How the pound, euro and dollar could boost your returns

The FTSE 100 has hit a new all-time high, but it has declined in dollar terms

One of the defining economic themes since the EU referendum last June has been the sharp slump in the pound, by close to a fifth against the dollar and 10 per cent against the euro.

However, the drop in the pound is just one facet of a global foreign exchange story that has at its heart a much more familiar theme: the strength of the dollar.

The US Dollar Index, which measures the greenback against a basket of global currencies, hit a 14-year high late last year – and remains less than 1 per cent down from that level now.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There are a number of factors at work here. One is the election of Donald Trump, which unexpectedly boosted the dollar as traders bet strongly that a promised $1trn infrastructure spending splurge, coupled with a package of tax cuts, would boost the US economy.

But there is also the weakness of other currencies boosting the dollar’s relative value. Aside from sterling’s travails, the euro remains mired well below its highs of recent years as internal strife, related to Greece’s debt crisis and the rise of populism, weighs heavily.

The euro is down 9 per cent against the dollar since May last year – and by almost 25 per cent from its level compared to the greenback three years ago.

Record breakers

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When you get a strong divergence between currency trends, this opens up space for profitable investing. Take, for example, the FTSE 100. It is another commonly-cited economic trend since the Brexit vote last June that the UK’s benchmark blue chip equity index is soaring – posting a record run of consecutive record closes in January. At the time of writing, it was at another all-time high in excess of 7,340.

What is widely acknowledged in investment circles, but not consistently in articles on the index’s stellar run, is the role of the pound’s slump.

More than two-thirds of the constituents on the FTSE 100 make their money in another currency, meaning their earnings and relative values have been boosted by the slump in the pound.

In fact, The Guardian noted at the end of last year that while the FTSE 100 had gained more than 14 per cent for the whole of last year, in dollar terms it was actually down 5 per cent for the 12 months.

Mining for profit

Among the London-listed companies that The Guardian said are doing particularly well are miners, whose operations are typically based overseas and whose revenues are defined by dollar-denominated commodity prices.

One such company that is especially well placed to take advantage of the current trends is Berkeley Energia, which is building the world’s only new uranium mine, in Salamanca in Spain.

The company is listed in the UK, generates operating costs almost exclusively in euros, and will generate its revenues in dollars when it begins producing uranium at the end of next year.

Its share price has more than doubled to around 53.5p in the past year – and several analysts are holding ‘buy’ ratings on the stock with a target price twice as high again.

Fundamentals

Of course, it would not be at all sensible to base investment decisions purely on the dynamics of an ever-fluctuating foreign exchange market.

In recent weeks we’ve seen the spectacle of the dollar – and related commodities prices such as gold – swinging substantially just on the basis of cryptic comments from Donald Trump’s officials related to the value of the euro.

But it is equally clear that the machinations of the currency markets can be a major factor in the performance of investments and should certainly be taken into account. It’s just that the fundamentals of the investment need to stack up, too.

Let’s go back to Berkeley Energia: its costs are very low, at around half the global average for a uranium miner, at a time when uranium prices are approaching 13-year lows – and when nuclear construction, and so expected uranium demand globally, is expanding rapidly.

If the current currency dynamic holds, that could merely be a tasty cherry on top for investors.

Winners and losers from the pound slump

Companies that generate revenues in euros or dollars, say, but which report in pounds, have seen their bottom line boosted since the sterling slump set in.

At the end of last year, the list of winners included global firms that have a stable-to- strong outlook, but which generate sales overseas that they then convert back profitably into the weaker pound.

Examples included businesses in the defensive pharmaceuticals sector such as GlaxoSmithKline and AstraZeneca; Burberry, which generates 85 per cent of its sales overseas; and Primark owner Associated British Foods.

On the flipside, companies that import goods to the UK but generate revenues in pounds are suffering the reverse trend. The likes of the big four supermarkets, consumer goods firm Unilever, Sports Direct and clothing firm Next are notable cases in point.

In general, the British consumer is likely to be a loser if inflation rises above average wage rises, while manufacturers are enjoying their best growth in several years and exports surge.

