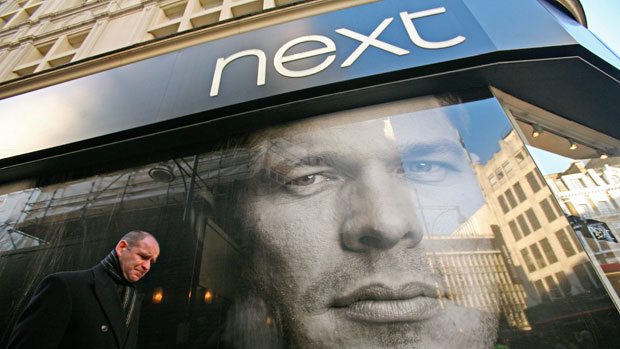

Next slashes directors' pay rises after profit dip

Chief executive Lord Simon Wolfson among those hit as clothing retailer warns of tough year ahead

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Next has slashed bumper pay rises planned for several senior executives after its recently reported profit dip.

"Operations director Michael Law and sales and marketing director Jane Shields, were in line for a 15 per cent increase in their salary [that] would have taken their salaries to £475,000, reflecting their recent promotions to the company’s board," says the Daily Telegraph.

However, in its formal annual results yesterday, the clothing retailer revealed both will see pay rises of one per cent, taking their salaries to £416,200.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

"A third senior member of staff, finance director Amanda James, would have had her pay increased by 18pc to £425,000… [instead she] will receive a 16 per cent increase to take her pay to the same amount."

Chief executive Lord Simon Wolfson will also see his salary rise one per cent this year, to £773,000. His combined pay package for 2016 was also much lower than the previous year, down from £4.3m to £1.8m, as a result of his performance-related bonus award falling.

The BBC says he was paid a bonus of £500,000 for the 12 months, while "none of the firm's other three top bosses or non-executive directors were paid a bonus".

The moves follow Next revealing a 3.8 per cent drop in pre-tax profits to £790.2m for the year to the end of January. It also warned trading would be tough this year, not least because of pressure on margins as a result of the Brexit vote-related surge in inflation.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Next shares surge despite first profit fall in eight years

Next's shares have rallied strongly in an otherwise flat market this morning, despite the clothing and homeware retailer reporting its first fall in profits since the financial crisis.

Pre-tax profit dropped 5.5 per cent from £836.1m to £790.2m last year, says the BBC, and there were also warnings over trading conditions for this year and, in some areas, the next decade.

Nevertheless, the retailer's share price jumped more than six per cent to £41.24, the highest it has been since mid-January.

This is mostly attributable to Next's strong balance sheet, which means it has been able to announce a final-year dividend of 105p per share, says the Financial Times. It has also maintained full-year investor distributions in line with 2015, at 158p.

Investors had been prepared for the worst after the company issued a profit warning in January. Shares tumbled from a high of £49.83 at the end of last year to a low of £37.91 last month.

The profit fall was concentrated in physical stores, where takings dropped three per cent to £2.3bn and pre-tax profits slumped 16 per cent.

Company chief executive Lord Wolfson said it was "legitimate to question the long-term viability of retail stores and whether the possession of a retail portfolio is an asset or a liability", says the FT.

Next's catalogue and online sales rose four per cent to £1.7bn and pre-tax profits increased by close to ten per cent, emphasising the shift in shopping habits that is driving business away from the high street.

Like other retailers, Next said its margins are also being affected by the new national living wage, the government's apprenticeship levy and rising import costs due to the slump in the pound.

It added that trading conditions would remain tough and that profits are expected to fall again this year to between £680m and £780m, reports The Guardian.