Retirement planning: When you're 64

At the start of the 20th century, the life expectancy of a male living in England and Wales was 48, whilst women could expect to live until 52. Those who lived longer than average typically worked until the age of 74, so very few people actually drew a pension.

Circumstances are different today. Most of us look forward to a long retirement and have aspirations for it, such as travelling or spending time with our grandchildren.

Whatever our preferred post-career lifestyle may be, one way of achieving it is via a pension. However, as with life expectancy, pensions are changing quickly. Not long ago, many employees could depend on their workplace pension scheme to provide an assured income in retirement, but employers today are reluctant to offer the generous final salary schemes they once did, as the ever-rising average age of UK residents makes these plans increasingly expensive to run.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Burying our heads in the sand

Despite much being done in the last 10 years to increase people's awareness of the need to take ownership of their retirement and start planning for it, many of us still believe that the State and our employers will pay our way in old age. In fact, we should be both planning for a longer retirement and accepting greater responsibility for our finances after we've finished work.

If we are to realise our aspirations and attain our desired quality of life in later years, we simply need bigger pension pots than before. Even more importantly, we need to start planning for retirement as early as possible.

When should I start planning for retirement?

As long as you have some disposable income – immediately. People in the UK are enjoying longer retirements than ever before, and this is primarily due to two factors.

Firstly, we are living longer – by the end of the twentieth century men lived on average to 76 and women to 81, meaning that people were living around 28 years longer than at the start of the 20th century.

Secondly, we are actually retiring younger – on average at 62. What this data reveals is that retirement is new to us. Even a lay logician could deduce that if 116 years ago we retired at 74 and died at 48, then there were very few pensioners. He or she could also conclude that now the exact opposite is true: if we now work until 62 and die at 76 or 81, the majority of us can expect a long retirement.

How can I start planning for retirement?

Whether you are unemployed, an employee, a partner or self-employed, you can contribute into a pension. Employers are legally bound to offer workers access to a workplace pension scheme, whilst anyone self-employed or unemployed who can't invest in an occupational plan can pay into a personal pension, such as a SIPP (Self Invested Personal Pension) or a stakeholder policy.

Pensions are the most tax-efficient wrappers available to investors, with up to 45% income tax reclaimable on contributions. What's more, many employers see their defined contribution workplace pension schemes as a valued and affordable benefit, so they offer generous contributions to their employees. If you're an employee and not currently a member of your company's pension scheme, ask your HR department for details.

