The week's best financial advice

Three top pieces of financial advice — from buying a new car in 2016 to rethinking airline credit cards

Here are three of the week's top pieces of financial advice, gathered from around the web:

A dismal year for portfolios

It wasn't easy to make money in 2015, said Heather Long at CNN. Nearly 70 percent of investors lost money last year, the worst for markets since the 2008 financial crisis, according to investment tracker Openfolio.com. Investors who did make money either held a lot of cash or took on serious risk, "two things that most investment books and advisers tell you not to do." Cash typically earns next to nothing long term, but it still beat U.S. stocks and many popular bond funds last year. "The other winning strategy was to bet big on individual stocks," especially red-hot tech companies like Amazon and Netflix, both of which gained more than 120 percent in 2015. But that strategy can backfire. Apple, always a popular stock pick, actually performed worse than the S&P 500 last year.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Buying a new car in 2016

Americans are in a car-buying mood, and it's easy to see why, said Karl Brauer at Kiplinger. Pent-up demand, low interest rates, and cheap gasoline all contributed to 2015 being the best year for auto sales ever, according to Kelley Blue Book. Consumers can continue to use market trends to their advantage to get a great deal on a new car this year. With interest rates still low, it's common to be offered 0 percent interest if you have a high credit score. "But even if you don't, a fair number of financing companies will figure out a way to work with you." Hunting for deals can also slash "thousands of dollars off the sticker price." With gas-guzzling trucks and SUVs resurgent, you can also find deals on fuel-efficient models like the Toyota Prius.

Rethinking airline credit cards

"With all the recent changes to frequent-flier programs, it may be time to shuffle your credit cards," said Scott McCartney at The Wall Street Journal. Airlines are making it harder to earn miles and to use them for flights. Delta and United now reward miles based on the price of your ticket rather than the distance you travel; American will follow this year. For infrequent travelers, such changes could mean cash-back rewards programs offer more value. Cards tied to hotel programs may also be a better deal. With more rooms available than award seats on airlines, it's often much easier to redeem points. But airline cards still have their perks, especially if you travel a lot, including waived baggage fees, early boarding, and generous sign-up bonuses "that can by themselves yield a free ticket."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

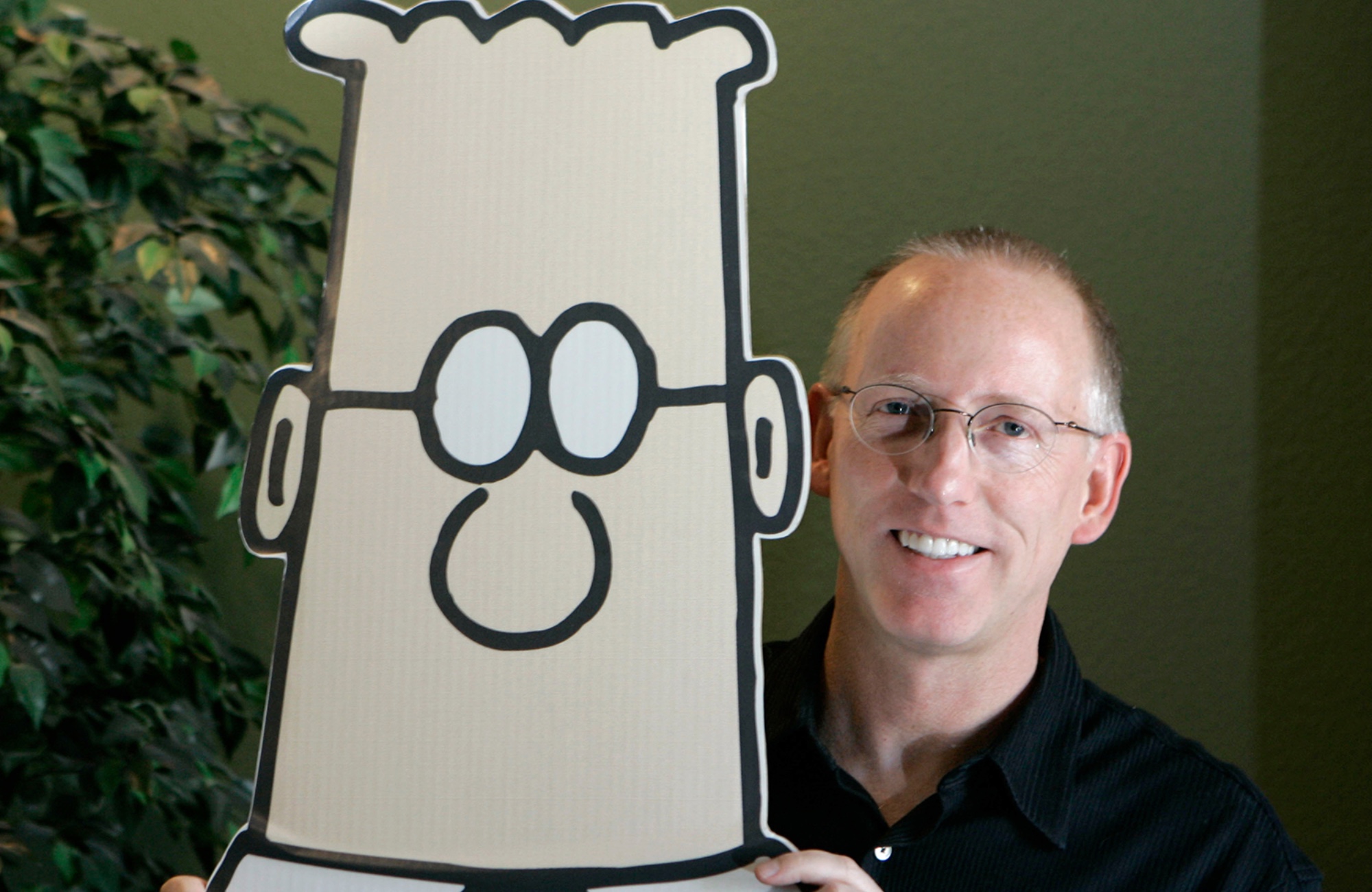

Scott Adams: The cartoonist who mocked corporate life

Scott Adams: The cartoonist who mocked corporate lifeFeature His popular comic strip ‘Dilbert’ was dropped following anti-Black remarks

-

The 8 best animated family movies of all time

The 8 best animated family movies of all timethe week recomends The best kids’ movies can make anything from the apocalypse to alien invasions seem like good, wholesome fun

-

ICE: Now a lawless agency?

ICE: Now a lawless agency?Feature Polls show Americans do not approve of ICE tactics