Why diversification is an investor’s best friend

Preparing your investments for times of volatility

On 12 March earlier this year, global stock markets went into full meltdown mode. Panic erupted, as market turbulence (“volatility”, in the jargon) hit all-time highs. “Dow tanks 2,300 in worst day since Black Monday, S&P 500 bear market,” read one headline on CNBC. Every single one of the 11 stock market sectors in the US was negative that day, and the news wasn’t much better anywhere else. For example, the UK’s FTSE 250 index of medium-sized businesses also fell by nearly 10%.

Yet if one had bothered to look at other, less newsworthy numbers, a contrasting story emerged. A fund investing in a basket of leading UK government bonds (gilts) was also caught up in the sell off – but it ended the day losing just 2%. An investor who had made a very simplified diversified bet at the start of the day, putting £50 each into both US equities and “safe” UK gilts, would have ended up losing just over 6%, rather than the 10% lost in stocks alone.

This is why, were you to round up a bunch of economists and lock them in a room, the one thing they’d probably all agree on is the virtue of portfolio diversification. This advice may seem obvious, but it’s worth explaining why diversification makes such a big difference.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

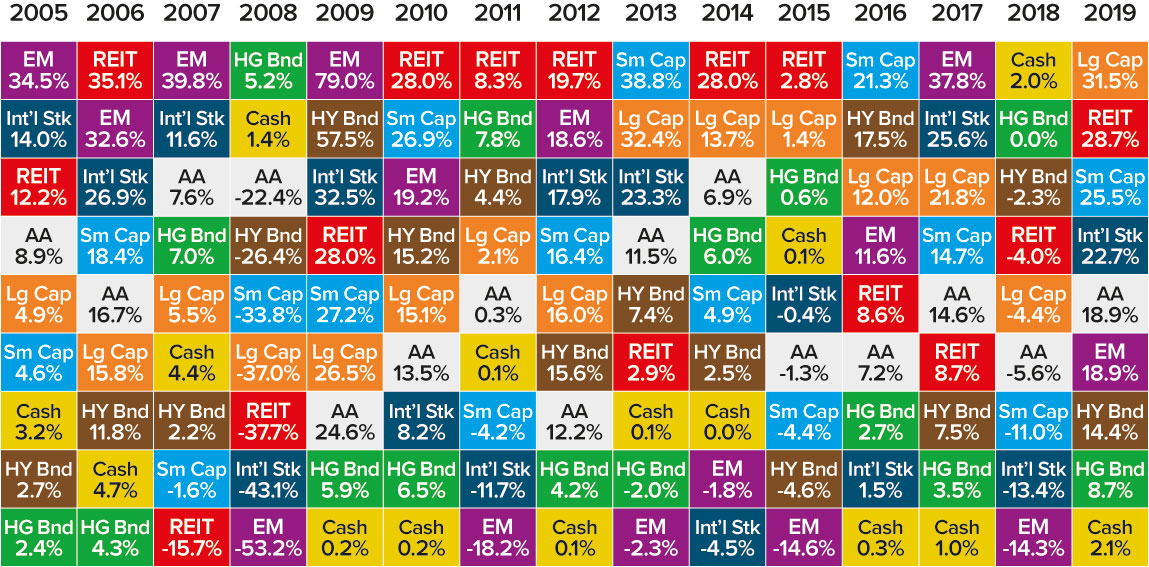

The graphic below is a heat map (aimed at US investors) that shows which type of assets have produced the best and worst results since 2000. It’s a complicated picture but one message comes through clearly – the reason the map looks such a mess is because no single asset manages to outperform all the time. The map isn’t quite random, but it’s not far off. The only consistent outcome worth noting is that in most years cash produced the lowest returns.

This explains why mixing and matching different types of investment makes a lot of sense. It’s here that “asset allocation” comes in. It divides the vast world of investments such as equities (and different types of equities), bonds and alternatives into different buckets of risk and returns. By having varying proportions of these different “classes” in your portfolio (depending on your investment time horizon and goals), you can potentially maximise returns whilst minimising downside risk.

A prevalent strategy foreshadowed earlier is called the 60/40, and sees an investor put 60% of their money into equities and 40% into bonds. This has been shown to produce decent risk-adjusted long-term returns (with lower risk levels) than, for example, a 100% equities portfolio. Better still, you can increase diversification within these bigger buckets (equities, bonds and alternatives) by mixing and matching investments in small and large businesses or different types of stocks – for instance, combining companies that pay out lots of dividends with faster-growth companies that might not pay any dividends at all.

There’s another way to diversify. While the heat map looks at different types of assets such as small and large businesses, property funds, emerging market stocks and corporate bonds, another interesting study, this time by giant US hedge fund Bridgewater Associates (founded by the legendary – and vocal – Ray Dalio) looked at geographic diversification over many decades.

The Bridgewater analysts took two strategies. The first was to keep picking the market of a country that they thought would do well that year, and invest in it. The other was to build a diversified basket of stocks, split between all markets equally. After studying the data over many decades, the analysts compared the results.They found that the second strategy was the better bet.

Although some markets do consistently outperform others (for example, US equities have been consistent winners in recent decades), by and large, a winner one year was just as likely to be an equally big loser the next. Instead, it made more sense to buy a basket of properly diversified stocks from different countries in equal proportion.

Geographical diversification is especially important for British investors – many studies show that most active private investors (and their advisers) have UK equity exposure of at least 20% or 30% at a minimum in their portfolio (and in some cases it’s closer to 100%). Yet if one looks at a big global benchmark index such as the MSCI World (which tracks the total market of all equities), UK stocks only account for about 5% of total market capitalisation. In other words, if you stick to UK stocks alone, you are missing out on 95% of the global stock market.

Discover more of the latest investment views and ideas from Liontrust’s experienced fund managers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry

-

Quentin Deranque: a student’s death energizes the French far right

Quentin Deranque: a student’s death energizes the French far rightIN THE SPOTLIGHT Reactions to the violent killing of an ultraconservative activist offer a glimpse at the culture wars roiling France ahead of next year’s elections

-

Secured vs. unsecured loans: how do they differ and which is better?

Secured vs. unsecured loans: how do they differ and which is better?the explainer They are distinguished by the level of risk and the inclusion of collateral