Ageing – a 21st-century threat

Perhaps the most important question you can ask yourself today is 'how prepared financially am I for the future?'

It is well documented that a worrying majority of working-age people in the UK have vastly inadequate provision in place for their retirement – a situation that can only worsen as we continue to live longer.

The 2013 House of Lords Committee Report by the Public Service and Demographic Change Committee argued that "Government and our society are woefully underprepared" for ageing. They pointed out that while longer lives are a success story, the failure to address ageing could result in "a series of miserable crises". It's a growing issue that we all need to consider going forward.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Right now, there are more over 60s than under 18s. And in the next 30 years, the population aged over 75 in the UK is expected to double. It means in the next 20 years or so, 1 in 12 people will be over 80 and nearly 1 in 4 will be over 65. Essentially, an ever smaller working-age population will need to support older generations in terms of health, social care and pensions.

If you add the recent global debt crisis and historically low investment yields to our vastly improved life expectancy - one of the greatest triumphs of the last century - this combination of factors looks set to be one of the greatest challenges we will face this century.

Chasing yields in golden years

It is the burgeoning ranks of longer-living retirees who most require stable, quality investment yields. Yet these have become scarce as we continue to work through the unconventional policy measures that central banks have rolled out to combat the continuing aftershocks of the global financial crisis.

Ultra-low interest rates and extraordinary monetary stimulus have driven investors further up the risk spectrum in the hunt for income; government bond yields are now at historic lows – many with negative yields; and UK interest rates continue to return virtually nothing to savers making saving for longer retirements and future generations even more problematic.

And it’s not a problem that’s going away any time soon. After years of bingeing on debt to boost economic growth, the world is now trying to rebalance its revenues against its outgoings – and it is highly likely that growth in years to come will continue to be lower.

But it isn’t just an ageing world and historically low yields that threaten our future economic sustainability. Individuals’ savings levels are simply too low – despite the success of auto-enrolment pensions. Unless we put more by for old age, future generations of retirees will find themselves poorer than today’s pensioners – and, unlike today’s pensioners, they won’t necessarily have the option to sell down their capital to fund their retirement.

Time to grow up

As individuals there's not a lot we can do to solve the world’s economic problems, but there is more we can do to become more financially savvy and take responsibility for our own sustainable economic futures. While most of us know what a mortgage is, too few of us know what an annuity is. Quite simply, we need to better equip people to build their savings, invest their savings then spend their savings.

In 2013, The Alliance, a coalition of eight organisations came together to ensure our society is ready for ageing. Perhaps we should find a way of getting every 45 year old to at least look at the 11-point prescription for successful ageing:

There's no denying it. Our ageing society poses a threat to economic growth, societal prosperity and even our future welfare state. And neither individuals, companies nor governments are preparing adequately for the slow but inevitable change we are witnessing. At least we, as individuals, can do something towards taking responsibility for our own futures even if it’s starting with the simple steps above.

Find out more

Thankfully, with careful planning and prioritising, you can help ensure your long-term needs are met – and look forward to a more secure and comfortable later life.

If you’d like to talk about your future with a Canaccord Genuity Wealth Management specialist, just call us on +44 20 7523 4738 or email wealthmanager@canaccord.com.

