UK ranks joint worst for 'real' wages since crisis

Pay rates fall more than ten per cent in eight years, says TUC, putting workers on a par with Greece

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

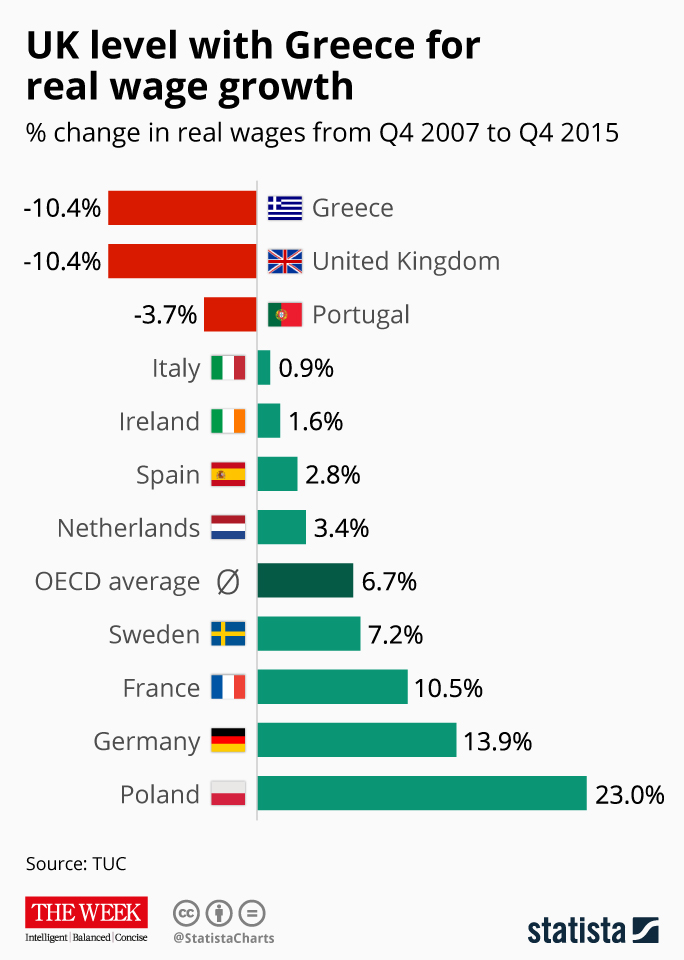

UK workers have endured the joint-worst hit to real incomes since the financial crisis compared to all other advanced nations, a drop in pay that's matched only by thrice-bailed out Greece.

According to analysis published today by trade-union umbrella group the TUC, UK pay rates fell by 10.4 per cent between 2007 and 2015 after the effects of inflation were taken into account. That's the same rate of decline as Greece.

Portugal is the only other developed country within the Organisation for Economic Co-operation and Development (OECD) with falling real wages over the same period, recording a drop of 3.7 per cent.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

In contrast, real pay in Poland has surged by 23 per cent and in Germany and France by nearly 14 per cent and 10.5 per cent. On average across the OECD, on whose data the Trades Union Congress based its figures, underlying wages have risen by 6.7 per cent.

"Real" wages rise when the rate of growth exceeds inflation, which relates to the price of goods people are spending their earnings on. When real pay growth is negative, it means workers feel on average proportionately poorer.

After the crash, UK inflation exceeded pay growth for six consecutive years until 2014, according to the BBC. Real pay has been on the rise ever since, but only marginally and as a result of inflation falling to near zero.

Median wages and disposable income in cash terms actually surpassed their pre-crash peak last year, official figures show.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

A government spokesman told The Guardian that the TUC's findings should be treated with caution as they fail to take into account changes to taxation that have targeted lower-paid workers, adding that living standards have been rising in the UK and that employment is currently at a record high.

The strong labour market highlights what economists refer to as the UK's "productivity puzzle" - more people are in work but they are proving less productive, bringing downward pressure on wages.

In France and the US, real wages have increased since 2007 despite a similar drop in productivity, the Financial Times notes, but this has come at the cost of higher unemployment. Germany is alone among larger nations in recording rising wages and employment.

The TUC says the government should invest in big infrastructure projects to bring higher-paying jobs to the UK and boost the country's productive capacity.

While public investment certainly wouldn't hurt", on its own, it "wouldn’t solve the productivity crisis", says Duncan Weldon in the Guardian. He suggests the government introduce policies designed to encourage more long-term corporate decision-making and to boost pay directly, such as the national living wage.

Infographic by www.statista.com for TheWeek.co.uk.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’