What the latest jobs report can tell us about the Fed's rate hike fiasco

There's good news and bad news...

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

As I've explained before, the monthly jobs reports can be difficult to parse. Job gains were good? Okay, but how does it compare to the trends of the last few years. But this past Friday came with some unambiguously good news.

Or at least good news when it comes to the economic recovery. It's bad news if you're concerned about the political ability of our policymakers — especially officials at the Federal Reserve — to sustain that recovery.

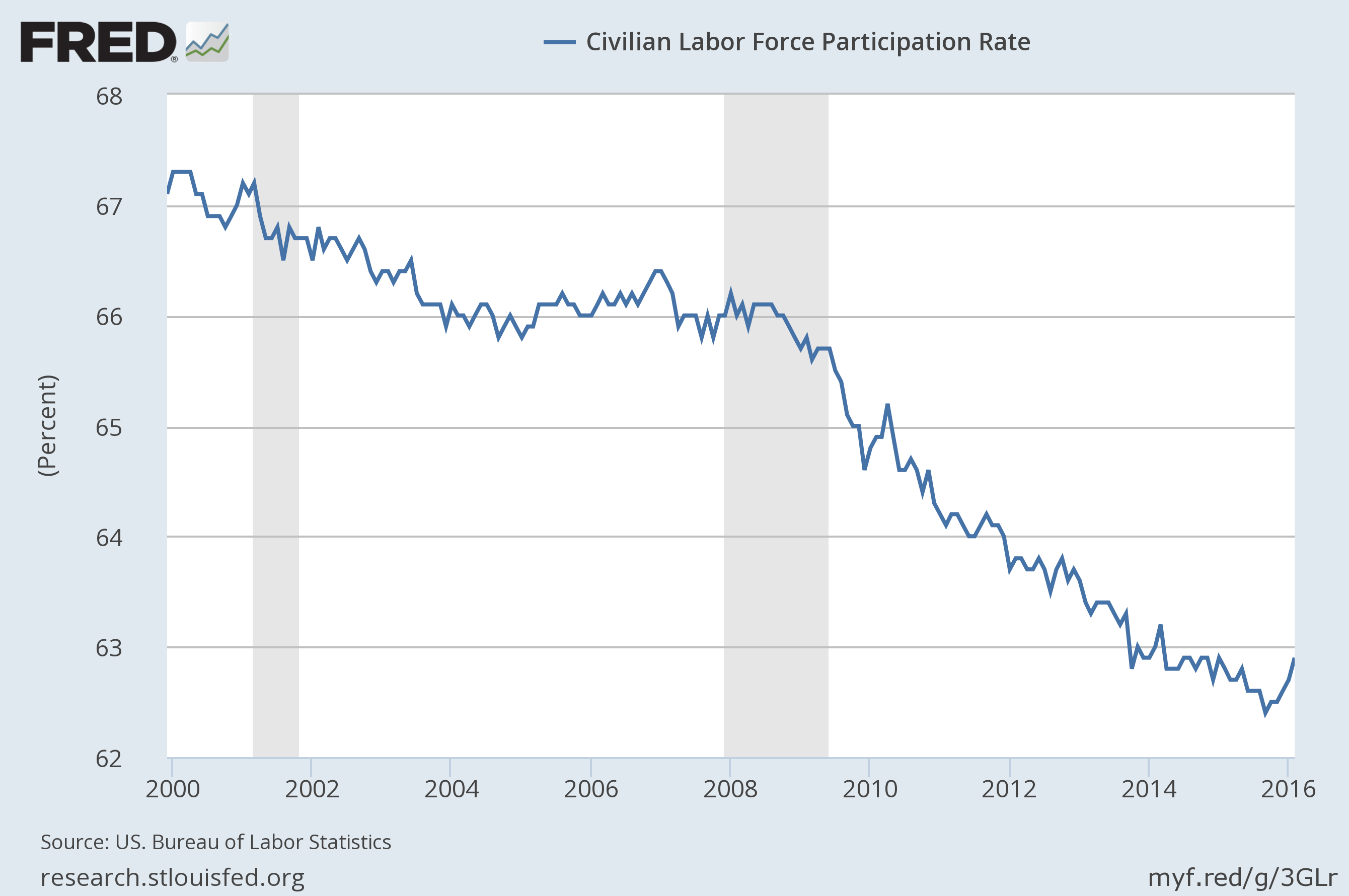

To explain: Last Friday's report showed a gain of 242,000 jobs in February and an unemployment rate holding steady at 4.9 percent. That's encouraging. But the real twist was the labor force participation rate (LFPR). That's the percentage of Americans who either have a job or have actively looked for one in the last four weeks — it's not just people who are working, it's people who have faith that they can find work. It steadily rose over the '70s, '80s and '90s as women entered the labor force, and peaked around 67 percent in the economic boom of the late '90s. Then it began a slow slide and collapsed with the Great Recession: from 66 percent in early 2008 to 62.4 percent this past September. After that it began to tick back up, and this latest report showed that it snapped up to 62.9 percent in February.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

That uptick on the far right is significant. As the Economic Policy Institute's Josh Bivens explained to The Week, there's a debate among economists over how much of that fall is "cyclical" or "structural."

