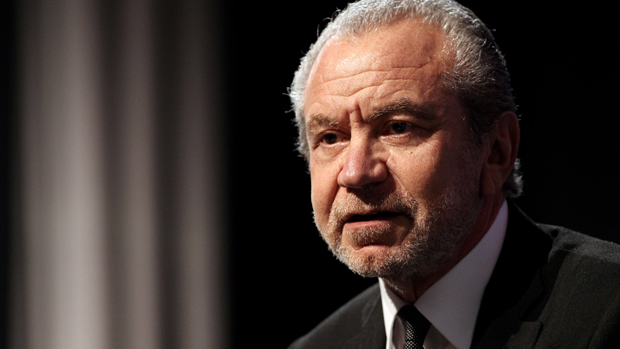

Lord Sugar beats tax hike with bumper £181m payout

Tycoon's holding company pays out three times to avoid increase in dividend duties for higher-rate taxpayers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Lord Alan Sugar beat a hike in the tax rate on dividend payments by paying himself a bumper £181m in the last financial year.

Accounts filed by Sugar's holding company, Amshold, show £100m was paid in December 2015, followed by two payouts of £50m and £31m just two days apart in March last year, says the Daily Telegraph.

A spokesman for the tycoon confirmed to The Times the combined award, up from £9m a year earlier, was timed to beat an increase in dividend taxes for higher-rate taxpayers from 31 to 38 per cent in April.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Andrew Bloch added: "For the avoidance of doubt, this dividend is not some offshore tax scheme. We wish to make it abundantly clear that Lord Sugar is paying the correct amount to the UK revenue."

Pre-tax profits generated by the company fell from £134m to £80m that year.

Having made his name in consumer electronics and computing in the 1980s with his Amstrad computers, Sugar's business interests are now mostly concentrated in commercial property.

Amshold controls a £500m property empire, including the Lever Building in London, which is let out to supermarket giant Tesco, and Gloucester House in Mayfair, the site of Hard Rock Cafe.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Its main redevelopment project is the Crosspoint in the heart of the City, a mix of office and retail units due to be completed this month, adds the Telegraph.

The company sold £130m worth of properties during the course of the 12 months, making a profit of £7.2m, says the Times. Sales included the Sugar Building in the City for £80m, four times its purchase price three years earlier.

-

The ‘ravenous’ demand for Cornish minerals

The ‘ravenous’ demand for Cornish mineralsUnder the Radar Growing need for critical minerals to power tech has intensified ‘appetite’ for lithium, which could be a ‘huge boon’ for local economy

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’