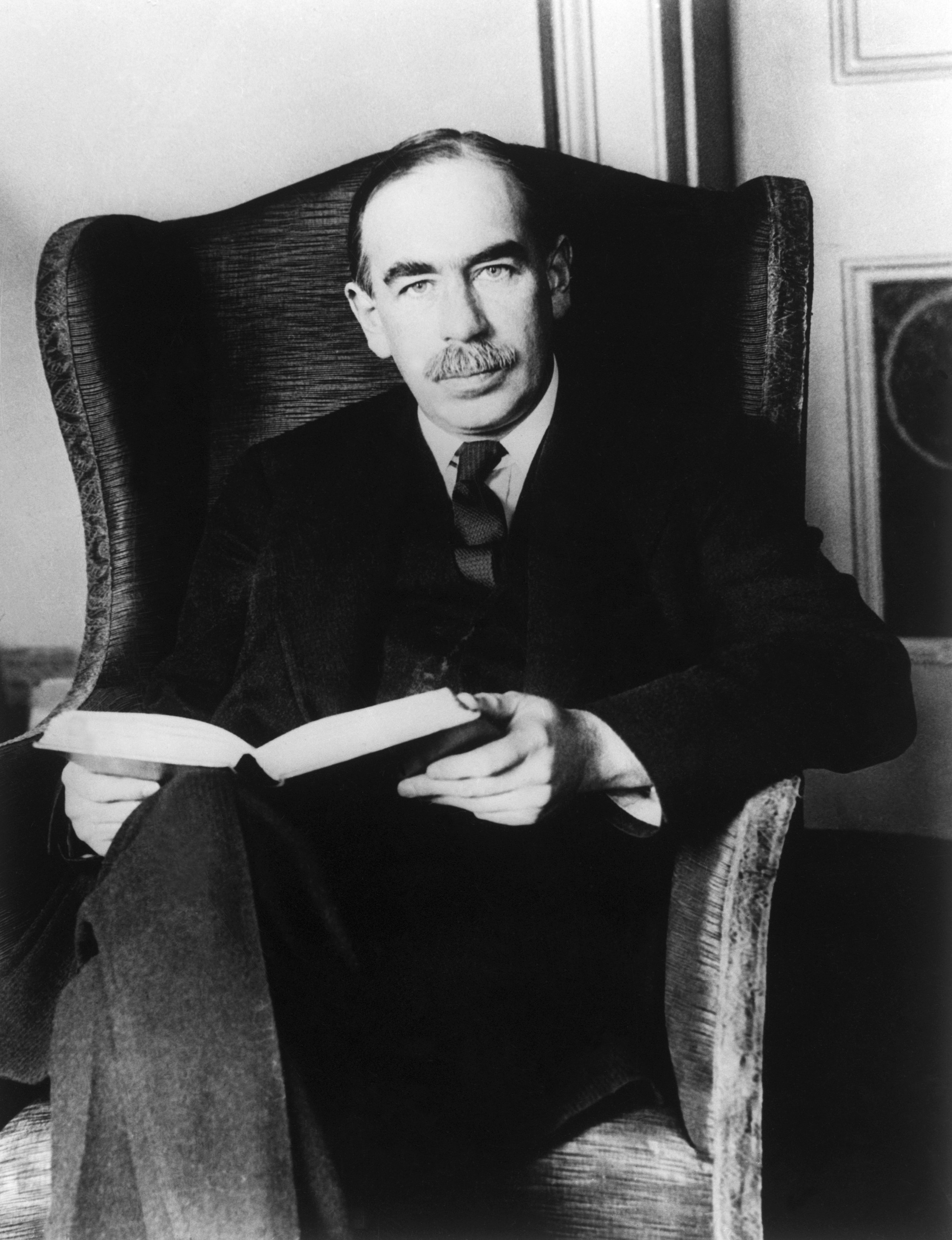

Who's afraid of John Maynard Keynes?

Democratic Party economists, apparently

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Does the economy have room to grow? Could we create many more jobs and wealth if we really tried, or have we reached the limits of what we can produce?

This — what I'll call the capacity debate — is at the heart of a recent dispute among academic economists. It's nominally centered on Bernie Sanders' economic plan, but also illustrates a major fault line in the practice of theoretical economics today. The question, at heart, is a basic one: Will the economy always tend towards full employment, when economic output is maximized and most everyone who wants a job can find one?

Modern economic models say yes. But an older tradition says no — including John Maynard Keynes, who is supposedly the godfather of today's center-left economic establishment. Where the economic policymakers settle could have major implications for the American future.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

But let me back up. Last month, Professor Gerald Friedman of the University of Massachusetts-Amherst released an analysis of Sanders' economic program, showing extremely good results for growth, employment, and productivity.

