First Homes: will first-time buyers really benefit from the new scheme?

A property ‘scramble’ is predicted while many people could still be priced out

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Housing Secretary Robert Jenrick last week launched the government’s new flagship First Homes scheme - an initiative to create a “realistic and affordable route” into property ownership.

Part of Boris Johnson’s affordable homes pledge, the opening First Homes went on the market last Friday in the Bolsover district of the East Midlands and the scheme will be rolled out across the rest of England on 28 June.

While the news is welcomed by some first-time buyers, it’s predicted there could be a huge “scramble” for the homes as prices continue to rise, the Daily Mail says. There are also concerns that the properties will still be unaffordable to people on average incomes, especially in more expensive areas such as London.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

How does the scheme work?

First Homes is designed to give local first-time buyers and key workers in England - such as NHS staff and veterans - the chance to get on to the housing ladder.

It will offer homes at a discount of between 30% and 50% compared to the market price and that same percentage will then be passed on with the sale of the property to future first-time buyers. “The scheme will support local people who struggle to afford market prices in their area, but want to stay in the communities where they live and work,” the government said.

Following the launch in Bolsover, further sites across the rest of the country will be announced in the coming weeks. A further 1,500 will enter the market from the autumn.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

“These homes will be locked in for perpetuity to first-time buyers and key workers from their local area – making them an asset to both their owners and the wider local community,” Jenrick said.

The scheme does not apply in Wales, Scotland or Northern Ireland.

Who is eligible and what are the price caps?

The scheme is open to first-time buyers only who are in households with combined earnings of less than £80,000 per year - or £90,000 in London. Buyers must have local connections and/or key worker status as determined by the relevant local authority.

There is also a value cap on the homes. Once the discount has been applied homes cannot be sold for more than £250,000 across England or £420,000 in Greater London.

Property ‘scramble’ predicted

According to property website Rightmove, the current average asking price for first-time buyers in Britain is £205,925, The Guardian reports. While this could see some buyers save £100,000 or more, it also means that there could be huge demand for First Homes.

“We’re seeing a lot of first-time buyers entering the market at the moment, now that there are more lower deposit mortgages available, so there’s likely to be a scramble for properties being sold under this scheme,” said Tim Bannister, director of property data at Rightmove. “If you are eligible to buy a home under this scheme and you find one in your local area, you’ll need to act quickly to have the best chance of securing one.”

Unaffordable for many Londoners

First Homes will still be unaffordable to people on average incomes, especially in areas such as London and the South East, the Daily Mail says.

With the average house price in the capital now more than £500,000, Dolphin Living chief executive Olivia Harris says that a First Homes property with a 30% discount will therefore cost around £350,000, “which is not affordable to a London median earner, defined by HMRC in 2018 as being on £26,300”. She added: “It would possibly be affordable to a dual-income household, but they’d need a deposit of at least £35,000, which puts this out of the reach of many.”

Estate agent Savills suggests that a typical two-bed flat would still be unaffordable for 88% of households in the capital, and 68% in some areas of the South East, the Mail adds.

Could key workers and families miss out?

Average property values have soared and according to Nationwide the UK’s annual house-price growth increased by 10.9% in the 12 months to May - the highest level in nearly seven years.

This could see many “Covid heroes” and families blocked from the latest housing scheme with developers ending up building smaller homes to meet quotas, The Daily Telegraph says.

Analysis by Hamptons found that 30% of new-build homes sold in England last year were priced above the new scheme’s caps - and the figure is likely to rise to 34%. “It is likely that in London and more expensive parts of southern England the scheme will be limited to flats,” said David Fell of Hamptons.

Labour MP Meg Hillier, who chairs the public accounts committee, said: “The government has run at our housing crisis from every angle except the one that counts: supplying suitable homes for families now. There must be real questions about why First Homes will work any better.”

Mike Starling is the former digital features editor at The Week. He started his career in 2001 in Gloucestershire as a sports reporter and sub-editor and has held various roles as a writer and editor at news, travel and B2B publications. He has spoken at a number of sports business conferences and also worked as a consultant creating sports travel content for tourism boards. International experience includes spells living and working in Dubai, UAE; Brisbane, Australia; and Beirut, Lebanon.

