The first ladies of finance

How the relationship between Janet Yellen and Christine Lagarde could shape our economic destiny

In the first in a series of dispatches examining the human stories behind the business and financial trends now shaping America, we swoop in on the relationship between two women who have the world's financial future in their hands. What makes them tick?

Pleased to meet you?

"History is the biography of great men," argued 19th century British historian, Thomas Carlyle. Yet, it is also shaped by the personal relationships that are struck up by people in power. What great empires have been lost, or nations' destinies altered by a perceived snub or a clumsy placement at dinner? Consider the great consequences for the world order that sprang from Margaret Thatcher's 1984 observation, "I like Mr. Gorbachev. We can do business together". Arguably the relationship with the most at stake for the world economy at present is between the French‐born head of the International Monetary Fund, Christine Lagarde, and the chair of the US Federal Reserve, Janet Yellen. Aside from its obvious interest to students of gender politics (both women made history with their appointments), the strength of their rapport is critical for markets globally – poised as they currently are on the timing of the Fed's first interest rate rise since 2006, after nearly seven years of zero rates.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Hitching a ride

Fortunately, we can report that things seem to be going well. Both policymakers are credited with being unstuffy and laughing easily. Indeed, they hitched a ride together at last year's G20 meeting in Sydney, after which Lagarde observed that Yellen is "a very talented, very competent, very friendly woman whom I greatly respect and admire". As a further twist, Yellen's husband, the Nobel‐prize winning economist George Akerlof, is a senior resident scholar at the IMF, which makes Lagarde his boss.

But we have seen glimmers of differences – however politely they have been expressed in the nuance‐filled terminology of central bankers. In June, the IMF urged the Fed to wait until next year to raise interest rates, cautioning that there was too much uncertainty to justify an immediate hike. After the "taper tantrum" of 2013 – when even the hint that the US would begin trimming its quantitative easing programme caused massive market upheavals globally – Lagarde had every reason to be concerned about a "premature" rise. But her admonition that the US be "mindful" of the impact on other economies, and her warning that the Fed's "credibility" was at stake, was interpreted by some as a slight dig.

No pushover

Voted the best finance minister in Europe by the Financial Times in 2009, Lagarde has long been a force to be reckoned with. The IMF's sometimes controversial embroilment in the protracted Greek debt crisis might have diminished her star in the eyes of some. But according to former IMF chief economist, Christine Lagarde & Janet Yellen at the International Monetary Fund (IMF) 02 July 2014, Washington, DC In the fi rst in a series of dispatches examining the human stories behind the business and financial trends now shaping America, we swoop in on the relationship between two women who have the world's financial future in their hands. What makes them tick? Kenneth Rogoff: "she is enormously impressive, politically astute and a strong personality. At finance meetings all over the world, she is treated practically like a rock star".

Yet with the US recovery apparently on track; stock markets and other asset prices looking toppy, and fears of inflation surfacing, Yellen isn't going to be pushed around. When she was appointed to the job in 2013, her Keynesian background and "doveish" (or nonhardline) outlook on inflation caused one Nomura banker to observe that "if Karl Marx had been in charge of the world, he would have appointed Janet Yellen as his central banker". However, history shows that Yellen, a down to earth Brooklyn native, who regards herself "as being in the prime of a late blooming career", is quite capable of turning "hawkish" when circumstances demand. Indeed, before taking the top job at the Federal Reserve, she was credited with having chalked up more "hours" in monetary policy than any other Fed chief in history. In 1996, she strode into Fed chief Alan Greenspan's office to demand higher rates to counteract the overheating economy. "There was an awkward silence," recalls a colleague. Greenspan, to his later regret, ignored her advice.

Grappling with governance

Even assuming the two policymakers can forge a smooth route on interest rates, their relationship may yet be tested by another, perhaps more intractable, problem: the refusal of US Congress to ratify IMF reforms that would give new economies a greater role in global governance. Lagarde deems the reform "critical to strengthen the fund's credibility, legitimacy and effectiveness". Indeed, without it, the likely response of emerging economies is to seek to develop alternative institutions. The proposed BRICS Bank, for example is threatening the role of currently western‐ dominated organisations like the IMF and the World Bank as linchpins of the international finance system. In a recent blow to the US, the IMF under Lagarde gave full backing to the new Asian Infrastructure Investment Bank – a new organisation dominated by China, which Washington had tried to block.

So, how close to Lagarde is Yellen on the vexed question of IMF reform? We don't know as yet, but with the future of America's influence in the world at stake, a lot depends on how these particular two ladies lunch. The eminent Yale economist, Robert Shiller, once observed that Yellen has "a sort of gentle firmness". It will be interesting to see it tested.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

‘Was a new statue of Thatcher really a wise idea?’

‘Was a new statue of Thatcher really a wise idea?’Instant Opinion Your digest of analysis from the British and international press

-

‘People are being economically penalised for being disabled’

‘People are being economically penalised for being disabled’Instant Opinion Your digest of analysis from the British and international press

-

‘Welcome to the Labour conference where comradeship is scarcer than BP unleaded’

‘Welcome to the Labour conference where comradeship is scarcer than BP unleaded’Instant Opinion Your digest of analysis from the British and international press

-

Who will be on the new £50 note?

Who will be on the new £50 note?In Depth Margaret Thatcher is surprise addition to longlist of scientist candidates

-

Margaret Thatcher ‘believed South Africa should be whites-only’

Margaret Thatcher ‘believed South Africa should be whites-only’Speed Read Ex-head of diplomatic service also says former PM distrusted Germany and hated men with moustaches

-

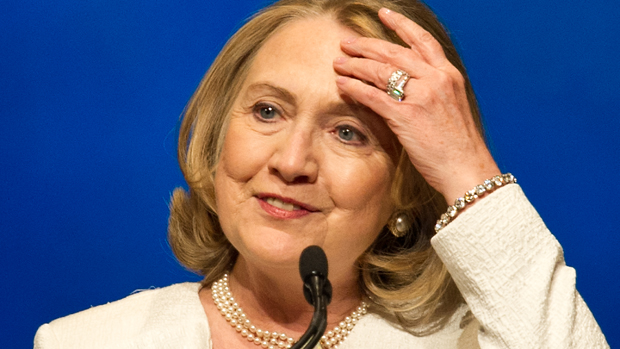

Hillary Clinton for President! A timely boost from Thatcher?

Hillary Clinton for President! A timely boost from Thatcher?In Depth Political strategists and fundraisers already pushing for Hillary before this 'glass ceiling' reminder