Next shares nosedive after it warns of worst year since crisis

Clothing retailer facing 'a challenging year' as consumer spending moves to other sectors

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Next shares are leading the FTSE 100 lower on Thursday, slumping by almost 15 per cent in the final two hours of trading after it warned it was facing its worst trading year since the financial crisis.

Writing in the company's full-year results, chairman John Barton said the retailer was facing "a challenging year with much uncertainty in the global economy".

Chief executive Lord Wolfson added there were signs that higher levels of disposable income were causing a cyclical shift away from clothing and "into areas that suffered the most during the credit crunch".Citing official figures on public spending, he said it "can clearly be seen that growth in experience related expenditure, such as eating out, travel and recreation, was much stronger" than in the clothing sector.The results revealed that sales growth was modest for the year to 23 January. Sky News notes underlying profits rose five per cent, to £821m, on the back of a three per cent rise in sales to £4.15bn.Looking forward to next year, Next lowered guidance for sales from growth of between one and six per cent to between negative one per cent and four per cent. It said profits could actually fall by as much as 4.5 per cent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

The company also said that growth in sales in its online arm, up 7.7 per cent last year, is slowing as competitors make ground and that overseas sales would slow to a still-impressive 25 per cent as it has already opened into all of its largest target territories, including China.

Next disappoints City with pre-Christmas sales

05 January

Next has become the first UK high street retailer to report sales figures for the critical pre-Christmas period – and they have not been warmly received by investors.

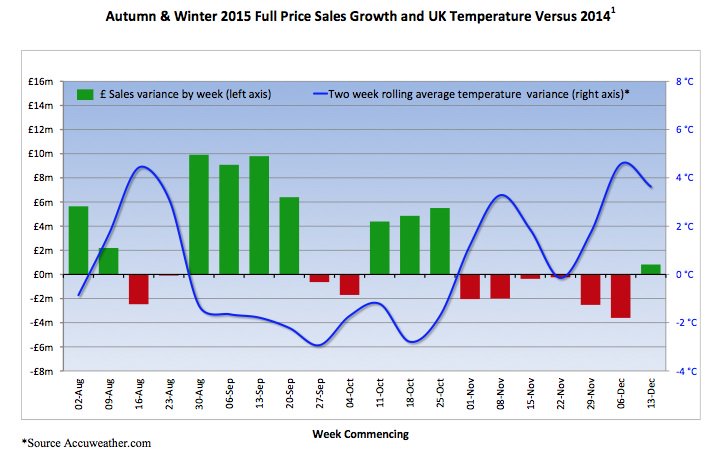

The company branded as "disappointing" a 0.4 per cent increase in overall sales between 26 October and 24 December, which it said was in large part due to the unseasonably mild weather in November and December. It even published a graphic (see below) showing the correlation between average temperature and sales in the second half of last year.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Analysts had expected a rise of around four per cent, says The Guardian. Underneath the headline figure was a 0.5 per cent drop in sales in stores, which was offset by a two per cent rise in sales through its catalogue and online businesses. The 0.4 per cent rise includes sales at stores open less than a year, meaning the like-for-like sales figure preferred by analysts could have been negative.

The company's shares are leading the fallers on the FTSE-100 this afternoon, dropping 5.1 per cent to 6,827.5p.

That sales were still marginally positive overall was in part a reflection of Next's refusal to follow rivals and discount early, which helped to hold margins higher. Marks and Spencer adopted a similar strategy, but it is expected to report even more dismal figures later this week.

Having recorded a six per cent rise in profits in its clothing division in the six months to September, analysts reckon it is likely to report that sales fell two per cent in the lead up to Christmas compared to the same period in 2014, says the Yorkshire Post. Some have even predicted a fall of more than five per cent.

FastFT notes that the retail sector in general is likely to have struggled in the mild weather, which exacerbated the pressure on many traditional high-street stores, which are continuing to lose market share to cheaper online rivals. Before Christmas Bonnmarche and Game were among those to warn they would likely undershoot previous profit guidance.

-

The Olympic timekeepers keeping the Games on track

The Olympic timekeepers keeping the Games on trackUnder the Radar Swiss watchmaking giant Omega has been at the finish line of every Olympic Games for nearly 100 years

-

Will increasing tensions with Iran boil over into war?

Will increasing tensions with Iran boil over into war?Today’s Big Question President Donald Trump has recently been threatening the country

-

Corruption: The spy sheikh and the president

Corruption: The spy sheikh and the presidentFeature Trump is at the center of another scandal

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’