After a frankly shameful and extremely unprofessional round of rank-pulling and amateur psychoanalysis about why Friedman might be juking the stats for Sanders, the center-left economics establishment grudgingly took a hard look at Friedman's paper. Christina Romer (a signatory to an earlier letter basically exiling Friedman from Seriouspants Economics) and her husband actually ran the numbers, and aside from ordinary optimistic assumptions, found one real error — at least by traditional economic modeling standards.

As fellow establishment economist Justin Wolfers explains, the basic issue is in how one thinks that economic stimulus will behave over the medium and long term. Traditional economic models assume that its effects will be strictly temporary. When the government spends a dollar in a depressed economy, when there is lots of unemployment and idle productive capacity, it will create more economic activity as those payments are spent on additional goods and services beyond the initial purchase. This is called the multiplier, and the economic literature suggests it is in the neighborhood of 0.5 to 2.5, depending on the type of stimulus and how weak the economy is.

Friedman, by contrast, implicitly assumed a model in which Sanders' huge stimulus would push the economy up to full capacity (meaning full employment and maximum output), after which it would stay permanently at a higher level. If one assigns all the credit to the stimulus for this behavior, it leads directly to massive multipliers. By mainstream lights, this is not credible. As Romer and Romer write: "temporary spending could cause a temporary boom, but its effect on the level of GDP a few years after its end will be, to a first approximation, zero."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

However, the key assumption behind the mainstream model is that an economy always tends towards full employment. This can be seen in a paper done by Romer herself (along with Jared Bernstein) in the early days of the Obama administration predicting the effects of the Recovery Act. The paper later became somewhat infamous, as the actual economic trajectory was far worse with the stimulus than they thought it would be without the stimulus, but this was mostly due to a huge underestimation of the size of the recession.

But as economist Jamie Galbraith argues, a far larger problem in the paper was the standard economic assumption that no matter what the administration did, after several years the economy would automatically return to "normal," which meant full employment and output. Indeed, they predicted that should the Recovery Act pass, by 2016 the economy would be suffering slightly due to the burden of debt repayment.

From today's standpoint, this assumption — the same one on which their Friedman takedown rests — looks profoundly ridiculous. Instead, even by conservative assumptions we are still something like $500 billion under total economic capacity, productivity has been consistently very weak, and there is absolutely nothing on the horizon that looks like it will return us to the level of employment we had in 2007, let alone 1999. (The center-left economist crew even has a name for this, "secular stagnation," or a semi-permanent state of weak employment and low growth.)

What's more, a Friedman-style model in which a stimulus delivered to a depressed economy returns it to full capacity, after which it stays there, is not ridiculous. Rather than some quasi-mystical policy that continues to have an effect years and years down the line, a large enough stimulus could be conceived as the force that returns the economy to its healthy state, just as the standard model assumes will happen automatically. Imagine, for example, a government public works projects giving people the employment history and income that they need to get a private job after the program winds down. Such an effect holds double for infrastructure improvements that ought to provide long-lasting structural benefits.

This is precisely what happened after World War II, by far the most aggressive fiscal stimulus in history, after which the Great Depression did not return. One could construct a Romer-style analysis of the New Deal/wartime mobilization spending that would pop out truly colossal multipliers, far above anything in the Friedman paper — and as economist J.W. Mason points out, the 1933-39 period is the only comparable historical period of economic slack.

I confess I did not catch this issue when I read the paper (though in my defense, neither did any of the establishment types before Romer and Romer). But that might be because the establishment economists don't seem to believe the supposedly mainstream models when it comes to serious economic crises. Indeed, even before secular stagnation came up, back during the pits of the Great Recession, Paul Krugman was writing posts about how stimulus is like driving a car up an icy hill — if you don't hit it with enough momentum, you get stuck halfway or even slide back to the bottom. That's a prescient observation!

Keynes made this a centerpiece of his mature theory. One of the major objectives in his magnum opus, The General Theory of Employment, Interest and Money, is demonstrating that the economy can get stuck indefinitely in a depressed state, with lots of extra capacity going to waste. Though some scraps of his ideas survive in the mathed-up "New Keynesian" tradition, as the Romer analysis shows, this one is not very influential.

Ultimately, there is only one way of resolving this question for sure: Attempt aggressively expansionist policy, and see how far we can get. No one knows for sure where the top is, or whether serious efforts to bring the millions of discouraged workers with fiscal stimulus, active labor market policies, or paid family leave would pay dividends. But they are unquestionably worth trying.

Insofar as the professional center-left economist corps is creating a sense that such efforts are futile, they are doing their nation a massive disservice.

Ryan Cooper is a national correspondent at TheWeek.com. His work has appeared in the Washington Monthly, The New Republic, and the Washington Post.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy