Shared ownership explained: how the home buying scheme works

Getting on the property ladder is being made more affordable – but there are downsides

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

With both house prices and mortage rates tipped to climb, getting on the first rung of the UK property ladder is a tough challenge for many would-be homeowners.

One way to potentially make that first step more affordable is through shared ownership, a government scheme available in England, Northern Ireland, Scotland and Wales. Here we look at how shared ownership works and who is eligible – plus the pros and cons of the home buying scheme.

1. What is shared ownership?

A number of government initiatives have been launched to help first-time buyers get on the property market, including Help to Buy equity loans and 95% mortgages.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Shared ownership “has existed since the 1980s, and currently there are more than 150,000 households in England living in shared ownership homes – that's around 1% of all households”, said MoneySavingExpert.

The scheme is sometimes referred to as “part-rent, part buy” and the concept is “straightforward”, the site continued. However “in practice, it can be both complicated and expensive”.

The Gov.uk website explained that “when you purchase through a shared ownership scheme, you buy a share of the property and pay rent on the rest”. In England, the share bought is usually between 25% and 75%, but can be as low as 10%.

2. How does it work?

Under the scheme, the buyer only pays a mortgage on their share of the property. The remaining portion of the property belongs to a housing association, to which the buyer pays rent.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Since the buyer only needs a mortgage for the share they are purchasing, the down payment is made more affordable.

After buying in, the purchaser may have the option to increase their share during their time in the property via a process known as “staircasing”, depending on the terms of their lease. Shares can be bought in increments, “which will in turn reduce your rent”, said the HomeOwners Alliance.

3. What are the rules and who is eligible?

Shared ownership “isn’t limited to first-time buyers”, said MoneySavingExpert. The scheme is also open to previous homeowners who are struggling to get back on the property ladder, as well as existing shared owners.

However, the rules in England and for the devolved schemes in Scotland, Wales and Northern Ireland can differ.

Shared ownership in England

Shared ownership projects are always leasehold properties.

You can purchase a home through shared ownership if:

- your household earns £80,000 a year or less (£90,000 a year or less in London)

- you cannot afford all of the deposit and mortgage payments for a home that meets your needs

One of the following must also be true:

- you’re a first-time buyer

- you used to own a home, but cannot afford to buy one now

- you own a home and want to move but cannot afford a new home suitable for your needs

- you’re forming a new household – for example, after a relationship breakdown you’re an existing shared owner and want to move

Co-ownership in Northern Ireland

You can buy a share of between 50% and 90% of a property. However, there is a property price cap of £165,000. You can increase your share at any time in 5% amounts – this is known as “buying out”, the NIDirect website said.

Shared ownership in Scotland

Aimed at first-time buyers and other priority groups, in Scotland you can buy a 25%, 50% or 75% share of a home. The remaining share is owned by a housing association. There is also an occupancy charge to pay to the housing association.

Shared ownership in Wales

In Wales, you can purchase an initial share of between 25% to 75% of the value of the chosen property. You must also take out a repayment mortgage for the share of the home purchased. The share can be increased at any time.

To be eligible for shared ownership in Wales, you must have a combined household income of £60,000 or less each year. You must also be a first-time buyer, or a newly forming household, or be relocating for work purposes.

4. The pros

Shared ownership provides a “quicker route onto the property ladder, without years of saving”, said Bristol Live. Shared ownership “not only provides financial security” but also offers buyers “flexibility, affordability and spacious homes with modern interiors”, the site added.

The main advantage of shared ownership is that it can be “easier to achieve than full ownership”, said financial journalist Nick Green on Unbiased. “Since you only need a smaller mortgage, the necessary deposit will also be smaller.”

5. The cons

Although it’s “a great way” to get a stake in a property, there are some “common complaints from people in shared ownership schemes”, said the HomeOwners Alliance. Potential pitfalls include maintenance charges, curbs on sub-letting, restrictions within the lease, a risk of negative equity, and possible problems selling the share when moving home.

And “although most first-time buyers do not pay stamp duty, this exemption doesn’t always apply with shared ownership purchases”, said Green on Unbiased.

Buyers also don’t have greater protection under shared ownership. “Just because this is a government-backed scheme doesn’t mean you get any more protection,” the HomeOwners Alliance warned. “Costs can spiral” and “while rents start low, expect these to increase”.

Buyers are responsible for “all home repairs, regardless of how much of the property you own”, said MoneySavingExpert. Selling a shared ownership home can “also be complicated if you’ve not staircased up to 100% ownership by the time you come to sell”.

There are three main costs to be aware of for shared ownership:

- mortgage repayments on the share that you own (along with your deposit)

- rent on the share you don’t own

- monthly property service charges, which typically apply to these types of properties

“As the name suggests, shared ownership doesn’t grant you all the benefits of complete ownership,” concluded Green on Unbiased.

-

Why are election experts taking Trump’s midterm threats seriously?

