House Republicans want to cap student borrowing and overhaul the federal loans program

House Republicans are planning to propose a bill this week that would bring about drastic changes to federal loans servicing and higher education policy, The Wall Street Journal reported Wednesday. The bill is part of a push to provide students with more skills in a modern labor market, but would also do away with programs meant to ease students' borrowing burdens.

Under the Promoting Real Opportunity, Success and Prosperity Through Education Reform (PROSPER) Act, student loan debt would no longer be forgiven for workers after they spend 10 years in the public sector. The Journal notes, however, that the bill would "grandfather in" people who signed their loans before the bill's implementation. The bill would also cap the amount of money students or their parents could borrow to pay for tuition.

For-profit colleges are expected to reap many of the benefits of this proposal, The Journal notes. The Education Department would no longer be able to enforce the "gainful employment regulation," which looks at the debt-to-income ratio of students post-graduation when considering how much federal student aid for-profit education institutions should receive. Earlier this year, Sen. Sherrod Brown (D-Ohio) said this rule was "critical in holding for-profit schools accountable and we must continue fighting to make sure students come before profits."

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Steve Gunderson, CEO and president of Career Education Colleges and Universities — a trade organization representing for-profit colleges — told the Journal, "If we can replace [the gainful employment regulation] with a common set of outcomes for everybody, I think we're all better off."

Read more about the proposed bill at The Wall Street Journal. Kelly O'Meara Morales

Editor's note: This piece originally stated that income-driven repayment would be eliminated for private sector workers. Under the new bill, income-driven repayment would be preserved. We regret the error.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Kelly O'Meara Morales is a staff writer at The Week. He graduated from Sarah Lawrence College and studied Middle Eastern history and nonfiction writing amongst other esoteric subjects. When not compulsively checking Twitter, he writes and records music, subsists on tacos, and watches basketball.

-

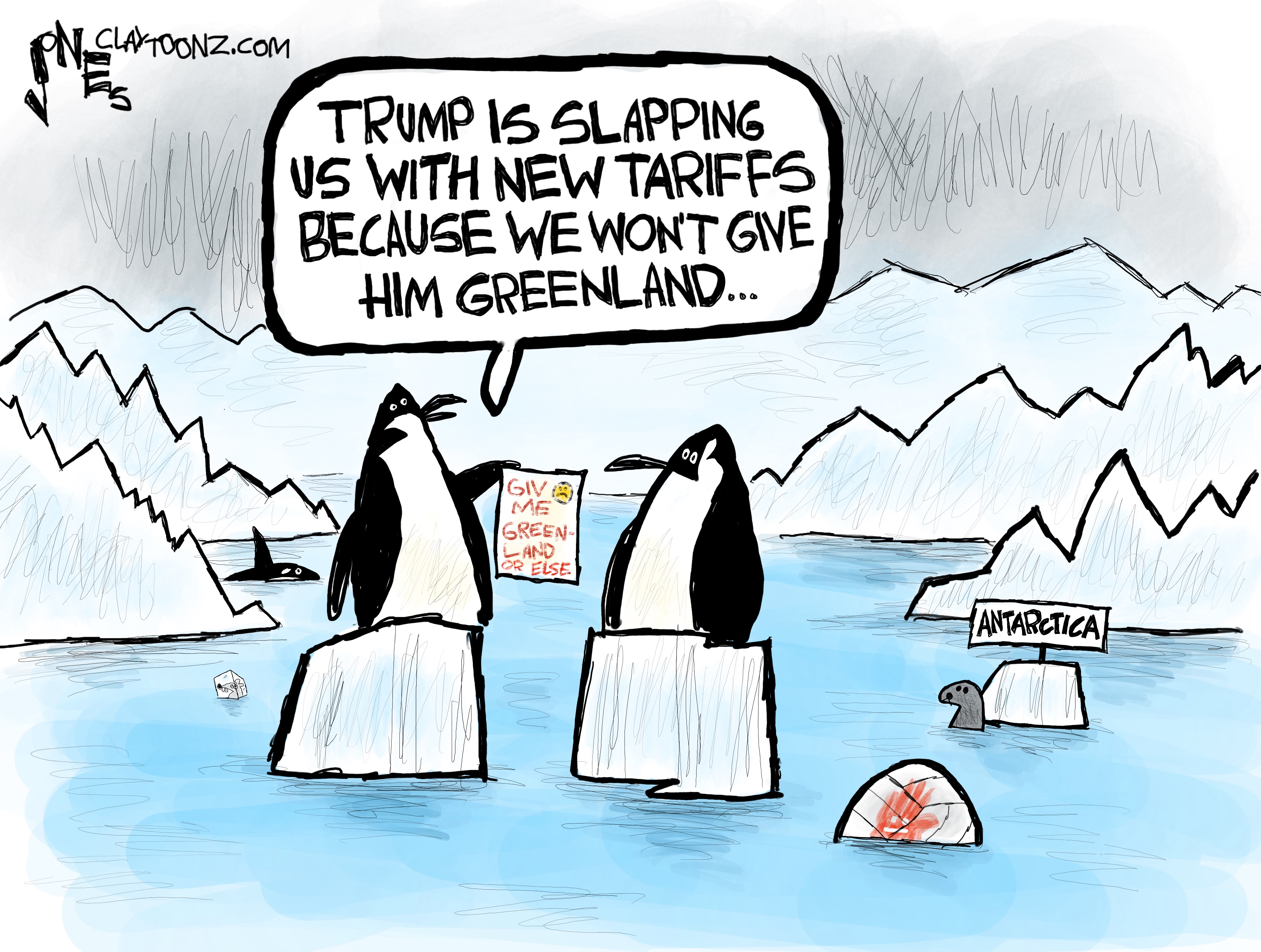

Political cartoons for January 19

Political cartoons for January 19Cartoons Monday's political cartoons include Greenland tariffs, fighting the Fed, and more

-

Spain’s deadly high-speed train crash

Spain’s deadly high-speed train crashThe Explainer The country experienced its worst rail accident since 2013, with the death toll of 39 ‘not yet final’

-

Can Starmer continue to walk the Trump tightrope?

Can Starmer continue to walk the Trump tightrope?Today's Big Question PM condemns US tariff threat but is less confrontational than some European allies

-

TikTok secures deal to remain in US

TikTok secures deal to remain in USSpeed Read ByteDance will form a US version of the popular video-sharing platform

-

Unemployment rate ticks up amid fall job losses

Unemployment rate ticks up amid fall job lossesSpeed Read Data released by the Commerce Department indicates ‘one of the weakest American labor markets in years’

-

US mints final penny after 232-year run

US mints final penny after 232-year runSpeed Read Production of the one-cent coin has ended

-

Warner Bros. explores sale amid Paramount bids

Warner Bros. explores sale amid Paramount bidsSpeed Read The media giant, home to HBO and DC Studios, has received interest from multiple buying parties

-

Gold tops $4K per ounce, signaling financial unease

Gold tops $4K per ounce, signaling financial uneaseSpeed Read Investors are worried about President Donald Trump’s trade war

-

Electronic Arts to go private in record $55B deal

Electronic Arts to go private in record $55B dealspeed read The video game giant is behind ‘The Sims’ and ‘Madden NFL’

-

New York court tosses Trump's $500M fraud fine

New York court tosses Trump's $500M fraud fineSpeed Read A divided appeals court threw out a hefty penalty against President Trump for fraudulently inflating his wealth

-

Trump said to seek government stake in Intel

Trump said to seek government stake in IntelSpeed Read The president and Intel CEO Lip-Bu Tan reportedly discussed the proposal at a recent meeting