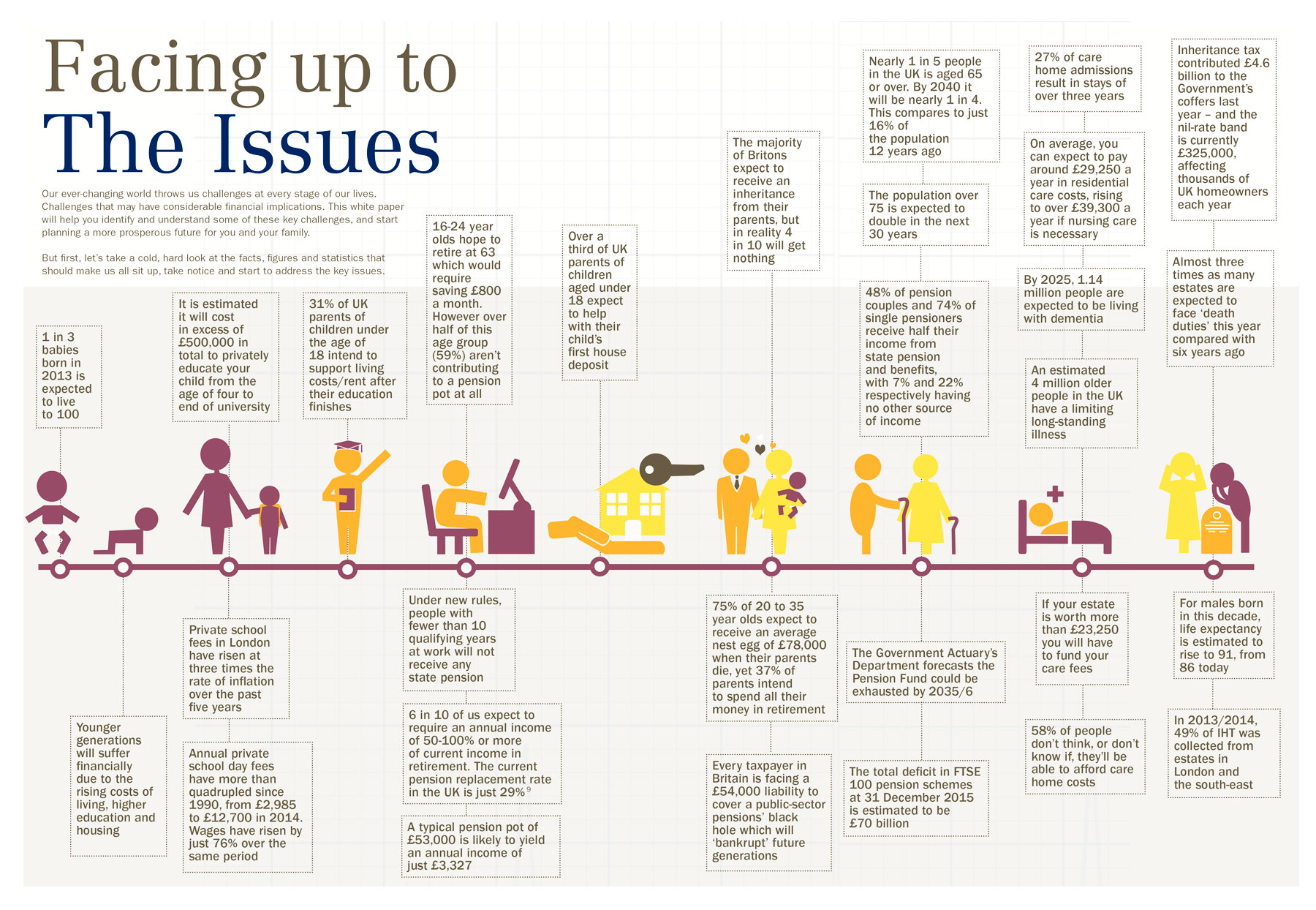

Facing up to the issues (click to expand)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

-

Political cartoons for March 1

Political cartoons for March 1Cartoons Sunday’s political cartoons include the new normal, the sign of times, and more

-

Death in Lyon: the growing violence in French politics

Death in Lyon: the growing violence in French politicsTalking Point The death of Quentin Deranque has revealed the violence within the anti-fascist movement, and shown how the Right are ‘shamefully exploiting’ this tragedy

-

The row over student loans: is the system unfair?

The row over student loans: is the system unfair?The Explainer Millions of graduates have been left with hefty student loans, at high interest rates

-

What are the best investments for beginners?

What are the best investments for beginners?The Explainer Stocks and ETFs and bonds, oh my

-

Received a windfall? Here is what to do next.

Received a windfall? Here is what to do next.The Explainer Avoid falling prey to ‘Sudden Wealth Syndrome’

-

How to invest in the artificial intelligence boom

How to invest in the artificial intelligence boomThe Explainer Artificial intelligence is the biggest trend in technology, but there are fears that companies are overvalued

-

What’s the difference between a bull market and bear market?

What’s the difference between a bull market and bear market?The Explainer How to tell if the market is soaring or slumping.

-

Is it a good investment to buy a house?

Is it a good investment to buy a house?The Explainer Less young people are buying homes, opting to rent and invest in the stock market instead

-

What is day trading and how risky is it?

What is day trading and how risky is it?the explainer It may be exciting, but the odds are long and the risks high

-

What to know about investing in ETFs

What to know about investing in ETFsThe Explainer Exchange-traded funds can be a great choice for beginners

-

Retail investors drive a flurry of IPOs

Retail investors drive a flurry of IPOsFeature After years of slowness, companies like Klarna and Gemini are reviving the IPO market