Why are election experts taking Trump’s midterm threats seriously?IN THE SPOTLIGHT As the president muses about polling place deployments and a centralized electoral system aimed at one-party control, lawmakers are taking this administration at its word

-

‘Restaurateurs have become millionaires’

‘Restaurateurs have become millionaires’Instant Opinion Opinion, comment and editorials of the day

-

Earth is rapidly approaching a ‘hothouse’ trajectory of warming

Earth is rapidly approaching a ‘hothouse’ trajectory of warmingThe explainer It may become impossible to fix

-

The end of leasehold flats

The end of leasehold flatsThe Explainer Government reforms will give homeowners greater control under a move to the commonhold system

-

Why baby boomers and retirees are ditching Florida for Appalachia

Why baby boomers and retirees are ditching Florida for AppalachiaThe Explainer The shift is causing a population spike in many rural Appalachian communities

-

The pros and cons of new-builds

The pros and cons of new-buildsPros and Cons More options for first-time buyers and lower bills are offset by ‘new-build premium’ and the chance of delays

-

How the Grenfell tragedy changed the UK

How the Grenfell tragedy changed the UKfeature Six years on since the government vowed to ‘learn lessons’ has sufficient progress been made?

-

Pros and cons of building on the green belt

Pros and cons of building on the green beltPros and Cons More housing and lower house prices must be weighed against urban sprawl and conservation concerns

-

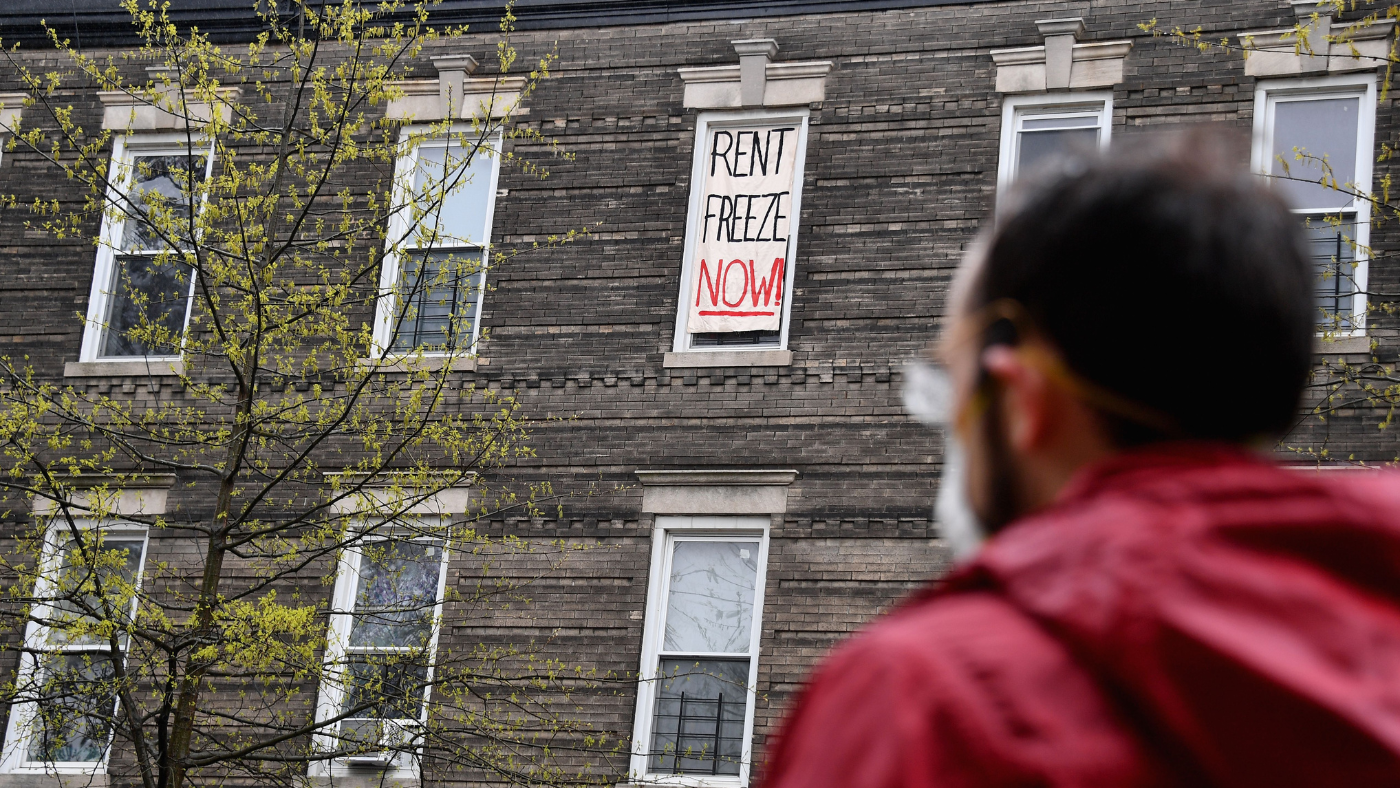

The pros and cons of rent freezes

The pros and cons of rent freezesPros and Cons Proponents say rent controls provide stability for tenants, but critics claim they won’t fix the housing crisis

-

The cooling housing market: what happens next for UK property?

The cooling housing market: what happens next for UK property?In the Spotlight The end of the latest boom is in sight. What kind of landing can we expect?

-

Is buying a house cheaper than renting?

Is buying a house cheaper than renting?In Depth Renters face rising costs and a shortage of properties on the market