School fees planning: Education – but at what cost?

The path is a familiar one. You leave university, embark on a career, meet 'the one', settle down, buy a property – and before long you have started a family.

At this point, your priorities change. It's time to focus on what is potentially the most important decision in your child's life – which school they will attend. Naturally you wish to give them the best possible start and the greatest opportunities.

But does that mean a private education? If so, is it to be a day school or will they board?

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

[[{"type":"media","view_mode":"content_original","fid":"102083","attributes":{"class":"media-image"}}]]

The cost of a priceless education

Private school fees have risen at an alarming rate in recent years. Since 1990, overall fees have increased by more than 300% while wages have risen by just 76% over the same period (Source: Killik & Co). So what can you do to ensure that you are in a position to provide for your children's education?

If you are in the service of a good Financial Planner, you will have already started to address the funding issue. Some of the key planning considerations to address:

- For the selected school, what are the fees?

- What rate of inflation should be assumed? School fees inflation, has on average been 4.5% per annum over the last 10 years, and has outstripped the Consumer Price Index (CPI) (2.3% over the same period).

- Which funding option is suitable for you?

- Are there tax efficiencies available to you?

The importance of early funding

The Independent Schools Council Census in 2012 concluded that the average annual fees for private schooling are £10,539 for junior school, £12,408 for senior school and £13,053 for sixth form. But the price of private education can be significantly higher, with many of the most sought-after schools costing as much as three times the average rate per annum. For example, Eton, Winchester and Harrow start at £37,500 for the 2016/17 school year.

Current consensus dictates that it will cost in excess of £500,000 in total to privately educate your child from the age of four to end of university. For many of us, this is an eye-watering figure. However, if you start planning early, private education is achievable.

Funding options available

- Maximise your tax-efficient savings. Were you to commit to funding your ISA with £1,666 per month from 6 April 2017 for 10 years, and assuming an annualised growth of 6%, you would generate a pot of c.£270,000 from which to fund your child's education. This would represent approximately 50% of the cost of one child's total education.

- Invest a lump sum for a 5-10 year timeframe. For example, in a designated children's school fees account, or set aside a nominal amount within your overall financial plan. Maybe ask a grandparent to assist – a useful IHT strategy perhaps? To put this into perspective, a £50,000 lump sum that grows at a rate of 6% per annum over 10 years could produce c.£90,000. Portfolio returns have exceeded those of cash over the last three and five years, but this option does not come without risk, and returns will vary depending upon your personal risk profile.

- Pre-pay the school fees. If you have significant savings in place, this may be the most prudent way of paying fees as you will 'lock-in' the cost for years to come. When compared with the current low rate of interest available on holding cash in a bank account, this is a favourable option. However, your money could be at risk in the unlikely event that the school goes bust. Furthermore, a well-structured investment portfolio is likely to outperform over the medium term.

- 'Pay as you go'. This is the easiest option to understand and arguably requires the least planning – you simply pay the school fees, from income, as they arise. The only major risk is that your earnings continue to be sufficient to cover the cost of fees.

Whichever funding option you choose, thought and planning is essential, ideally well in advance of the actual expenditure. So an early conversation with a Financial Planner could prove invaluable in the long run, and may also be beneficial in other matters such as pension planning and consolidation or identifying and filling a simple shortfall in your and your family's protection needs.

In short, if you are considering private schooling, book an appointment with a Financial Planner today – it may well help you to help your children's future. And the sooner it's addressed, potentially the greater choice you will have in your children's schooling.

To discuss further, please contact David Goodfellow on +44 20 7523 4738 or email wealthmanager@canaccord.com.

