Church of England generates 'stellar' investment returns

Church Commissioners post 17.1 per cent return for 2016, above Yale University's top-rated fund

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The Church of England is officially one of the best investment funds in the world, generating what its own commissioners called a "stellar" return in 2016.

Its endowment fund has posted a 17.1 per cent return for the year, more than double the 8.2 per cent of 2015.

On a ten and 20-year basis, it has earned an average annual return of 8.3 and 9.5 per cent respectively, says the Financial Times, ranking it ahead of the top-rated US Ivy League university endowment fund run by Yale University, which produced an annual return of 3.4 per cent last year and has averaged 8.1 per cent for the past decade.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

However, over 20 years, Yale is still well ahead, with an annual average return of 12.6 per cent.

"Armed with a long-term mandate and an in-house team of 35 investment professionals, the Church Commissioners [who run the fund] are... known for taking positions counter to industry trends", says the FT.

In one particular respect, they are going against the grain at the moment: retaining a core belief in the power of active management to drive outperformance, rather than cheaper index tracking.

However, criticism has been aimed at the Church's ethical investment policies, which in theory stop it taking stakes in companies that derive above a set percentage of earnings from pornography, arms sales, tobacco, alcohol or high-interest lending.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In 2012 the fund was criticised for upping investments in hedge funds at a time of anger over "corporate excess", while in 2013, it was revealed that the Church had invested in payday lender Wonga, in direct contravention of its policies. It has since left the lender.

Returns last year were driven in large part by UK equities, which benefitted from the post-Brexit vote slump in the pound, says the BBC.

Church Commissioners chief executive Andrew Brown said the fund contributed £230.7m to the Church of England last year, around 15 per cent of its total income.

-

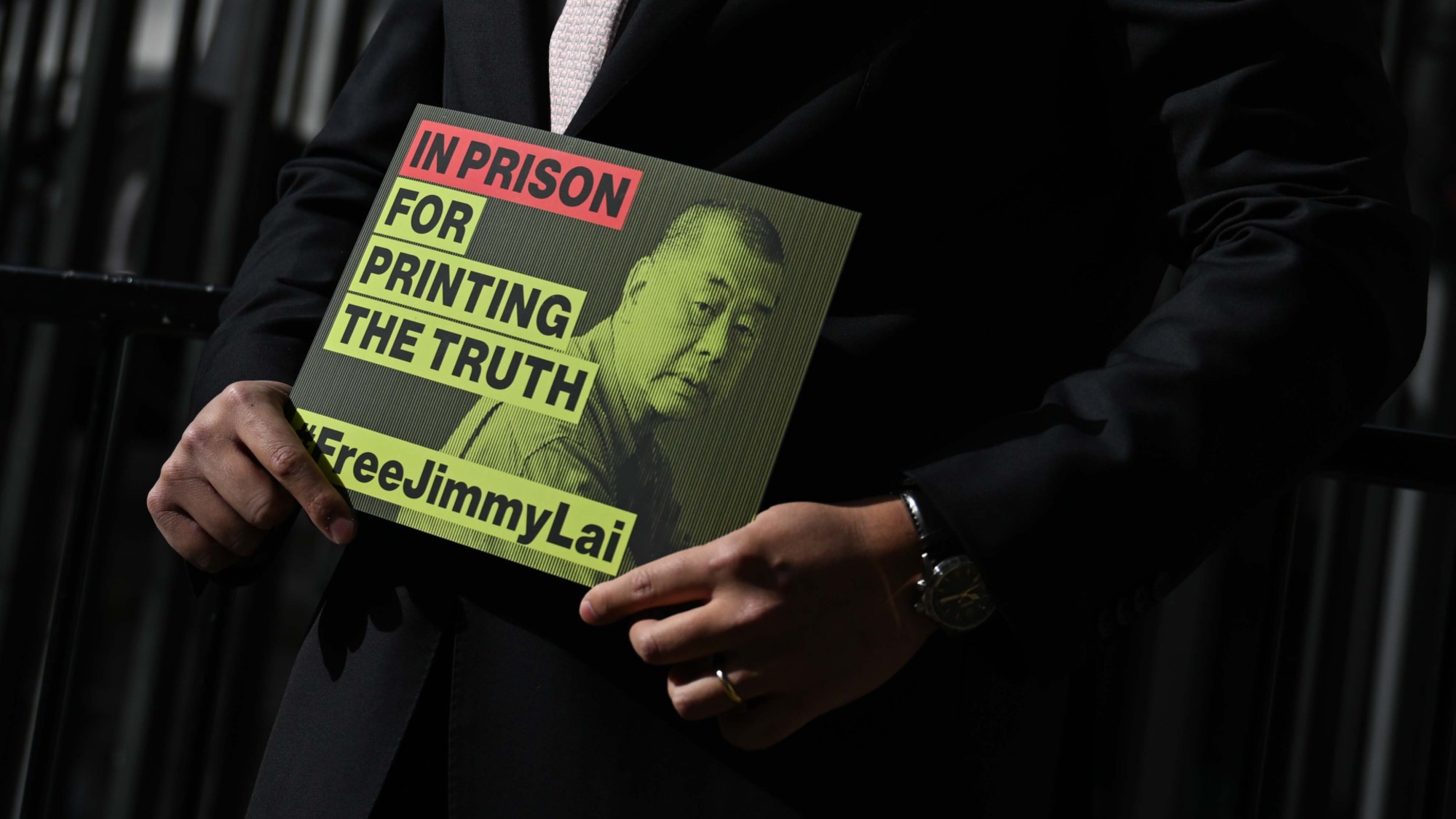

‘Hong Kong is stable because it has been muzzled’

‘Hong Kong is stable because it has been muzzled’Instant Opinion Opinion, comment and editorials of the day

-

Magazine solutions - February 20, 2026

Magazine solutions - February 20, 2026Puzzle and Quizzes Magazine solutions - February 20, 2026

-

Magazine printables - February 20, 2026

Magazine printables - February 20, 2026Puzzle and Quizzes Magazine printables - February 20, 2026

-

Epstein files topple law CEO, roil UK government

Epstein files topple law CEO, roil UK governmentSpeed Read Peter Mandelson, Britain’s former ambassador to the US, is caught up in the scandal

-

Iran and US prepare to meet after skirmishes

Iran and US prepare to meet after skirmishesSpeed Read The incident comes amid heightened tensions in the Middle East

-

Israel retrieves final hostage’s body from Gaza

Israel retrieves final hostage’s body from GazaSpeed Read The 24-year-old police officer was killed during the initial Hamas attack

-

China’s Xi targets top general in growing purge

China’s Xi targets top general in growing purgeSpeed Read Zhang Youxia is being investigated over ‘grave violations’ of the law

-

Panama and Canada are negotiating over a crucial copper mine

Panama and Canada are negotiating over a crucial copper mineIn the Spotlight Panama is set to make a final decision on the mine this summer

-

Why Greenland’s natural resources are nearly impossible to mine

Why Greenland’s natural resources are nearly impossible to mineThe Explainer The country’s natural landscape makes the task extremely difficult

-

Iran cuts internet as protests escalate

Iran cuts internet as protests escalateSpeed Reada Government buildings across the country have been set on fire

-

US nabs ‘shadow’ tanker claimed by Russia

US nabs ‘shadow’ tanker claimed by RussiaSpeed Read The ship was one of two vessels seized by the US military