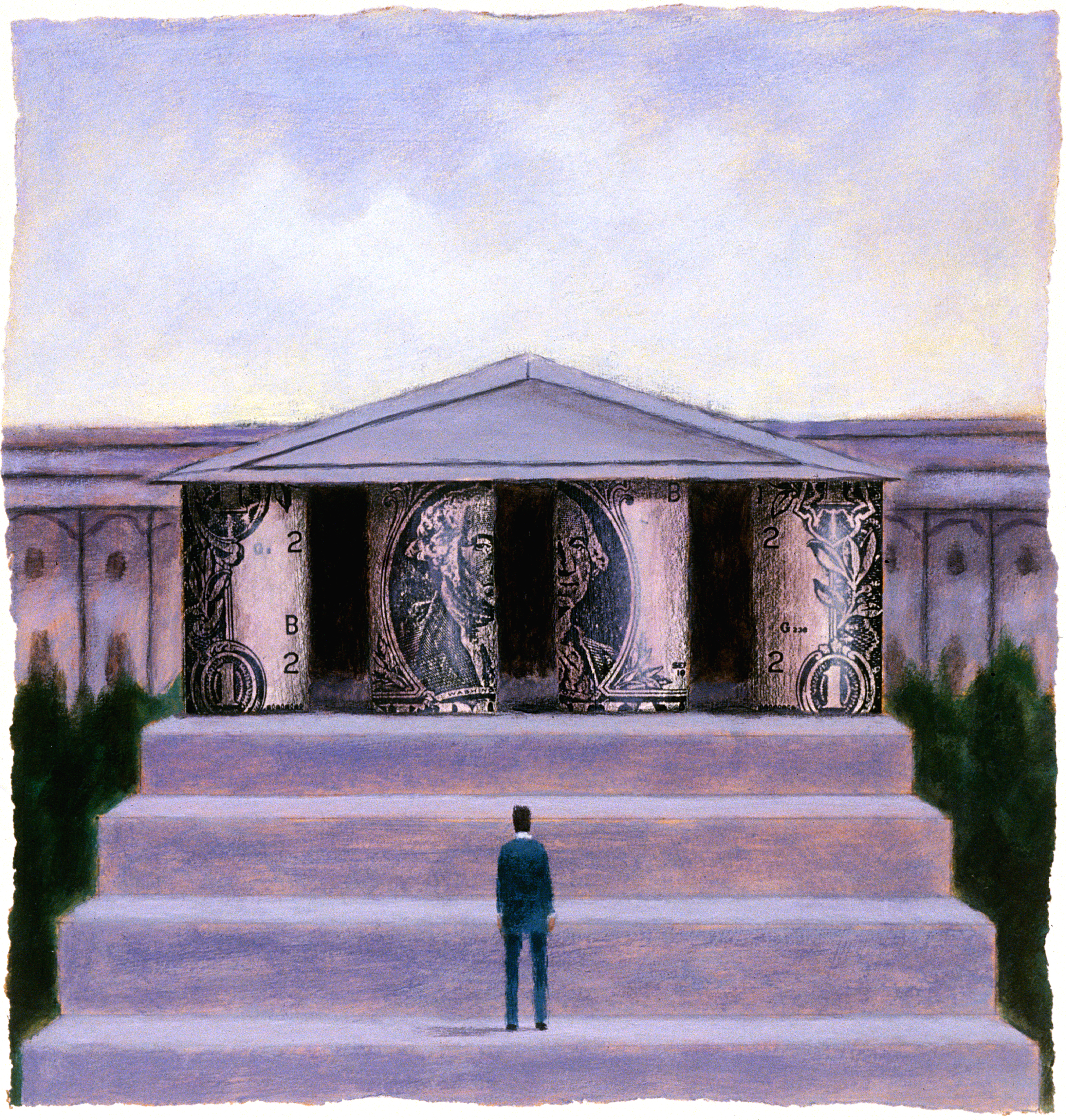

The return of 'too big to fail'

"The politics of financial regulation are certainly getting weirder and more interesting"

The smartest insight and analysis, from all perspectives, rounded up from around the web:

It was the last thing Wall Street expected from a Republican who used to work for Goldman Sachs, said Zachary Warmbrodt at Politico. In a speech last week, the new president of the Federal Reserve Bank of Minneapolis, Neel Kashkari, "blindsided" the financial establishment by suggesting that the biggest banks in America "are still too big to fail." These institutions "continue to pose a significant, ongoing risk to our economy," Kashkari said, despite a slew of regulations enacted since the financial crisis to prevent the next meltdown. Warning that the biggest banks are still "so entrenched in the economy" that Washington would have no choice but to come to the rescue if one of them failed, Kashkari said the government should consider breaking these banks up, or treating them like public utilities. As the former Bush administration official who oversaw the 2008 bailout effort known as the Troubled Asset Relief Program (TARP), Kashkari should know.

The speech met with a "predictably indignant response" from the banks, said Olivia Oran and Anjuli Davies at Reuters. They have lately been suffering from unpredictable market swings, weak earnings, and persistent questions about their ability to withstand another crisis. Piling on more regulations, they contend — such as Kashkari's suggestion that banks be required to hold even more capital to safeguard against emergencies — would only further hurt their ability to make a profit. Still, "many top bankers acknowledge that their institutions might be better off smaller and simpler." They're just not sure how to scale down without damaging their business models.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Kashkari is right that the Dodd-Frank financial reform law of 2010 "has been a flop," said Lee Schafer in the Minneapolis Star Tribune. Its various rules and regulations now exceed 22,000 pages, yet the basic structure of the financial industry is the same as it was before the crisis. Breaking up the banks would at least make them better run, "since too big to fail is also too big to manage," said Chris Arnade in The Atlantic. But there remains a bigger problem: Compensation is still structured so that it rewards excessive risk. It used to be that bankers had their own money at stake in investment decisions, because many banks were private partnerships. Now most of them are paid in cash bonuses. In other words, they "get paid if they win and don't have to give anything back if they lose."

Breaking up the banks won't necessarily make the financial system safer, said Mark Thoma at CBS News. "Interconnectedness" is the real issue. When banks are borrowing from one another to finance deals, like they do in today's mind-bogglingly complex world of investment firms, hedge funds, mutual funds, and mortgage companies, everyone is at risk when a deal goes bad. Whatever comes of this debate, "Kashkari is going to be fascinating to watch," said Jordan Weissmann at Slate. The outspoken official plans to hold a series of symposia on "too big to fail" and is soliciting suggestions from the public on how to fix the issue. That's "something you'd expect from a Senate candidate, not a central banker." Who knows if it will have any real effect. "But the politics of financial regulation are certainly getting weirder and more interesting."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy