Austerity will continue into 2020s, says IFS

Think-tank warns UK tax burden will reach highest level in more than 30 years over course of this parliament

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

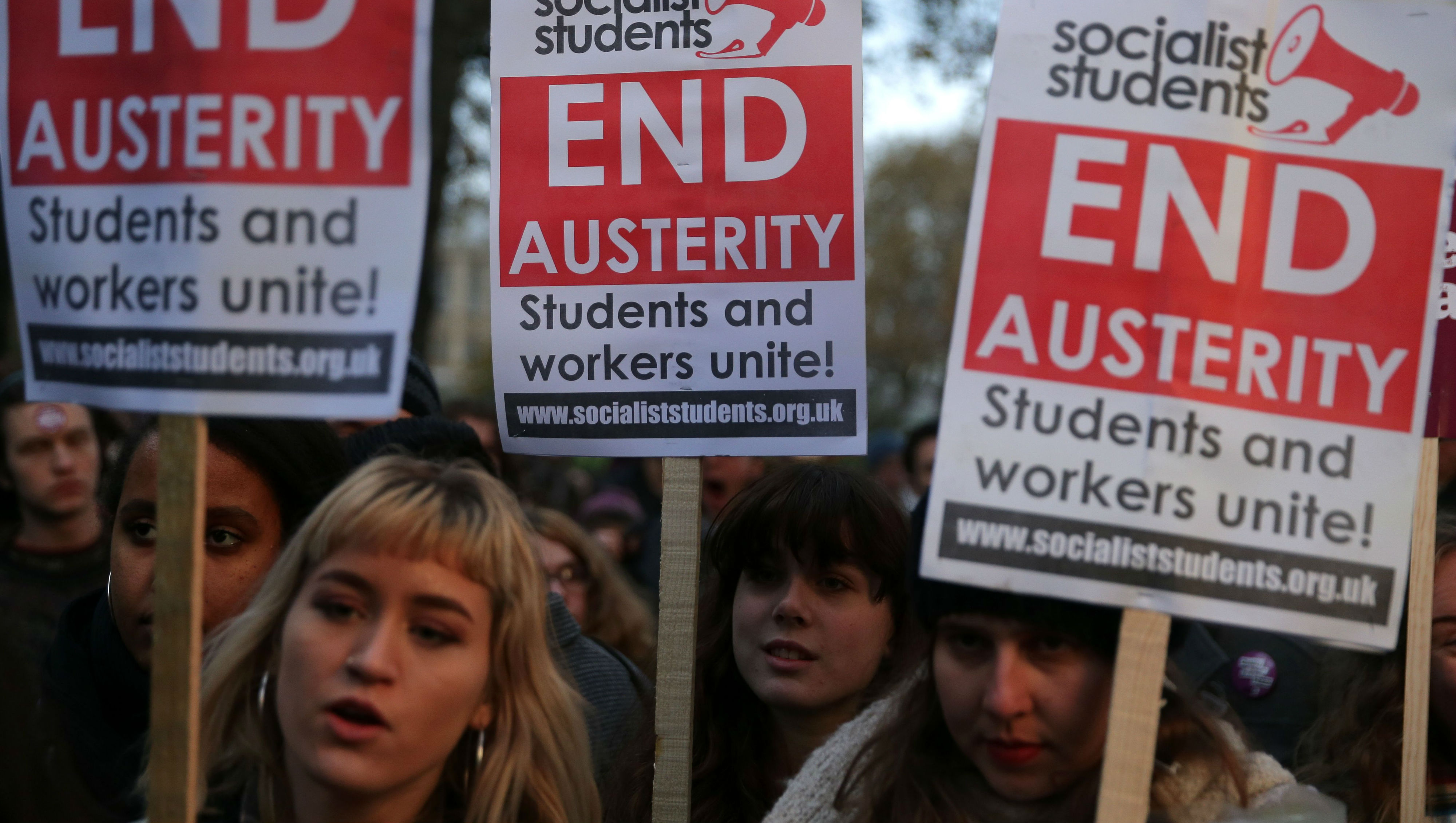

Austerity will continue well into the next decade, according to a study by respected think-tank the Institute for Fiscal Studies (IFS).

In a new report produced by Oxford Economics, the IFS predicts the tax burden will reach its highest level in more than 30 years over the course of this parliament, with tax receipts hitting 37 per cent of national income for the first time since 1987.

Seven years after austerity began, UK borrowing remains the fourth highest of 28 advanced economies while the national debt is the highest it has been since 1966.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Spending on public services since 2010 has already fallen by ten per cent in real terms, "the longest and biggest fall on record", says the IFS.

But "far from easing up, austerity is about to hit harder over the final three years of the parliament, putting the squeeze back on the economy, and there is little sight of the consolidation ending soon", warns The Times.

Despite the continued cuts, slower economic growth following the vote for Brexit will leave the government needing to find £34bn to eliminate the budget deficit, "one of the largest black holes in public spending in the developed world", says The Guardian.

The report also describes Theresa May's Brexit plan to take Britain out of the single market and seek a bespoke trade deal as the "second worst" option for the country.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Only leaving the EU with no deal and falling back on World Trade Organization rules would be worse, it says, adding that staying in the single market would be much better.

The bleak outlook comes at a time of severe pressure on public services, particularly social care and health, and after spending grew at its slowest rate since the mid-1950s between 2010 and 2015.

The IFS says Britain's ageing population and increasing demands on the NHS will blow a large hole in the government budget over the next two parliaments.

Consequently, despite scraping George Osborne's goal of balancing the budget by 2019/20, Chancellor Philip Hammond will have to extend austerity "well into the 2020s" to meet his target of eliminating the deficit during the next parliament, says the Daily Telegraph.

Paul Johnson, director of the IFS, said: "For all the focus on Brexit, the public finances in the next few years look set to be defined by the spending cuts announced by George Osborne."

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day

-

Labour shortages: the ‘most urgent problem’ facing the UK economy right now

Labour shortages: the ‘most urgent problem’ facing the UK economy right nowSpeed Read Britain is currently in the grip of an ‘employment crisis’

-

Will the energy war hurt Europe more than Russia?

Will the energy war hurt Europe more than Russia?Speed Read European Commission proposes a total ban on Russian oil

-

Will Elon Musk manage to take over Twitter?

Will Elon Musk manage to take over Twitter?Speed Read The world’s richest man has launched a hostile takeover bid worth $43bn

-

Shoppers urged not to buy into dodgy Black Friday deals

Shoppers urged not to buy into dodgy Black Friday dealsSpeed Read Consumer watchdog says better prices can be had on most of the so-called bargain offers

-

Ryanair: readying for departure from London

Ryanair: readying for departure from LondonSpeed Read Plans to delist Ryanair from the London Stock Exchange could spell ‘another blow’ to the ‘dwindling’ London market

-

Out of fashion: Asos ‘curse’ has struck again

Out of fashion: Asos ‘curse’ has struck againSpeed Read Share price tumbles following the departure of CEO Nick Beighton

-

Universal Music’s blockbuster listing: don’t stop me now…

Universal Music’s blockbuster listing: don’t stop me now…Speed Read Investors are betting heavily that the ‘boom in music streaming’, which has transformed Universal’s fortunes, ‘still has a long way to go’

-

EasyJet/Wizz: battle for air supremacy

EasyJet/Wizz: battle for air supremacySpeed Read ‘Wizz’s cheeky takeover bid will have come as a blow to the corporate ego’