How do you know when you're financially prepared to have children?

It's a big decision. Consider it carefully.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The smartest insight and analysis, from all perspectives, rounded up from around the web:

"How do you know that you are financially ready to handle the responsibility of starting a family?" asked Denise Hill at Wise Bread. Having children is a "life-altering decision," and the first step is understanding that it's a lifetime commitment, emotionally and financially. Although there's no single "magic income or savings number" that will determine whether you're prepared, it's smart to commit to several targets. Begin by tackling any credit card and student loan debt and trying to cut extraneous costs and unnecessary luxuries. "Having a family is a sacrificial endeavor," so the sooner you understand "you can't have it all and do it all," the better. A top priority should be to establish an emergency fund with at least six months of living expenses. That will provide you with a foundation of security, since "things rarely go exactly as planned" when a child comes along.

Having a family "is one of the most exciting decisions you will ever make, but like any major investment, it requires a plan," said Candace Sjogren at Entrepreneur. Most health insurance plans don't cover fertility treatments, so you can avoid significant "heartburn and arguments" by simply having a hard look at your savings and financing options to ensure you can cover costs. It's estimated that couples can face an extra $2,000 to $5,000 in fertility-related costs for each year a woman ages beyond 30. My partner and I spent $27,000 on fertility treatments, and our lack of planning meant "each expense hit us like a separate ton of bricks." Whether you require such treatment or not, this is also a good moment to educate yourself on your health insurance policy — how it works and what it covers. Have a look, too, at what paternity and maternity leave benefits your employer offers, said Aimee Picchi at USA Today. Many parents face "tough decisions about balancing work and family," particularly in the early stages of their child's life.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Another tip for soon-to-be parents: Review your life insurance policy, and if you don't have one yet, get one, said Matthew Helfrich at Kiplinger. Update your beneficiaries and ensure that your policy sufficiently covers potential "education spending, debt elimination, and salary replacement" needs in the event of your early death. Make sure your child is promptly added to your health insurance, and begin constructing a budget that factors in potential child-care costs, kids' activities, and recurring items such as diapers. The average cost of raising a child in the U.S. to age 17 is $233,610 — a figure that doesn't include college, so your long-term savings strategy should incorporate a college fund. "The first nine months are just the tip of the iceberg — they represent the beginning of a lifetime's worth of financial decisions."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Rock Villa, Bequia: a hidden villa on an island epitomising Caribbean bliss

Rock Villa, Bequia: a hidden villa on an island epitomising Caribbean blissThe Week Recommends This gorgeous property is the perfect setting to do absolutely nothing – and that’s the best part

-

Mexico’s vape ban has led to a cartel-controlled black market

Mexico’s vape ban has led to a cartel-controlled black marketUnder the Radar Cartels have expanded their power over the sale of illicit tobacco

