The Federal Reserve is irrationally obsessed with the 1970s

On the badly misunderstood event that explains the Fed's inflation anxiety

By the time we notice inflation, is it too late? If you've been following the debate about whether the Federal Reserve should hike interest rates today, you've probably heard references to this basic question. Many Fed policymakers, including doves like Chair Janet Yellen, believe that once the inflation rate gets going, it's like a runaway train — nearly impossible to stop and demolishing everything in its path.

But there's just one problem. This belief is based on just one badly misunderstood historical example in the United States.

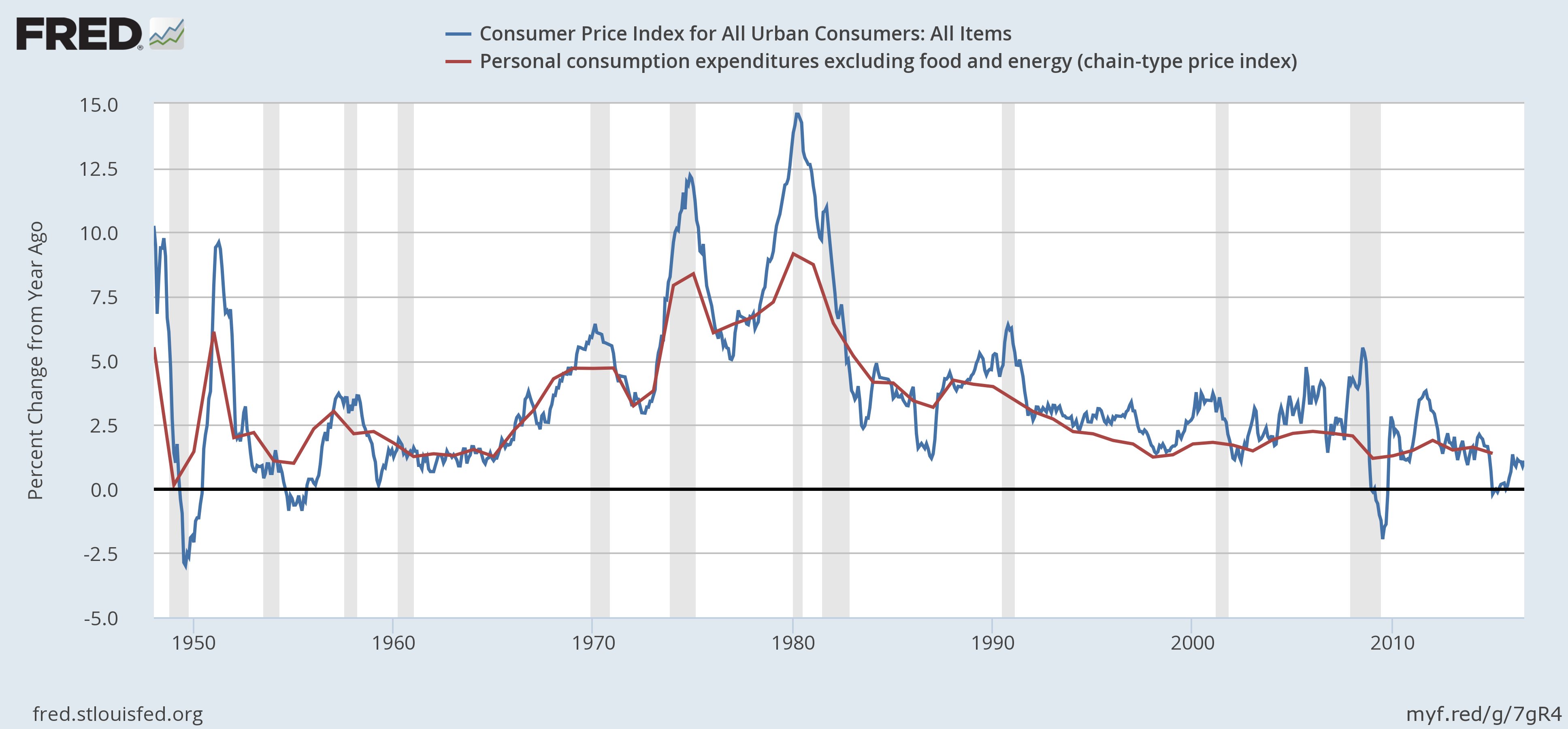

The runaway inflation of the 1970s was really the only time when inflation seemed to just keep inexorably rising, no matter what anyone did. (There was a spike in inflation prior to 1950, but it was due to World War II.) Otherwise inflation has bobbed up and down through economic booms, busts, wars and more, but has basically behaved itself.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The 1950s and 1960s are still remembered as a golden age of low unemployment, brief recessions, and low inflation. But prices started to creep up at about 2.5 percent in the late 1960s, and inflation finally hit a rate of over 10 percent by 1980. Controlling it became crucial for President Jimmy Carter, who appointed Paul Volcker to Fed chair in 1979.

