Best Business Commentary

With exchange-traded index funds, “the hype is finally justified” for regular investors, says Jonathan Clements in The Wall Street Journal. As liquid wealth shifts to former third-world countries, we “can’t afford to write off China, or India, or the Pers

ETFs for the rest of us

With exchange-traded index funds, “the hype is finally justified” for regular investors, says Jonathan Clements in The Wall Street Journal. Most of the 600 ETFs from Wall Street “merely mimic existing mutual funds” or are too narrow for “prudent investors.” But new, “intriguing” low-cost ETF offerings in four key areas—foreign real estate, international small caps, commodities, and foreign bonds—offer “ordinary investors some great new ways to diversify.” When U.S. markets dip, having investments in local markets abroad can help protect you. But still, ETFs are “volatile investments,” and you should cap each of these at 5-10 percent of your portfolio.

Beggars can’t be choosy

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

As liquid wealth shifts to former third-world countries, we “can’t afford to write off China, or India, or the Persian Gulf” because they lack brand cachet, says Daniel Gross in Slate. People are worried about Jaguar’s “upscale image” if it is purchased by Tata—an “enormously successful and sophisticated Indian company”? With U.S. firms like Citigroup, AMD, and Blackstone getting much-needed cash from places like China and Abu Dhabi, we should accept that we’ve “become imperial beggars.” And with our economy slowing and a looming housing bust, “being a snob about the source of capital” is just one of the “rising number of luxuries” we can no longer afford.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

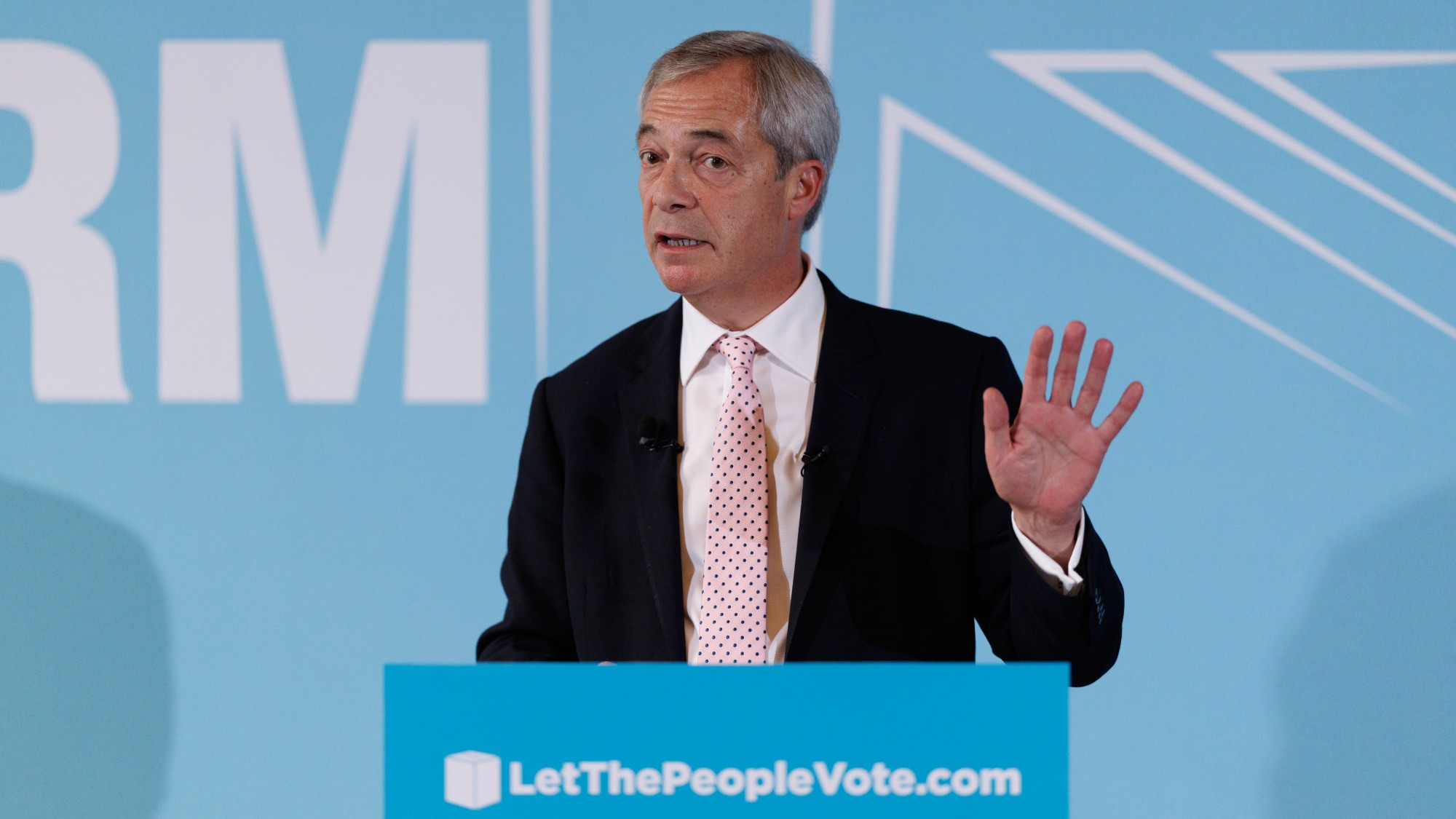

Farage’s £9m windfall: will it smooth his path to power?

Farage’s £9m windfall: will it smooth his path to power?In Depth The record donation has come amidst rumours of collaboration with the Conservatives and allegations of racism in Farage's school days

-

The issue dividing Israel: ultra-Orthodox draft dodgers

The issue dividing Israel: ultra-Orthodox draft dodgersIn the Spotlight A new bill has solidified the community’s ‘draft evasion’ stance, with this issue becoming the country’s ‘greatest internal security threat’

-

Codeword: December 13, 2025

Codeword: December 13, 2025The daily codeword puzzle from The Week