-

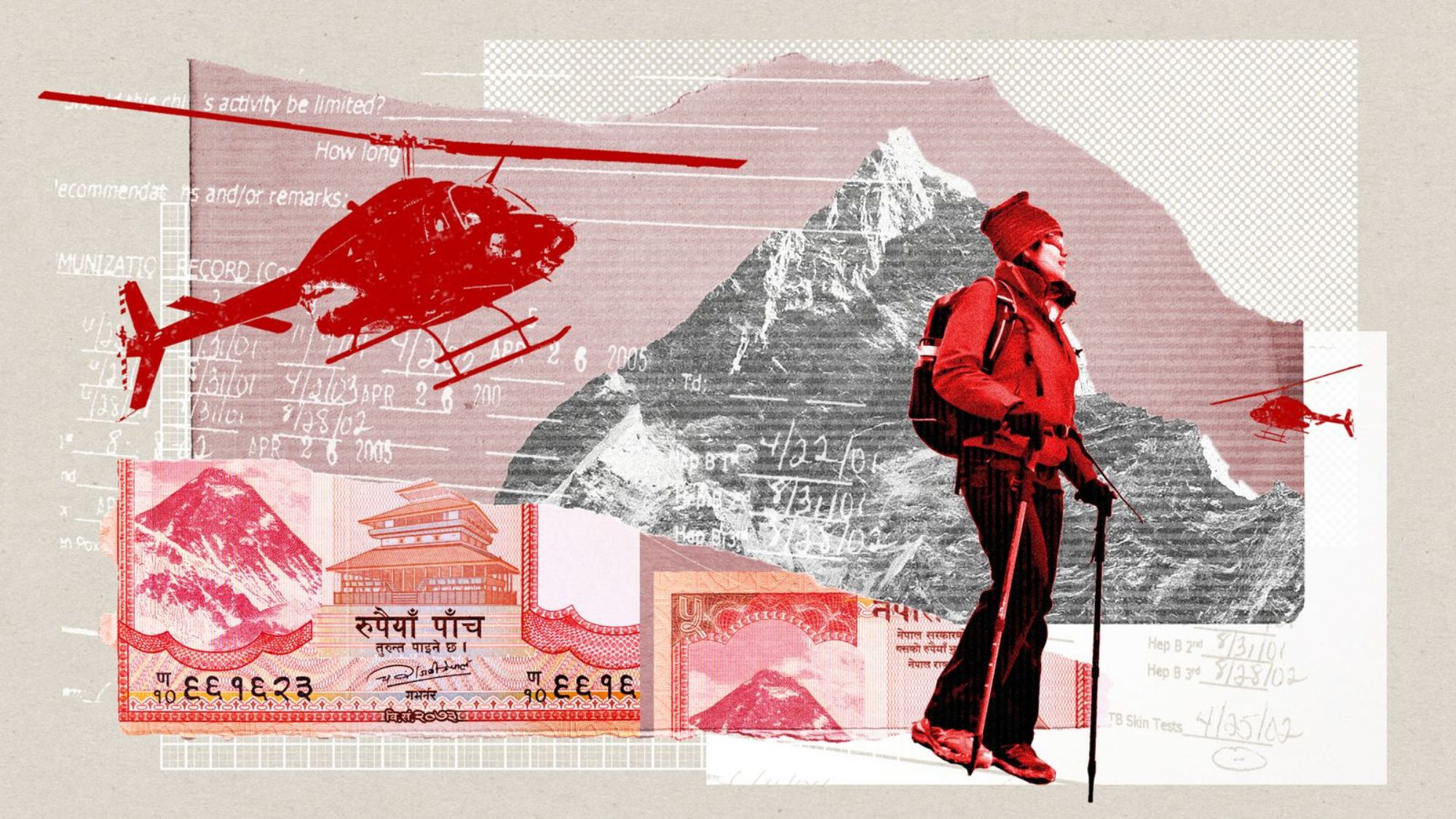

Nepal’s fake mountain rescue fraud

Nepal’s fake mountain rescue fraudUnder The Radar Arrests made in alleged $20 million insurance racket

-

The pros and cons of noncompete agreements

The pros and cons of noncompete agreementsThe Explainer The FTC wants to ban companies from binding their employees with noncompete agreements. Who would this benefit, and who would it hurt?

-

What experts are saying about the economy's surprise contraction

What experts are saying about the economy's surprise contractionThe Explainer The sharpest opinions on the debate from around the web

-

The death of cities was greatly exaggerated

The death of cities was greatly exaggeratedThe Explainer Why the pandemic predictions about urban flight were wrong

-

The housing crisis is here

The housing crisis is hereThe Explainer As the pandemic takes its toll, renters face eviction even as buyers are bidding higher

-

How to be an ally to marginalized coworkers

How to be an ally to marginalized coworkersThe Explainer Show up for your colleagues by showing that you see them and their struggles

-

What the stock market knows

What the stock market knowsThe Explainer Publicly traded companies are going to wallop small businesses

-

Can the government save small businesses?

Can the government save small businesses?The Explainer Many are fighting for a fair share of the coronavirus rescue package

-

How the oil crash could turn into a much bigger economic shock

How the oil crash could turn into a much bigger economic shockThe Explainer This could be a huge problem for the entire economy