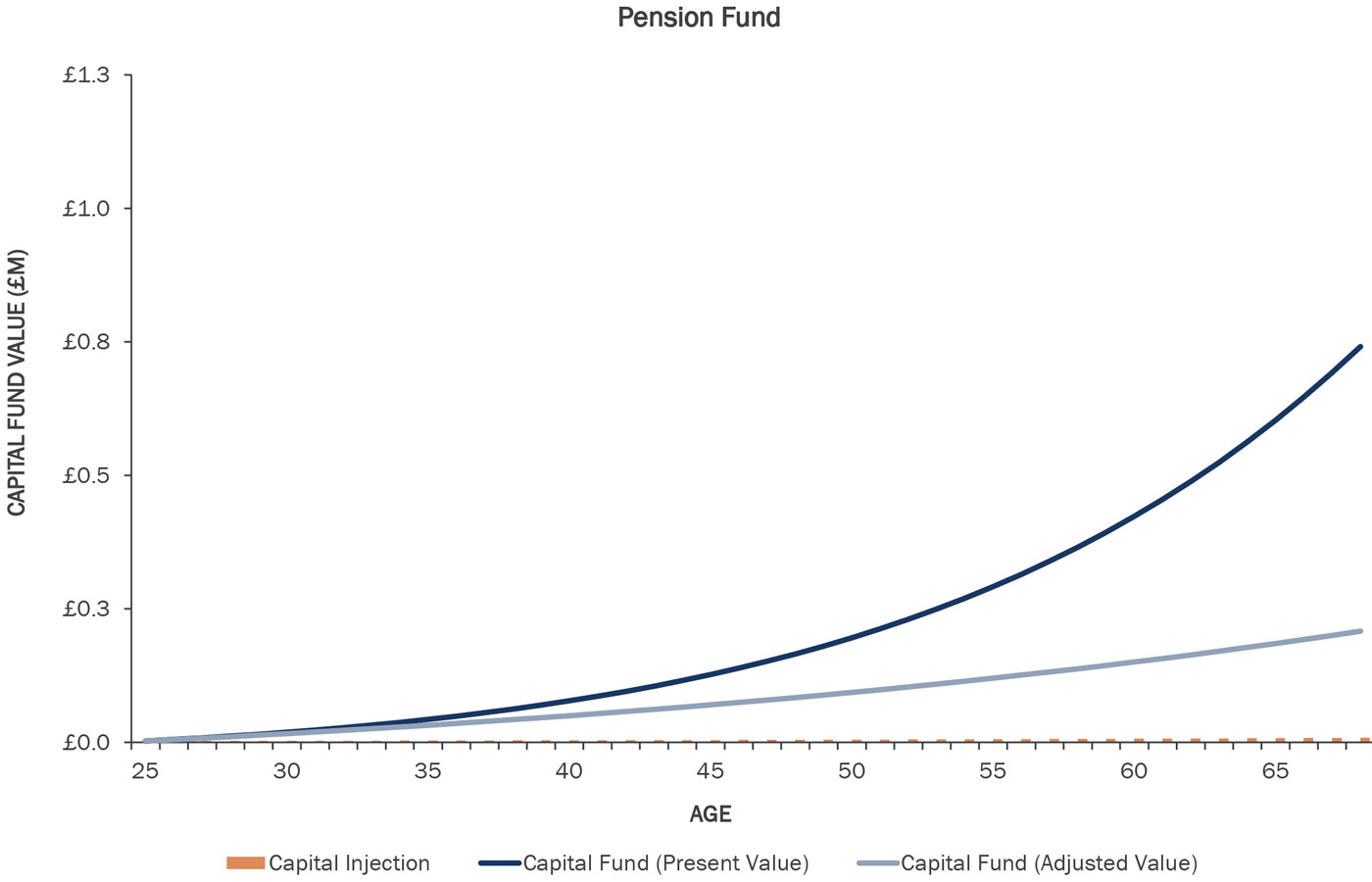

You don't have to be a high earner to enjoy a comfortable retirement, so long as you start investing young. As the graph below shows, a 25 year old contributing £200 each month (including employer contribution) can generate a healthy pension to supplement their state pension. If he/she were to contribute £200pcm until the age of 68, rising in line with inflation at 3%, and if that pension generated returns of 5.75% per annum, they'd have a fund of £741,337 on which to retire.

Are there any recent changes to pension rules I need to be aware of?

In 2015, legislation was introduced that provides people with greater control over how they spend, save or invest their pensions. These reforms included enabling people to access their pension from 55, removing the requirement to buy an annuity to generate a guaranteed income until death, and providing access to income drawdown schemes that were previously only available to wealthier pensioners.

Income drawdown enables people to remain invested in retirement whilst offering them the opportunity to take money from their pension as and when they need it. With annuity rates in freefall since the UK's vote to leave the EU, it could be argued that income drawdown has never been so attractive to retirees. For example, as of 8 July 2016, a 65 year old could only expect a yield of £5,069 per annum from an annuity of £100,000.

Alongside the new freedoms, the 2015 legislation introduced a change in the tax treatment of deceased individuals' pensions. Beneficiaries will now either pay tax at their own income tax level – with the money they receive added to their earnings to calculate this – or, if the person who dies is under 75, there will be no tax to pay. This means that leaving some of your pension to your estate may be a tax-efficient way to plan your legacy.

Our top tips for pension planning

- Start early – average life expectancy in the UK is getting higher, making retirements longer, so we need more money for later life

- Take responsibility for your own financial future – final salary pension schemes are far less common than they were so the burden is falling on ourselves and not our employers

- Save what you can – a little regular saving now goes a long way in the future

- Regularly check that your plans are still on track – if your circumstances change you may need to adjust your retirement options

- Seek advice when you need it – financial planning can be complicated, especially further down the line when you may have multiple pension pots or more complex requirements. Free pensions advice is available from the Pensions Advisory Service, or a financial planner can look at your individual situation to ensure all your investments are working in line with your long-term needs.

If you'd like to talk about your future with a Canaccord Genuity Wealth Management specialist in pensions and retirement planning, just call us on +44 20 7523 4554 or email wealthmanager@canaccord.com.

[[{"type":"media","view_mode":"content_original","fid":"100542","attributes":{"class":"media-image"}}]]

Disclaimer

It is important to remember that investment means that your capital is at risk and the value of investments can fall, therefore you may get back less than you invested, and that past performance is no guide to future performance.

Independent advice

To help ensure that you benefit from objective and comprehensive advice, the Canaccord Genuity group has structured our Wealth Planning Service as an independent service offering. Our independence enables us to work with you in a clear and transparent partnership. Your wealth adviser is not tied to any particular product or provider. Instead, he or she can consider all available options and recommend the ones that best meet your individual needs.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Local elections 2026: where are they and who is expected to win?

Local elections 2026: where are they and who is expected to win?The Explainer Labour is braced for heavy losses and U-turn on postponing some council elections hasn’t helped the party’s prospects

-

6 of the world’s most accessible destinations

6 of the world’s most accessible destinationsThe Week Recommends Experience all of Berlin, Singapore and Sydney

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

Six ways to boost your finances in 2026

Six ways to boost your finances in 2026The Explainer It’s not too late to make a new year’s resolution to finally get organised money-wise

-

The financial impact of returning to work in later life – should you 'unretire'?

The financial impact of returning to work in later life – should you 'unretire'?The Explainer Many people return to the workplace after retirement age, but what could it mean for your finances?

-

State pension underpayments: are you getting the right amount?

State pension underpayments: are you getting the right amount?feature Hundreds of thousands of women may have received less than they were owed

-

Early retirement: what is the ‘FIRE’ movement?

Early retirement: what is the ‘FIRE’ movement?feature Younger workers are aiming to quit the workforce early through extreme saving and investment

-

How women can bridge the gender pension gap

How women can bridge the gender pension gapIn Depth New figures have shown the extent of the problem for women in retirement years

-

How to plug the pension gap by buying National Insurance credits

How to plug the pension gap by buying National Insurance creditsfeature A temporary change in the state pension offers a ‘golden opportunity’

-

Are UK pensions safe?

Are UK pensions safe?Today's Big Question Bank of England governor says its debt market support must end – but the multi-billion-pound scheme could be extended

-

Pensions: time to end the triple lock?

Pensions: time to end the triple lock?In the Spotlight Ministers must decide whether to risk alienating older voters by ending guaranteed pension rises