Volcker had warned the Fed's models "did not take adequate account of the important factor of expectations" way back in 1975. What he basically meant was that prices are a self-fulfilling prophecy. If you're a worker, and you expect prices to rise, you might demand higher wages. If you're a business owner, and you expect your labor or input costs to rise, you might jack up your own prices to compensate. In other words, when people expect prices to rise, they do things that cause prices to rise.

Crushing those expectations became the central justification for the gargantuan interest rate hike that defined his own tenure as Fed chair. The resulting economic collapse was, in some ways, as severe as the Great Recession. But afterwards, inflation finally began to come back down, the Fed eased off interest rates, and the economy boomed again.

This would seem to back up the folks at the Federal Reserve worried about accelerating inflation. But there are some critical complications.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

First off, there was a screw-up in the consumer price index (CPI) — probably the most widely used measure of inflation. By the late 1970s, it was overstating the inflation rate by about 2 percentage points — which is a lot. That's important because unions, which were still pretty strong in the 1970s, had enforced automatic cost-of-living adjustments (COLAs) in a lot of workers' contracts. Those adjustments relied on the CPI, which created a perverse ratchet effect: As inflation rose, employers had to compensate with pay hikes that overstated inflation. Then prices had to increase to pay for those wages, leading to further inflation.

Another issue was the price of oil. The Organization of Petroleum Exporting Countries (OPEC) launched an oil embargo between 1973 and 1974. Then the government of Iran, one of the world's biggest oil producers, was overthrown in 1979. As a result of both events, oil prices rocketed into the stratosphere during the 1970s. Since oil is a fundamental expense in so much economic activity — commuting, shipping, even chemical engineering — those price jumps rippled into prices throughout the economy. It's a temporary effect, but it matters.

Third, labor markets in the 1970s were actually pretty tight, at least early on. Labor force participation wasn't down — in fact, it was rising due to the advent of the female workforce. So even though unemployment got uncomfortably high after the recessions in 1970 and 1974, wage growth ranged from 5 to 8 percent, often staying well ahead of the rising inflation rate. Those are signs employers are competing for workers, rather than workers competing for jobs.

Tight labor markets matter because they exacerbate the previous two effects. When labor markets are slack and workers are competing for a smaller supply of jobs, unions have far less leverage to enforce their demands. And businesses have a lot more flexibility to absorb cost hikes (like the COLAs), without letting them bleed into price increases for their own goods and services.

Finally, the government also ran an ever-increasing deficit that got unusually large for the post-WWII era up to that point. Again, that's not a big deal when labor markets are slack. (Which is most of time.) But when they're tight, it's another addition to inflationary pressure.

On their own, any one of these factors probably wouldn't have led to runaway inflation. Oil prices went just as high between 2008 and 2014. After 2008, the deficit got considerably higher than in the 1970s. Labor markets were pretty tight in the late 1990s. Inflation never took off in any of those instances. But put all four factors together, and you had a perfect storm that kept pushing the inflation rate higher.

Yet it was also a temporary storm. The flaw in the CPI was corrected in 1982. Oil prices fell back to earth by the mid-1980s. Inflation would almost certainly have fallen without Volcker's hike. It might not have fallen as quickly, but Americans also wouldn't have suffered Volcker's recession.

And today, as the Fed contemplates another rate hike, these factors are very different. OPEC has far less power: The American economy is more energy efficient and less dependent on Middle East oil, and we're producing and exporting our own oil like crazy. Tight labor markets are nowhere in sight: Despite the 4.9 percent unemployment rate, labor market participation is still deeply depressed thanks to the aftermath of the Great Recession. Nominal wage growth is at a mere 2.5 percent, compared to the 4 percent we saw in the economic boomlet of the late 1990s.

While Federal Reserve officials most likely won't raise interest rates today, the pressure on them to get ahead of unseen inflation will continue. They would do well to remember that behind their inflation anxiety is only one historical aberration.

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

A fentanyl vaccine may be on the horizon

A fentanyl vaccine may be on the horizonUnder the radar Taking a serious jab at the opioid epidemic

-

The 8 best comedy TV series of 2025

The 8 best comedy TV series of 2025the week recommends From quarterlife crises to Hollywood satires, these were the funniest shows of 2025

-

Codeword: December 16, 2025

Codeword: December 16, 2025The daily codeword puzzle from The Week