Top hedge fund managers earning 'more than some nations'

Top bosses collectively took home £9bn last year, despite some of their funds losing investors' money

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The highest-paid executives in the hedge fund industry were last year paid collectively more than the value of "the entire economies of Namibia, the Bahamas or Nicaragua", reports The Guardian.

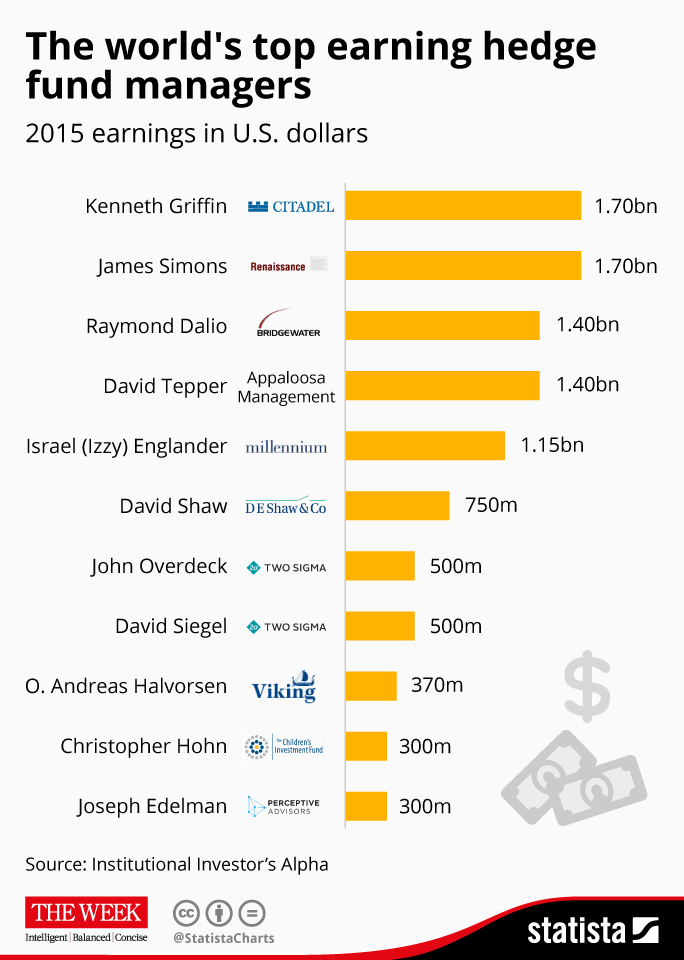

According to the annual estimates published by Institutional Investors Alpha, the top 25 executives earned just shy of $13bn (£9bn). The top two, Citadel founder and chief executive Kenneth Griffin and James Simons, the founder and chairman of Renaissance Technologies, each took home $1.7bn (£1.17bn), "equivalent to… 112,000 people taking home the US federal minimum wage of $15,080".

"Even as regulators push to rein in compensation at Wall Street banks, top hedge fund managers earn more than 50 times what the top executives at banks are paid," notes the New York Times.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Beyond simply enraging a wider population earning a tiny fraction of these amounts, the data points to some interesting trends that may worry hedge fund investors. Namely, there are a number of managers making ever larger pots of money, even when performance is poor and investors' money is being lost.

As an example, Ray Dalio made $1.4bn (£970m) in 2015 through Bridgewater Associates, the world’s biggest hedge fund firm with $150bn (£103bn) of assets under management and whose risk parity fund, called All Weather, lost seven per cent.

In all, five men – and they are all men – made bumper profits despite their funds performing poorly in a market the billionaire manager Daniel Loeb has called a "hedge fund killing field".

This is because hedges funds tend to operate a "two and 20" remuneration model, where the firm takes a two per cent fee out of the assets of the fund and 20 per cent of any profits above a certain "hurdle" rate. Some firms are now making more money from the two per cent element by amassing a huge asset base than they could ever make from outperformance.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Todd Petzel, the chief investment officer at private wealth management firm Offit Capital, said this poses a due diligence challenge for institutional investors in what is meant to be a risky alternative asset class.

"Once a hedge fund gets to be large enough to produce incredibly outsized remuneration, the hardest part of due diligence is determining whether the investment process is affected," he explained. "Is the goal to continue to make money in a risky environment or is the goal to preserve assets on which you collect fees?"

Infographic by www.statista.com for TheWeek.co.uk