-

‘States that set ambitious climate targets are already feeling the tension’

‘States that set ambitious climate targets are already feeling the tension’Instant Opinion Opinion, comment and editorials of the day

-

Mixing up mixology: The year ahead in cocktail and bar trends

Mixing up mixology: The year ahead in cocktail and bar trendsthe week recommends It’s hojicha vs. matcha, plus a whole lot more

-

Labor secretary’s husband barred amid assault probe

Labor secretary’s husband barred amid assault probeSpeed Read Shawn DeRemer, the husband of Labor Secretary Lori Chavez-DeRemer, has been accused of sexual assault

-

The end of leasehold flats

The end of leasehold flatsThe Explainer Government reforms will give homeowners greater control under a move to the commonhold system

-

Why baby boomers and retirees are ditching Florida for Appalachia

Why baby boomers and retirees are ditching Florida for AppalachiaThe Explainer The shift is causing a population spike in many rural Appalachian communities

-

The pros and cons of new-builds

The pros and cons of new-buildsPros and Cons More options for first-time buyers and lower bills are offset by ‘new-build premium’ and the chance of delays

-

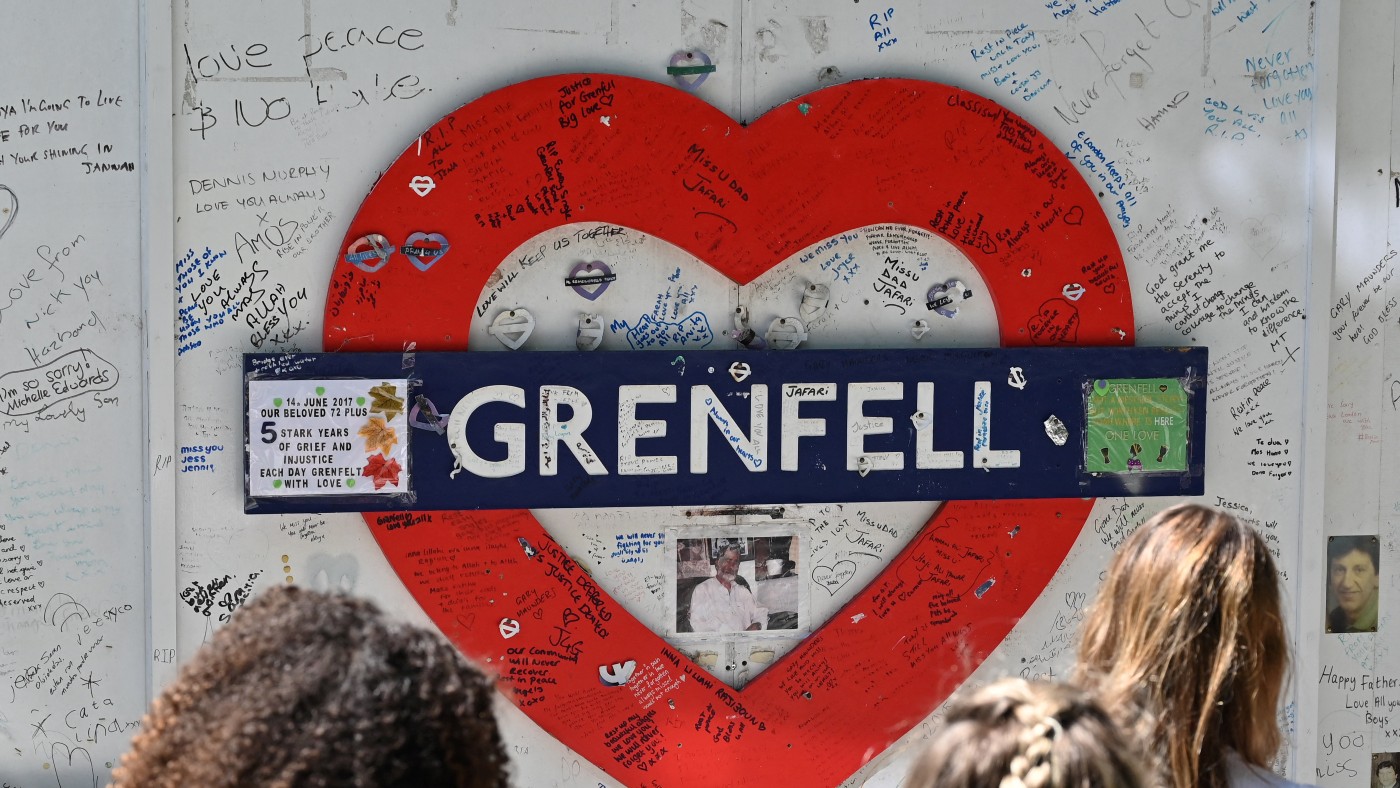

How the Grenfell tragedy changed the UK

How the Grenfell tragedy changed the UKfeature Six years on since the government vowed to ‘learn lessons’ has sufficient progress been made?