"Cyclical" basically means, "due to the recession." If there aren't enough jobs, people will get discouraged and leave the labor force. Which suggests that if government boosts aggregate demand with the right fiscal and monetary policies, it can create new jobs and bring them back in.

"Structural" means some deep and foundational change in the economy. The aging of the population is one example: If a larger portion of our population is retiring, that will lower the natural ceiling on how high the labor force participation rate can go. "Roughly half of the decline since 2007 is unambiguously demographic," said Bivens. "It's that remaining half that people mostly argue over."

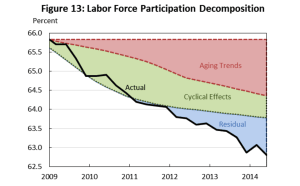

Back in July of 2014, the White House's Council of Economic Advisors (CEA) released a report that tried to break down the fall in the labor force participation rate with various analyses. Along with the half due to aging, they concluded roughly a fifth was cyclical. The rest they termed "residual," which was sort of a fancy way of saying "we don't know what's going on here."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

(Graph courtesy of the White House Council of Economic Advisors.)

Economists like Bivens argue the residual is actually also a cyclical effect. And it's a big deal if they're right: It would mean the job market is still deeply wounded, and that the government could accelerate the healing process if it boosted the economy with more deficit spending and if the Federal Reserve avoids hiking interest rates.

Skeptics often point to previous business-cycle peaks, particularly among age groups that don't include students or retirees, and note the peak-to-peak trend has been downward over the long-term. And they bring up darker stories about how government aid programs like disability insurance may be tempting people out of the job market. So maybe the residual isn't cyclical.

But Bivens thinks that assumption underestimates how much rot there's been in the economy even before the Great Recession: "Women's labor force participation was actually rising until 2000," and neither the official unemployment rate nor the employment rate among prime age workers in 2007 ever recovered to its 2000 peak. Bivens thinks the skeptics' approach "is actually picking up some cyclical weakness, given that we never mounted a labor market recovery in the 2001 to 2007 period."

The White House report concluded that the labor force participation rate could return to a little over 63 percent at most. But simply adjusting for the aging of the population suggests it could go as high as 64.3 percent. That's over three million more Americans we could bring back into the work force.

Of course, the ceiling won't stay at 64.3 percent. It will keep going lower — albeit very slowly — as the portion of the population that's retired continues to grow. "A return to full employment with the older workforce almost by definition means we're probably not going to get back to that kind of peak" we saw in 2000, Bivens continued. "There's gonna be a pretty steady downward ratchet from demography going forward."

But the point is, with inflation at rock bottom, policymakers should be aggressively testing the upper limits of how high the labor force participation rate can go. In particular, while the Fed's ability to boost the economy is uncertain — especially when interest rates are at zero — its ability to throttle job growth by simply raising interest rates is very well-documented. If the recovery has finally reached a phase where the participation rate has started to rise, then the Fed risks scuttling the healing process if it sticks with its plan to continue hiking interest rates this year — perhaps as early as mid March.

"Between the uptick [in the labor force participation rate] and especially the flat or falling wage number in this month's report, that to me certainly says we should not do another one in a couple of weeks," Bivens concluded. And as for the question of cyclical versus structural drops in the participation rate?

"I think we should assume it's cyclical until proven otherwise."

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

5 cinematic cartoons about Bezos betting big on 'Melania'

5 cinematic cartoons about Bezos betting big on 'Melania'Cartoons Artists take on a girlboss, a fetching newspaper, and more

-

The fall of the generals: China’s military purge

The fall of the generals: China’s military purgeIn the Spotlight Xi Jinping’s extraordinary removal of senior general proves that no-one is safe from anti-corruption drive that has investigated millions

-

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’

Why the Gorton and Denton by-election is a ‘Frankenstein’s monster’Talking Point Reform and the Greens have the Labour seat in their sights, but the constituency’s complex demographics make messaging tricky

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy