France's economic woes won't end anytime soon

The French government has fallen apart for the third time in two years

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The French government collapsed yesterday when all of President Francois Hollande's ministers resigned over what The Economist called "bitter internal disagreements over economic policy." Precipitated by public comments economic minister Arnaud Montebourg made about the failure of Hollande's fiscal austerity policies, the resignations were a stunning setback for the government.

Sadly, they will ultimately be futile.

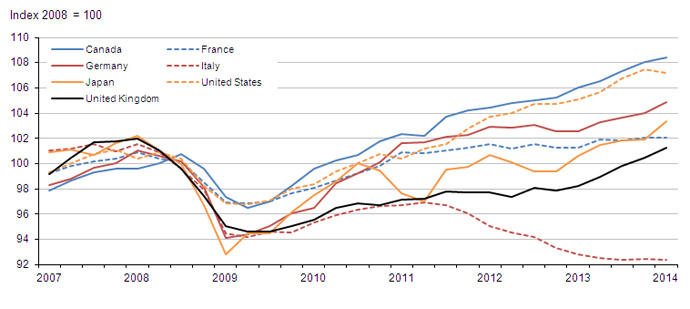

Like his predecessor Nicolas Sarkozy, Hollande has spent much of his presidency dealing with the aftershocks of the 2008 financial crisis. After initially bouncing back in 2009 and 2010, France's economy — like the eurozone as a whole — has severely stagnated:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Growth this quarter was zero, and growth last quarter was zero.

Adding to the challenge, unemployment in France has actually been rising this year, unlike in other developed economies, including the United States and Britain, where unemployment has been gradually falling since the financial crisis. Industrial production is also falling. In other words, France is teetering on the brink of another recession.

Faced with this crisis, Hollande's government has stuck to the default response for eurozone countries, enacting a mixture of spending cuts and tax hikes to raise revenue and decrease the budget deficit. The theory is that these austerity measures build confidence among investors and businesses, making them more willing to invest in the economy. But investment has never materialized nor has growth reignited.

The problem is, the advocates of austerity are fighting the wrong battle. If France's slump was caused by investors' worries about high budget deficits, then all of the austerity and promises for future austerity should have solved the problem. Instead, austerity is actually harming the country's economy.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

When a government cuts spending, it reduces people's incomes. And people who see their incomes fall are going to be under pressure to cut back on their own spending. That means that government contraction becomes contractionary for the entire economy. And that's exactly what has happened in France.

As an outside observer, it's simply amazing — beyond belief even — that France has continued to persist with measures that are clearly and consistently failing. As Montebourg said in his speech to supporters that helped precipitate the government's political crisis: "Promising to get the economy going again, on the path to growth and full employment, hasn't worked. Honesty obliges us to acknowledge this."

That honesty sadly cost Montebourg a job — and it looks to have done little good. Moving to a different approach seems to be off the menu for the French government.

As Business Insider's Rob Wile points out: "By accepting his own cabinet's resignation, Hollande — who recently bolstered his austerian credentials by restating the pro-austerity doctrine of Say's Law — is signaling that he will remain committed to his announced budget cuts."

In fairness to Hollande, by accepting membership of a common currency, France long ago gave up a lot of political sovereignty. Unlike Britain and the United States — who control their own currency — the French government runs the risk of running out of money, so it can't so easily go to the bond markets to get extra cash to invest and boost the economy. That puts France at the mercy of German conservatives, who are terrified of inflation, have long championed austerity, and have no intention of changing their minds.

So the collapse of the French government is just a lot of sound and fury, signifying nothing. The burden of lifting European growth falls to the European Central Bank, which, unlike America's Federal Reserve, has no mandate to do anything about unemployment. The ECB could in theory reduce interest rates further, and start enacting quantitative easing to stimulate the economy. But current ECB president Mario Draghi — who is also constrained by the diktats of inflationphobic German conservatives — remains in denial. In spite of the low-growth, low-inflation, high-unemployment environment Draghi believes the European recovery remains "on track."

This isn't getting any better any time soon.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

Political cartoons for February 20

Political cartoons for February 20Cartoons Friday’s political cartoons include just the ice, winter games, and more

-

Sepsis ‘breakthrough’: the world’s first targeted treatment?

Sepsis ‘breakthrough’: the world’s first targeted treatment?The Explainer New drug could reverse effects of sepsis, rather than trying to treat infection with antibiotics

-

James Van Der Beek obituary: fresh-faced Dawson’s Creek star

James Van Der Beek obituary: fresh-faced Dawson’s Creek starIn The Spotlight Van Der Beek fronted one of the most successful teen dramas of the 90s – but his Dawson fame proved a double-edged sword