-

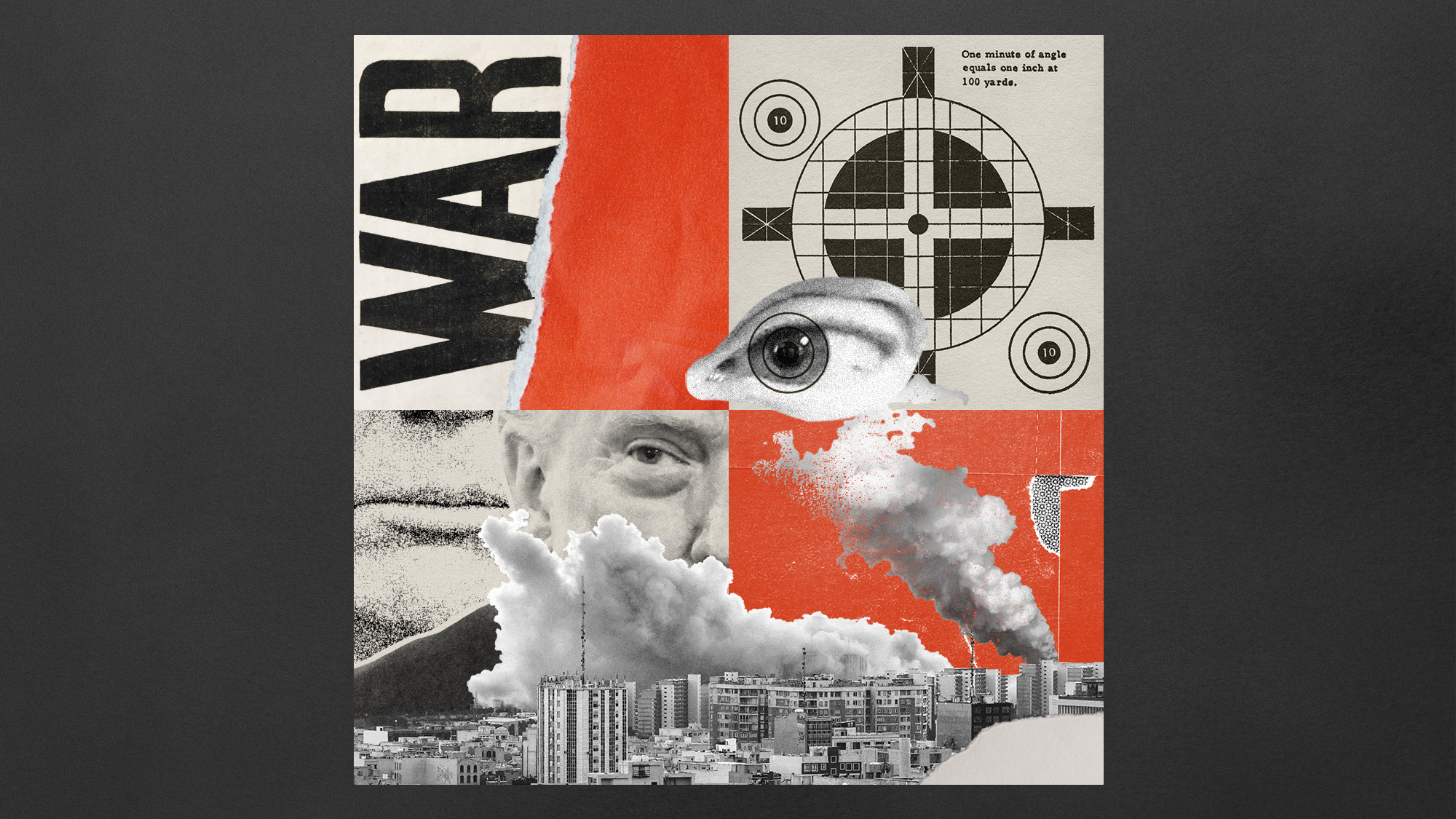

How strong is Trump’s case for war with Iran?

How strong is Trump’s case for war with Iran?Talking Points The administration is offering shifting rationales

-

‘Rebuilding that capacity is no simple matter’

‘Rebuilding that capacity is no simple matter’Instant Opinion Opinion, comment and editorials of the day

-

Have the spring break of your dreams at these 7 inviting hotels

Have the spring break of your dreams at these 7 inviting hotelsThe Week Recommends Follow your bliss