Is Snapchat the next tech titan?

Snapchat's parent company is poised to go public in March at an expected valuation of roughly $20 billion

The smartest insight and analysis, from all perspectives, rounded up from around the web:

"When Snapchat first became popular in 2013, many thought the messaging app would disappear almost as quickly as its vanishing messages," said The Economist. Instead, it captured the imagination of tens of millions of millennials. Now its parent company, Snap, is poised to go public in March at an expected valuation of roughly $20 billion, the biggest initial public offering for a U.S. tech company since Facebook. But unlike that social media juggernaut, which strives to create a record of its users' lives, "Snapchat offers liberating impermanence." Users love that they can share impromptu pictures and videos with groups of friends without worrying about them living online forever. About 41 percent of Americans ages 18 to 34 use Snapchat every day; about 161 million around the globe open the app daily.

"Snapchat may be a messaging app, but in many ways, it's also a new kind of television," said Christopher Mims at The Wall Street Journal. Snap reports that its users watch 10 billion videos a day. Often, these videos are no longer than 10 seconds, but they are typically strung into slide shows lasting several minutes, in a feature Snapchat calls Stories. If you have enough Snapchat friends, it feels a lot like the "lean back" experience of watching TV. As a result, Snap has a golden opportunity to capture some of the $71 billion a year that goes to TV commercials. Nielsen reported a 37 percent decline in the amount of time 18- to 24-year-olds spent watching TV between 2010 and 2016. That age group is "Snapchat's core demographic."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Sure, but does that make the company worth $20 billion? asked Shira Ovide at Bloomberg. Having 161 million global users is actually not very big "by internet standards." Snapchat's growth rate is slowing, making it unlikely to catch up to Facebook's 1.2 billion daily users. The strategy of almost all big advertising-supported internet companies — including Facebook, Twitter, and Google — is to go for sheer size. Snapchat plans to buck that approach and "go for niche rather than mass," selling pricier ads and keeping its dedicated users coming back dozens of times a day. It's an unproven strategy; hopefully investors recognize that. For some reason, Snap "has the valuation of a company that has figured all this out."

Snap wants Wall Street to think it's the next Facebook, even though its numbers make it look a lot more like Twitter, said Kurt Wagner at Recode. Snap lost more than $510 million last year; Twitter lost $79 million the year before its IPO, and five years later it still isn't profitable. Facebook, by comparison, was making $1 billion in profit before it went public. It also doesn't help that Facebook has a knack for copying Snapchat's best features, said David Pierce at Wired. Snapchat's growth plummeted more than 80 percent last August after Facebook launched a clone of "Stories" on Instagram. Perhaps it's no surprise then that Snap recently branched out beyond social media with its photo-taking glasses, Snap Spectacles. The only way for Snap to win completely might be "to play a different game."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Dozens dead as typhoon slams Philippines

Dozens dead as typhoon slams PhilippinesSpeed Read The storm ravaged the island of Cebu

-

Democrats sweep top races in off-year election

Democrats sweep top races in off-year electionSpeed Read A trio of nationally watched races went to the party

-

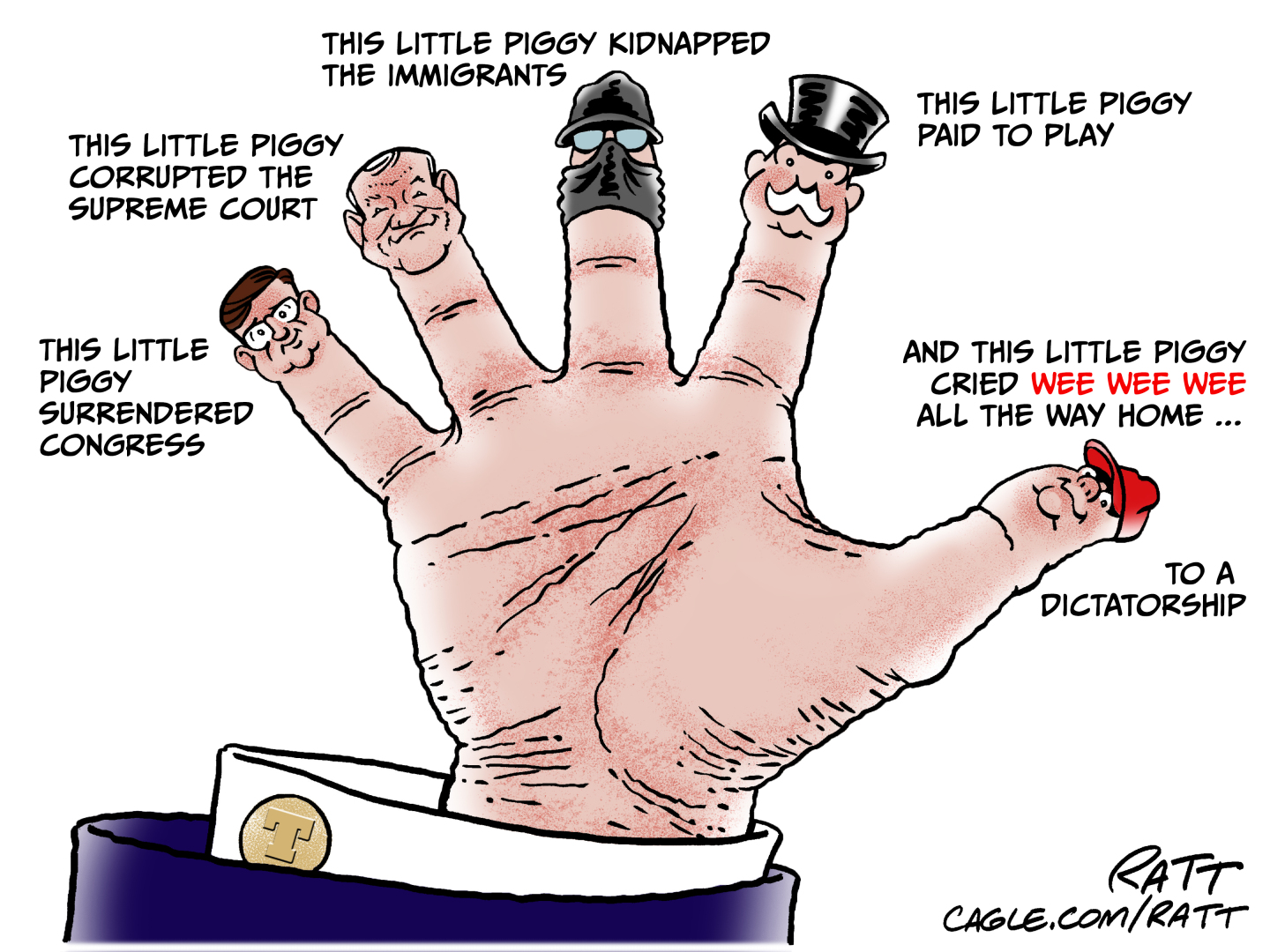

Political cartoons for November 5

Political cartoons for November 5Cartoons Wednesday’s political cartoons include five little piggies, narcoterrorist boats, the wealth divide, and more

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy