Why saving money won't help the American economy

Conservative economic theory says savings goes into investment. The evidence says otherwise.

In a previous broadside against what I called "radical savings scolds," I was a tad unfair. I asserted that they never considered what would happen to society if everyone did what they suggested in their lists of savings tips and investment advice — in other words, what effects a massive savings culture would have on the economy as a whole. But it turns out that's only about 95 percent right. The radical savers do turn to this question every so often.

Mr. Money Mustache, for example, defends saving using the idea of investment. By this view, savers are merely increasing investment and productivity! So if we all were to slowly adjust to a much higher savings rate, everything would be fine in the end.

Under certain circumstances, this is a reasonable defense. But it is not universally so — and the last six years have shown where it breaks down. Furthermore, at a fundamental level the Mustache defense reveals the inherent limitations of an ideology that always considers savings an unqualified good. The economy, alas, is more complicated than that.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

So let's dig into the Mustache defense. Consumers aren't the engine of economic growth, he argues. Instead:

It is the savers and investors. Only by sacrificing current consumption, can people put money into banks or share offerings, which end up in the hands of new and existing businesses who can then use that money to create new technology, factories, or human capital, allowing them to increase their productivity. Capital creates productivity, and productivity is the driver of our standard of living. [Mr. Money Mustache]

This is basically bog-standard conservative economics (though later he wanders into crankdom with an aside about how lack of investment might create hyperinflation (nope)). Still, back in the 1950s, it would have been a reasonable proposition.

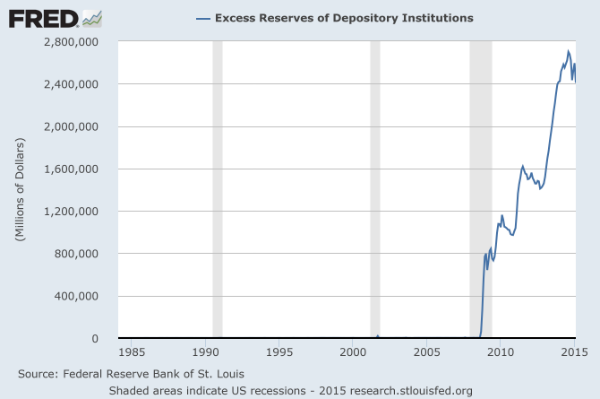

But the idea that the U.S. — or the world at large — is running short of savings today, or that more saving would increase investment, is ridiculous. On the contrary, the world economy is absolutely awash with savings with nowhere to go. As Paul Krugman explains, that's the characteristic sign of a liquidity trap, which we have been stuck in since 2008. Collectively, people want to save more than they want to invest. More than $2.4 trillion in excess of what banks are required to hold is currently just sitting there:

The question of finding sufficient investment has troubled capitalism since its very beginning. Eric Hobsbawm, in his history of the Industrial Revolution, illustrated how one of the chief benefits of the first railroads was their enormous expense, which soaked up the stupendous profits of the cotton mills. The over-saving problem recurred in the 1870s, and when no technical solution presented itself, nations thought exporting that extra capital to imperial colonies might help, so they stole half the world. It didn't really work, and a 20-year depression ensued.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Long story short, the upshot here is that saving is not always an unqualified "good," as the Mustache defense would have it. Neither is consumption. Instead, the value of each depends on the broader economic context and one's priorities. But in America in 2015, we have both a surfeit of money washing around and millions of people out of work, and yet we are still short of public investment.

In other words, we're in a mild depression, which we could attack with more consumption, or by forcing more corporate investment, or with direct government employment if we like. The point is that the economy is an interdependent system, and personal saving is one level that is currently jammed all the way. In the way that dumping 10 tons of fertilizer on your garden won't grow car-sized cantaloupes, manically ratcheting up savings for the sake of it will not serve either productivity or broader prosperity.

More sensible pro-saving analysts realize that, without mass roboticization, a universal Mustache utopia is impossible. Radical savers who retire super-early are not increasing productivity — they're living off the work of everyone else. Retired at 30 is a nice trick, but only if somebody else will keep picking up the trash.

Of course, conservatives don't like the whole ecosystem approach, and insist that individuals are responsible for all the good that happens in the world. Savers create all investment, which allows business owners to create all the jobs. And that's radical saving ideology — in a nutshell, it boils down to Reaganomics.

And that is why I find Mr. Money Mustache so pernicious. At root, his is a conservative ideology indistinguishable from the manic "you built that" capering of the 2012 Republican National Convention, but coated with a patina of aw-shucks environmentally conscious anti-consumerism.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

Bari Weiss’ ‘60 Minutes’ scandal is about more than one report

Bari Weiss’ ‘60 Minutes’ scandal is about more than one reportIN THE SPOTLIGHT By blocking an approved segment on a controversial prison holding U.S. deportees in El Salvador, the editor-in-chief of CBS News has become the main story.

-

‘Journalism is on notice’

‘Journalism is on notice’Instant Opinion Opinion, comment and editorials of the day

-

A foodie guide to Edinburgh

A foodie guide to EdinburghThe Week Recommends Go all-out with a Michelin-starred meal or grab a casual bite in the Scottish capital