The Fed bets the bank

Ben Bernanke & Co. gamble on a historically low interest rate

If Federal Reserve Chairman Ben Bernanke “weren’t an economist and central banker, we’d guess he’d be a poker player,” said The Wall Street Journal in an editorial. With the Fed’s cutting of its benchmark fed funds rate to between zero and 0.25 percent, from 1 percent, Bernanke showed he likes “to go all in on monetary policy, never mind the risks.” This “monetary adventure” might help unfreeze credit, but it won’t solve the market’s real problem: “fear and uncertainty.”

Cutting the rate to below 1 percent is “historic,” as it’s never been tried before, said Justin Fox in Time online, “but it’s also something of a nonevent”—the actual, not target, rate has been below 0.2 percent for a week. The real action is in the Fed’s pivot to “quantitative easing, also known as printing money,” to buy up assets.

That could be good news for homeowners and buyers, said Sue Kirchhoff and John Waggoner in USA Today. Not only should the rock-bottom fed funds rate push down mortgage rates, but the Fed’s plan to buy mortgage-backed securities would also boost the housing market. And that, in turn, would be “a powerful economic stimulus.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The Fed’s whole gamble “depends on banks’ willingness to lend,” though, said Dwight Cass in BreakingViews. And given that the banks are hoarding $600 billion on deposit at the Fed—up from $2 billion a year ago—it appears that their “appetite to extend new loans remains low.” The Fed has to hope its shift to directly buying assets will “prime the lending pump.” With its target rate near zero, “it has few other options” left.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

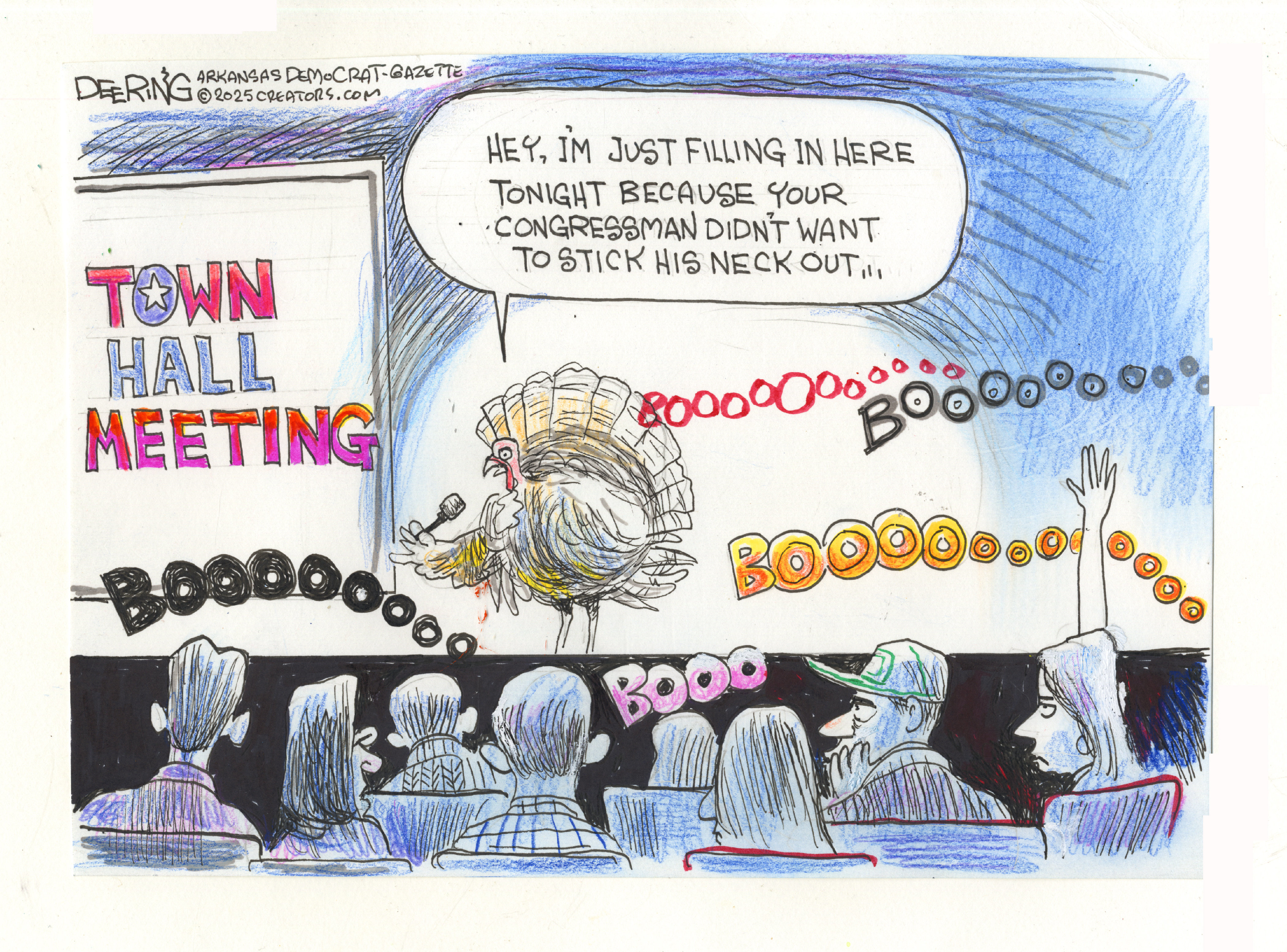

Political cartoons for November 15

Political cartoons for November 15Cartoons Saturday's political cartoons include cowardly congressmen, a Macy's parade monster, and more

-

Massacre in the favela: Rio’s police take on the gangs

Massacre in the favela: Rio’s police take on the gangsIn the Spotlight The ‘defence operation’ killed 132 suspected gang members, but could spark ‘more hatred and revenge’

-

The John Lewis ad: touching, or just weird?

The John Lewis ad: touching, or just weird?Talking Point This year’s festive offering is full of 1990s nostalgia – but are hedonistic raves really the spirit of Christmas?