-

Pros and cons of building on the green belt

Pros and cons of building on the green beltPros and Cons More housing and lower house prices must be weighed against urban sprawl and conservation concerns

-

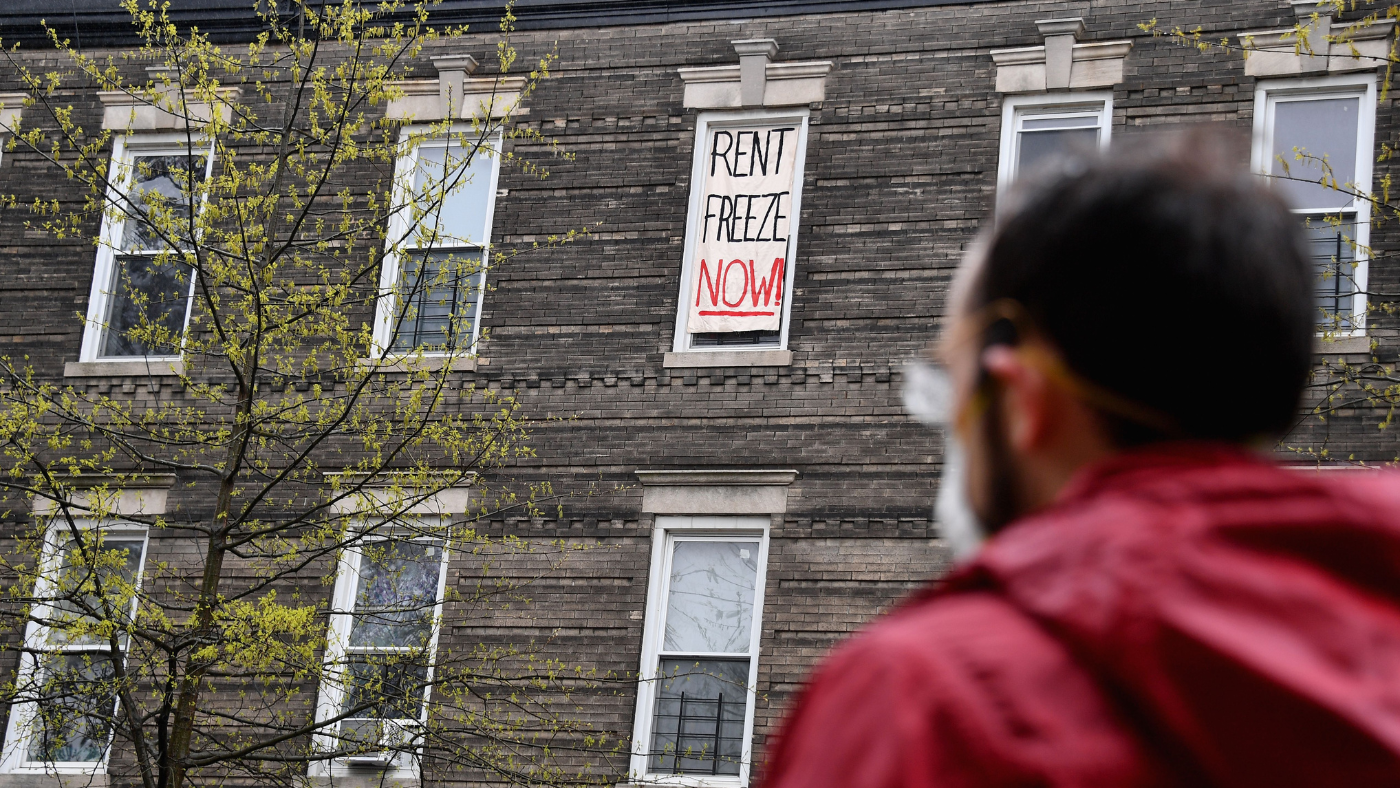

The pros and cons of rent freezes

The pros and cons of rent freezesPros and Cons Proponents say rent controls provide stability for tenants, but critics claim they won’t fix the housing crisis

-

The cooling housing market: what happens next for UK property?

The cooling housing market: what happens next for UK property?In the Spotlight The end of the latest boom is in sight. What kind of landing can we expect?

-

Shared ownership explained: how the home buying scheme works

Shared ownership explained: how the home buying scheme worksPros and Cons Getting on the property ladder is being made more affordable – but there are downsides