Important information

Investment involves risk and the value of investments and the income from them can go down as well as up. Past performance is no guide to future performance. Unless otherwise stated, the views expressed here are those of Canaccord Genuity Wealth Management. Nothing on these pages should be regarded as advice. It has no regard for the requirements of any particular person.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for March 2

Political cartoons for March 2Cartoons Monday’s political cartoons include total obliteration, partial exoneration, and more

-

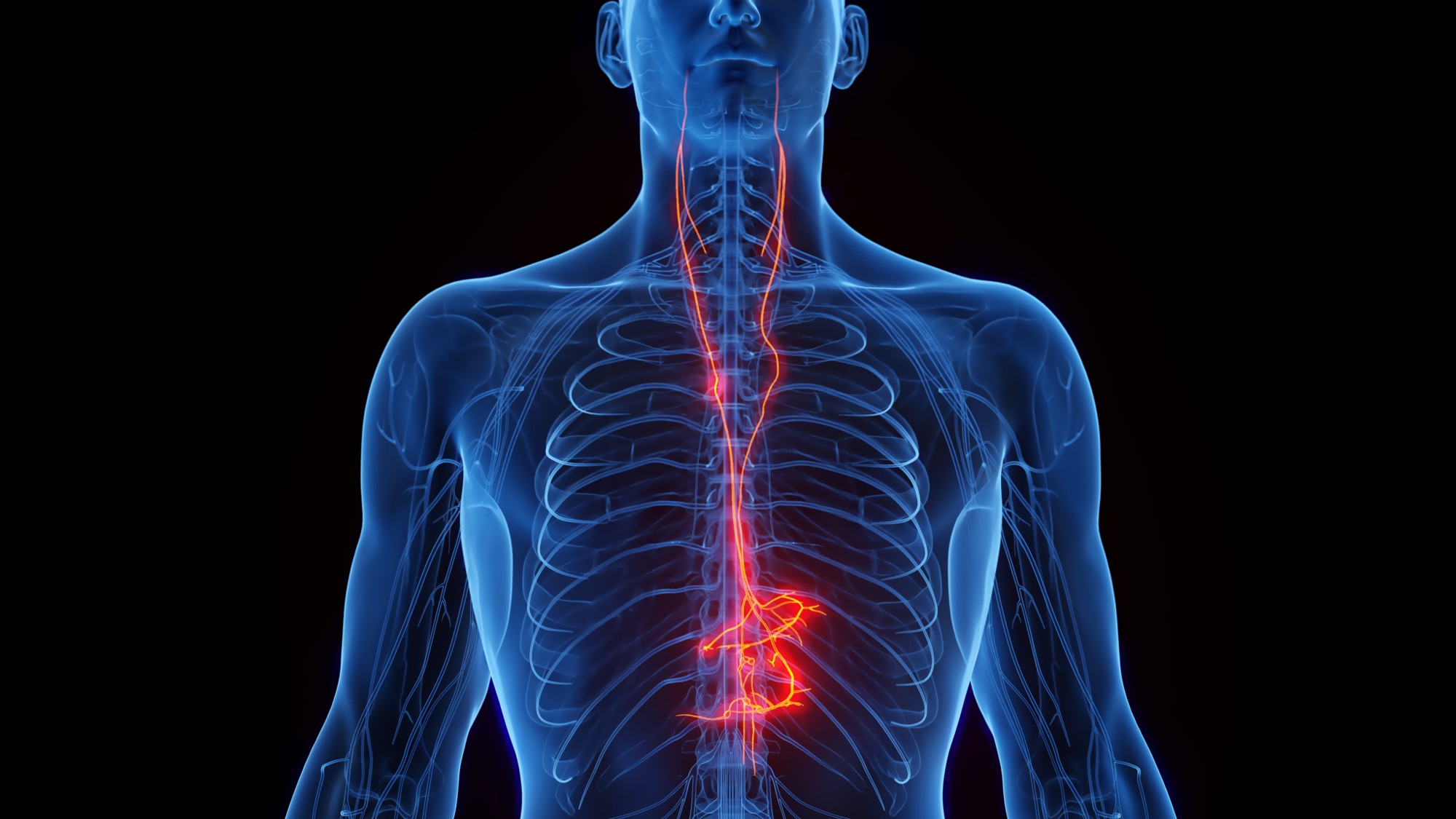

How the vagus nerve affects your health

How the vagus nerve affects your healthThe Explainer Could our ‘internal communication superhighway’ hold the key to mental and physical wellbeing?

-

How long will the Middle East attacks last?

How long will the Middle East attacks last?Today’s Big Question Following the death of Ayatollah Ali Khamenei, and strikes on Cyprus, Lebanon and Qatar, the US is risking a ‘long-lasting’ and ‘open-ended’ conflict