The daily business briefing: June 2, 2016

The Obama administration unveils proposed payday loan rules, Saudi Arabia invests $3.5 billion in Uber, and more

1. Obama administration unveiling rules on payday loans

The Obama administration is expected on Thursday to unveil federal rules to extend federal oversight to the $38.5 billion payday lending industry. The rules proposed by the Consumer Financial Protection Bureau would require lenders to assess borrowers' ability to repay, and discourage rolling over loans, which can pile up lending fees. Lenders say the new rules, now opening up for public comment, would gut the industry. Consumer advocates say the rules are necessary to protect borrowers who can be ruined by loans with effective interest rates that can exceed 390 percent.

The Wall Street Journal The New York Times

2. Uber gets $3.5 billion investment from Saudi Arabia

Uber said Wednesday that it had received a $3.5 billion investment from Saudi Arabia's Public Investment Fund, the kingdom's main investment fund. The infusion of cash was the ride-hailing service's largest yet. The investment valued Uber at $62.5 billion, right where the last valuation put it. The investment does not cash out any previous investors. As part of the deal, a managing director at the Public Investment Fund will get a seat on Uber's board.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Fed report shows economic expansion continues

The labor market tightened as the economy expanded at a modest pace since mid-April, according to the Federal Reserve's latest Beige Book, released Wednesday. "Wages grew modestly, and price pressures grew slightly in most districts," said the report, which is published eight times a year. Fed policy makers have said they would raise interest rates soon if the economy continued to improve, and the latest Beige Book is not expected to change the economic outlook. A hike could come as early as the next Federal Open Market Committee meeting on June 14 and 15.

4. Oil prices hold steady as OPEC meets

Oil prices held close to seven-months highs just above $49 a barrel on Thursday as OPEC leaders met in Vienna to discuss output levels. Saudi Arabia has been pushing for a production freeze at January levels to ease a global glut, but the country's energy minister said ahead of the meeting that supply and demand appear to be coming into balance. European stocks made early gains after two days of losses ahead of the OPEC meeting and an expected announcement on interest rates by the European Central Bank, which is not expected to add to its record monetary stimulus.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

5. 6.8 million homes face hurricane surge risk, report says

More than 6.8 million Atlantic and Gulf Coast homes are at risk of damage from hurricane storm surges, according to CoreLogic's 2016 Storm Surge Report, which was released at the start of the Atlantic hurricane season on Wednesday. The total reconstruction cost value for the homes potentially in the path of summer storms is more than $1.5 trillion. Forecasters say this season is likely to be slightly more active than 2015's, with 14 named storms, six hurricanes, and two major hurricanes.

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

A luxury walking tour in Western Australia

A luxury walking tour in Western AustraliaThe Week Recommends Walk through an ‘ancient forest’ and listen to the ‘gentle hushing’ of the upper canopy

-

What Nick Fuentes and the Groypers want

What Nick Fuentes and the Groypers wantThe Explainer White supremacism has a new face in the US: a clean-cut 27-year-old with a vast social media following

