How MetLife escaped 'too big to fail'

MetLife won a landmark lawsuit over its designation as a "systemically important financial institution." What now?

The smartest insight and analysis, from all perspectives, rounded up from around the web:

The nation's biggest life insurance company isn't "too big to fail" after all — at least in the eyes of a federal judge, said Renae Merle in The Washington Post. In a "significant setback" for the Obama administration's financial reform efforts, MetLife last week won a landmark lawsuit over its designation as a "systemically important financial institution." Prior to the 2008 crash, large, non-bank financial firms were subject to little oversight, but after the near collapse of insurance giant AIG, federal regulators decided tougher rules were necessary. So the government labeled MetLife, which has 100 million customers worldwide, and three other non-banks — AIG, Prudential, and General Electric's financing arm — as too big to fail, requiring them to set aside bigger financial cushions to ward off collapse. But MetLife challenged the label in court, and to the surprise of many, it won.

This ruling blows "a huge, MetLife-size hole" in the Dodd-Frank financial reforms, said Stephen J. Lubben in The New York Times. If the mega-insurer — which has $900 billion in assets and "big-time connections with other systemically important financial institutions" — can't be labeled too big to fail, what big firm can? Let's recall that some of the worst actors in 2008 "were flying below the radar," said Jon Talton in The Seattle Times. This decision puts us back on that road. Already, other major financial firms are pushing to shed their "systemically important" designations as well. Within a day of the MetLife ruling, General Electric's $265 billion financing arm, GE Capital, filed a formal request with regulators to get out of its own too-big-to-fail status.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Good on MetLife for having the "gumption" to resist Washington's overreach, said The Wall Street Journal in an editorial. "The Dodd-Frank Act of 2010 has become a license for regulators to control the U.S. financial system," with excessive compliance costs for companies and few benefits for the rest of us. Thankfully, "taxpayers are now standing behind one fewer financial giant." MetLife probably never deserved its "too big to fail" label in the first place, said The Economist. Unlike other big firms, it emerged from the financial crisis "in good shape." Life insurance, a long-term investment, is also not as vulnerable "to the sorts of panics and runs that afflict banks." Ironically, this decision comes "a little too late for MetLife itself," which was already in the process of breaking up its businesses in order to get rid of the "systemically important" designation. But the ramifications of this ruling are still "enormous."

Don't write an obituary for Dodd-Frank just yet, said Peter Eavis in The New York Times. The reform bill is "exacting slow, steady results." The biggest banks now operate with substantially higher levels of capital, while others are shrinking of their own accord. GE's lending operation, for instance, has slimmed down by more than half in response to rules triggered by its too-big-to-fail status. The danger now is that this ruling could force regulators to "jump through a lot more hoops" to identify and designate dangers to the financial system. That isn't a big worry when markets are stable, but it could spell disaster in the run-up to a collapse. Then we "might not be able to stop another AIG before it's too late."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

July 24 editorial cartoons

July 24 editorial cartoonsCartoons Thursday's political cartoons include an abrupt summer recess, the return of Hillary's emails, and an ominous climate announcement

-

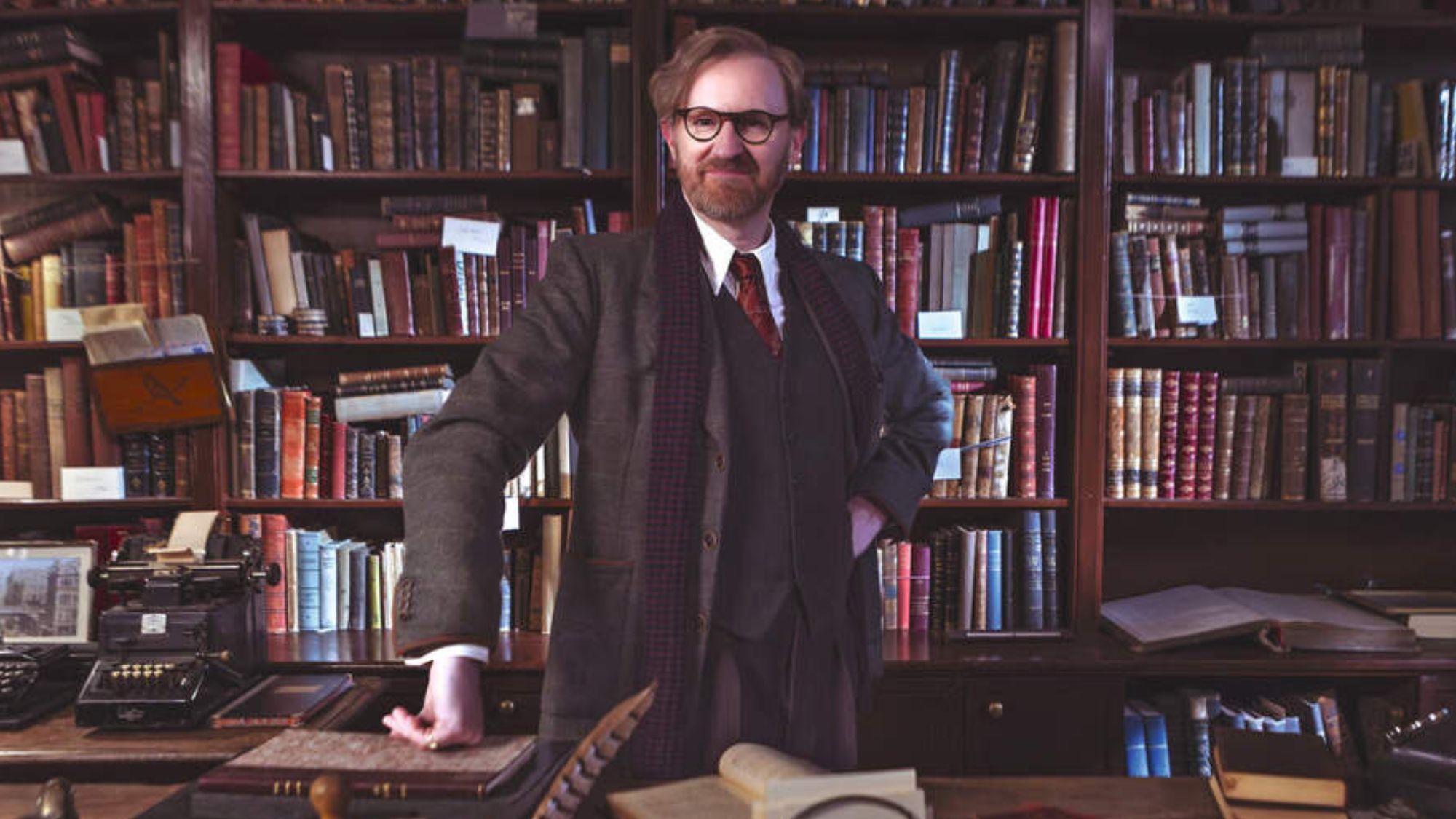

Bookish: delightful period detective drama from Mark Gatiss

Bookish: delightful period detective drama from Mark GatissThe Week Recommends 'Cosy crime' series is a 'standout pleasure' in an Agatha Christie-style formula

-

While away a balmy evening under the stars at these pop-up screenings

While away a balmy evening under the stars at these pop-up screeningsThe Week Recommends While away a balmy summer evening under the stars at these pop-up screenings

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy