Is America's economic future dependent on the 'gut feeling' of small business owners?

Part of our series on the future of Main Street

The pressure for a business to "grow or die" — or at least "improve or die" — is constant. The consumer is fickle. New government regulations can upend your business model. Lines of credit can be difficult to secure. New technology can crush you. Just look at what Uber is doing to the taxi business or what the cloud has done to hard drive manufacturers.

With threats like those, it's a wonder anyone starts a small business!

But of course, entrepreneurs of all stripes, in all corners of this country, are eager to start and grow businesses of their own. As a result, small business is hardly small. Indeed, small businesses — defined as having fewer than 500 employees and less than $21.5 million in annual revenue — provide employment for about 50 percent of the working population in America. Small businesses have created 65 percent of the new jobs since 1995, and account for about $8 trillion in revenue every year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

It's amazing, then, that such an important sector of the U.S. economy is so vulnerable to the "gut feeling" of small business owners.

(More on the future of Main Street: The booming future of collaborative work environments)

After all, even if capital is available, and even if government regulations are friendly, and even if your business model is not under threat from technological change, why risk your money if you have a hunch that overall economic conditions will worsen? How do you decide when it's time to grow or improve — or even to start?

Some look to the so-called experts for guidance. In recent years, there hasn't exactly been a shortage of pundits sharing their prognostications on our economic future. However, the deeper one looks, the more conflicting those opinions are. Many economists get it wrong — a lot. In a particularly egregious example, this study on the 2008 financial crisis showed that the vast majority of experts failed to predict the financial devastation of the crisis, let alone the crisis itself.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So what's a small business owner to do?

Some fall back on what's known as the herd mentality. They seek safety in numbers. If the general zeitgeist-y feeling surrounding the economy is positive, you're going to feel more confident, too. Many of our opinions on the future are a self-perpetuating feedback loop; that is, your sense of the future is as much your sense of other people's sense of the future as anything else.

(More on the future of Main Street: The amazing promise of electronic payments)

And here's the thing: Meaningful surveys about the future don't exist. The best we have are surveys of the present, which provide only a mere glimpse into the future, and only then if we're lucky. They can be helpful guideposts — but they tell us more about where we've been than where we're going.

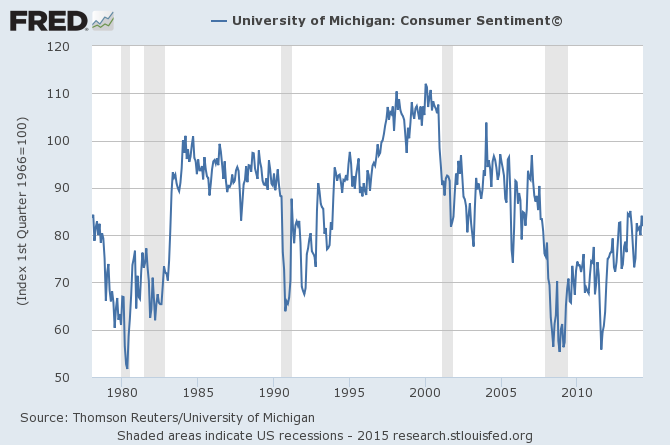

One of these surveys is the Consumer Confidence Index, a measure of how optimistic consumers feels about parting with their money.

Over the last few years, it does seem that things are looking up. But Americans are also tremendously less confident than they were in the pre-recession years. And remember, just because the trend line is going up now, that does not mean it always will. Those surveyed are highly influenced by their present situation.

Another popular view is the Purchasing Manager's Index (PMI), which is a reflection of purchasing managers' confidence in business. While primarily a tool of big business, small business owners who pay attention to more than just the headlines or sound bites on TV monitor the PMI. Any number above 50 percent is bullish on the economy. In November, it was at 58.7 percent.

Okay... so now what?

In the end, it really depends on your business. And as capricious and flimsy as it may sound, you probably ought to take all this survey data and opinionating with a grain of salt, and just go with your gut.

(More on the future of Main Street: How mom-and-pop businesses can thrive in the 21st century)

If you're selling hot dogs on a city street and foot traffic seems stronger at the next corner, the decision to move is easy to make. If you're a start-up trying a marry a wide array of advertisers with YouTube videos — one of the fastest growing businesses in marketing — future investment decisions are a heck of a lot more complex.

And guess what? Going with your gut is popular! One study from a human behavioral expert suggests that, even in big business, with potential support from both in-house expertise and consultants, 50 percent of decisions are based on gut feel. In fact, the more complex the situation, the more simplistic gut feelings factor in the decision-making process.

Don't believe me? Consider the recent plunge in oil prices. Between early July and today, nothing material on the supply or demand side has changed. There is nothing significant now that traders were not aware of back then. But the price of oil has been cut in half. This unprecedented price plunge was all about changing expectations, compounded by the herd mentality at work. And that might just be the best we can do.

Jay spent 30 years as a COO of North Technology Group. NTG includes in its portfolio North Sails and Southern Spars, which are technological leaders in their respective fields. He now does business management consulting for NTG and freelance writing on economics, finance, and sailing.

-

Into the Woods: a ‘hypnotic’ production

Into the Woods: a ‘hypnotic’ productionThe Week Recommends Jordan Fein’s revival of the much-loved Stephen Sondheim musical is ‘sharp, propulsive and often very funny’

-

‘Let 2026 be a year of reckoning’

‘Let 2026 be a year of reckoning’Instant Opinion Opinion, comment and editorials of the day

-

Why is Iran facing its biggest protests in years?

Why is Iran facing its biggest protests in years?TODAY’S BIG QUESTION Iranians are taking to the streets as a growing movement of civic unrest threatens a fragile stability