Why the AIG bailout isn't enough

Will it take new regulations to restore confidence on Wall Street?

The government’s “rescue du jour” prevented the near-failure of insurance giant AIG, said The Philadelphia Inquirer in an editorial, but watching the feds “scramble from forest fire to fire” is scaring investors and consumers. A “more systematic solution,” such as creating an agency to buy and resell troubled mortgage assets, would do more to stave off panic.

Bailing out one company after another will only work “until Washington runs out of cash,” said The Washington Post in an editorial. The key to restoring order is devising a “more predictable and transparent” way to handle Wall Street’s meltdown, “along with new rules to help prevent a repeat performance in the future.”

Regulations passed to prevent a repeat of Enron helped create this mess, said Zachary Karabell in The Wall Street Journal. AIG and Lehman Brothers and Bear Stearns only buckled because post-Enron rules on reporting assets made mortgages and derivatives look worthless when they really weren’t. The problem isn’t too little or too much regulation—it’s “bad regulation.”

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

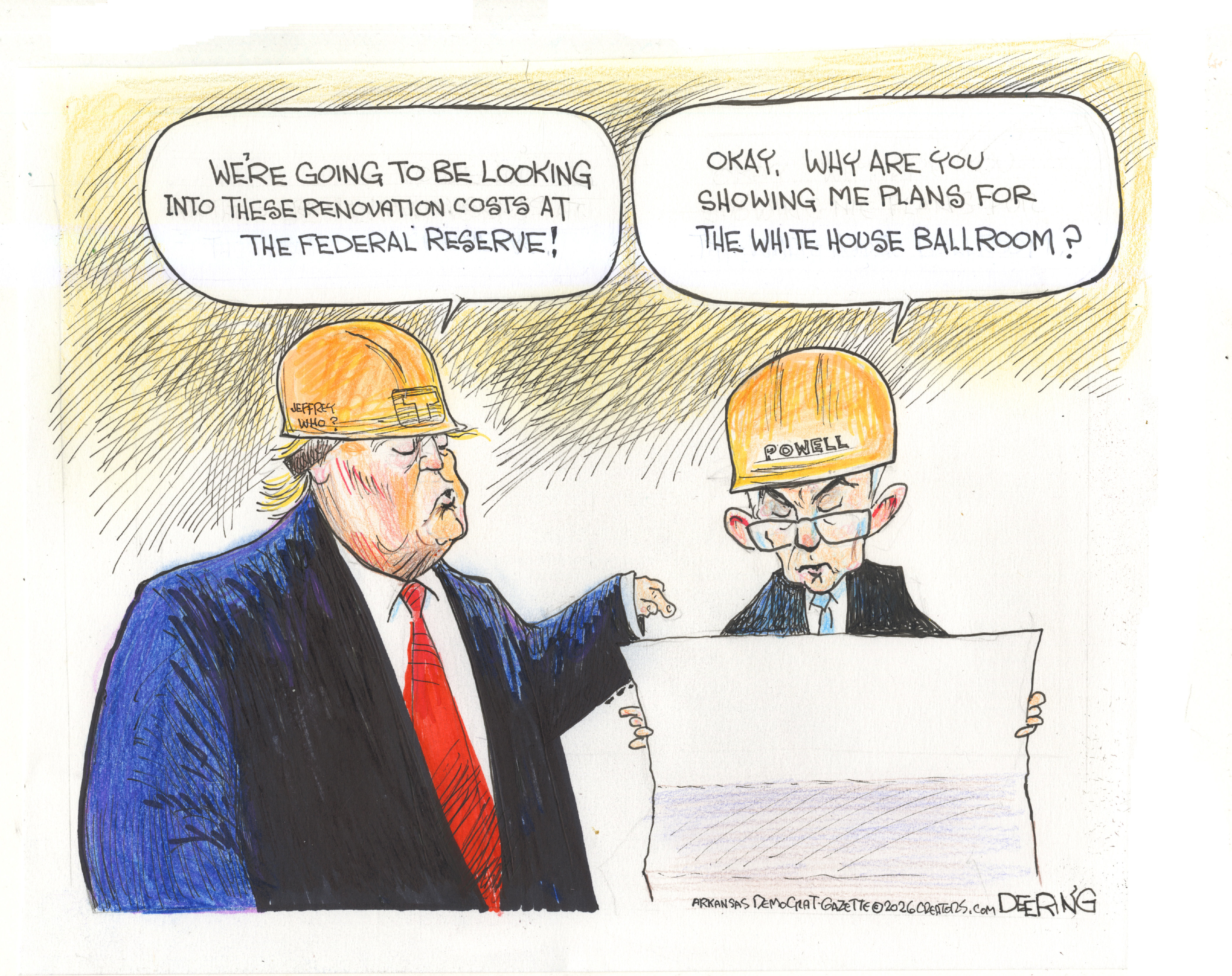

Political cartoons for January 17

Political cartoons for January 17Cartoons Saturday’s political cartoons include hard hats, compliance, and more

-

Ultimate pasta alla Norma

Ultimate pasta alla NormaThe Week Recommends White miso and eggplant enrich the flavour of this classic pasta dish

-

Death in Minneapolis: a shooting dividing the US

Death in Minneapolis: a shooting dividing the USIn the Spotlight Federal response to Renee Good’s shooting suggest priority is ‘vilifying Trump’s perceived enemies rather than informing the public’