precisely because they borrowed so much to fund their bets, must be relieved. “The rest of us? Not so much.”

Another sticking point is how to pay to dismantle firms that are “too big to fail,” said The New York Times in an editorial. The House and Senate both want to ensure that “stockholders and unsecured creditors—not taxpayers—will bear the losses of a failure.” But they go about it very differently. The House would require banks to pay into a $150 billion fund that would cover the costs of winding down a failing institution. The Senate bill has no such requirement, on the theory that a “resolution” fund would create a perverse incentive for banks to take big risks. But whatever regulations emerge in the final bill, the banks will probably figure out how to circumvent them, says Manhattan College finance professor Charles Geisst. “They’re finding a way to work around these new rules,” he says, “even before they’re passed.”

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Create an account with the same email registered to your subscription to unlock access.

-

Italian senate passes law allowing anti-abortion activists into clinics

Italian senate passes law allowing anti-abortion activists into clinicsUnder The Radar Giorgia Meloni scores a political 'victory' but will it make much difference in practice?

By Chas Newkey-Burden, The Week UK Published

-

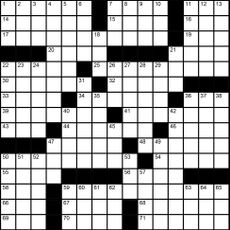

Magazine interactive crossword - May 3, 2024

Magazine interactive crossword - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Magazine solutions - May 3, 2024

Magazine solutions - May 3, 2024Puzzles and Quizzes Issue - May 3, 2024

By The Week US Published

-

Issue of the week: Yahoo’s ban on working from home

feature There’s a “painful irony” in Yahoo’s decision to make all its employees come to the office to work.

By The Week Staff Last updated

-

Issue of the week: Another big airline merger

feature The merger of American Airlines and US Airways will be the fourth between major U.S. airlines in five years.

By The Week Staff Last updated

-

Issue of the week: Feds’ fraud suit against S&P

feature The Justice Department charged S&P with defrauding investors by issuing mortgage security ratings it knew to be misleading.

By The Week Staff Last updated

-

Issue of the week: Why investors are worried about Apple

feature Some investors worry that the company lacks the “passion and innovation that made it so extraordinary for so long.”

By The Week Staff Last updated

-

Issue of the week: Does Google play fair?

feature The Federal Trade Commission cleared Google of accusations that it skews search results to its favor.

By The Week Staff Last updated

-

Issue of the week: The Fed targets unemployment

feature By making public its desire to lower unemployment, the Fed hopes to inspire investors “to behave in ways that help bring that about.”

By The Week Staff Last updated

-

Issue of the week: Is Apple coming home?

feature Apple's CEO said the company would spend $100 million next year to produce a Mac model in the U.S.

By The Week Staff Last updated

-

Issue of the week: Gunning for a hedge fund mogul

feature The feds are finally closing in on legendary hedge fund boss Steven Cohen.

By The Week Staff Last updated