-

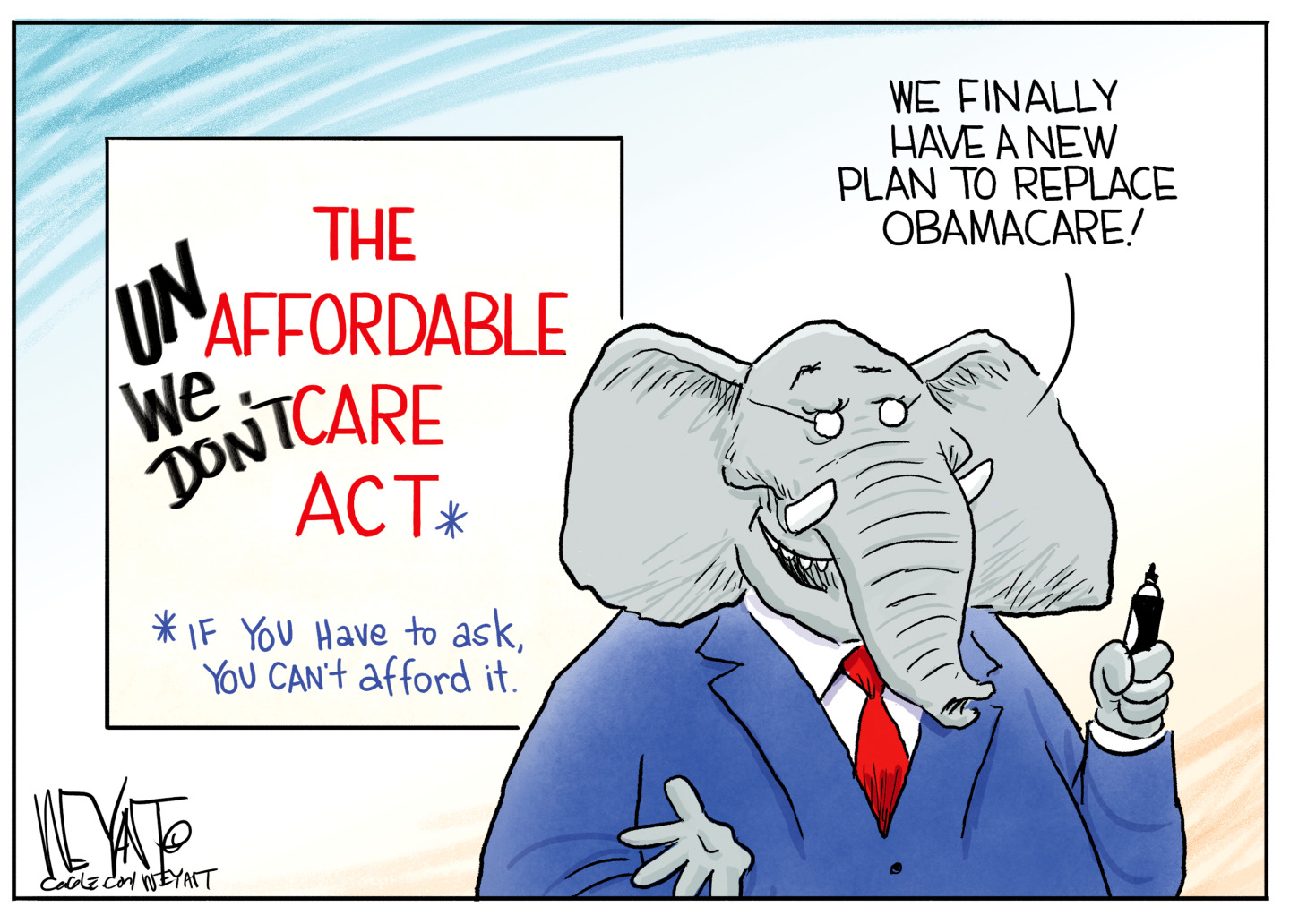

5 highly amusing cartoons about rising health insurance premiums

5 highly amusing cartoons about rising health insurance premiumsCartoon Artists take on the ACA, Christmas road hazards, and more

-

How Bulgaria’s government fell amid mass protests

How Bulgaria’s government fell amid mass protestsThe Explainer The country’s prime minister resigned as part of the fallout

-

Femicide: Italy’s newest crime

Femicide: Italy’s newest crimeThe Explainer Landmark law to criminalise murder of a woman as an ‘act of hatred’ or ‘subjugation’ but critics say Italy is still deeply patriarchal

-

Brazil’s Bolsonaro behind bars after appeals run out

Brazil’s Bolsonaro behind bars after appeals run outSpeed Read He will serve 27 years in prison

-

Americans traveling abroad face renewed criticism in the Trump era

Americans traveling abroad face renewed criticism in the Trump eraThe Explainer Some of Trump’s behavior has Americans being questioned

-

Nigeria confused by Trump invasion threat

Nigeria confused by Trump invasion threatSpeed Read Trump has claimed the country is persecuting Christians

-

Sanae Takaichi: Japan’s Iron Lady set to be the country’s first woman prime minister

Sanae Takaichi: Japan’s Iron Lady set to be the country’s first woman prime ministerIn the Spotlight Takaichi is a member of Japan’s conservative, nationalist Liberal Democratic Party

-

Russia is ‘helping China’ prepare for an invasion of Taiwan

Russia is ‘helping China’ prepare for an invasion of TaiwanIn the Spotlight Russia is reportedly allowing China access to military training

-

Interpol arrests hundreds in Africa-wide sextortion crackdown

Interpol arrests hundreds in Africa-wide sextortion crackdownIN THE SPOTLIGHT A series of stings disrupts major cybercrime operations as law enforcement estimates millions in losses from schemes designed to prey on lonely users