Is inflation really picking up?

The signals are mixed, but probably not

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

With the U.S. recovery strengthening — unemployment is now down to just 6.1 percent from its peak of 9.9 percent in 2009 — some are saying that the Fed should change course and raise interest rates. Unless the Fed ends not only its program of quantitative easing, they argue, but also its regime of ultra-low interest rates that has been in place since the financial crisis, the economy is in serious danger of overheating.

What signal is the Fed waiting for? While traders have their eye on the rising stock market — many argue that stocks are in a bubble — the Fed is watching for inflation.

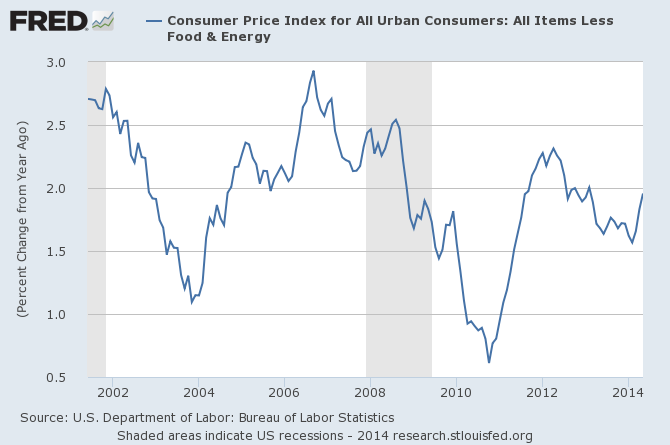

The Fed uses core consumer prices as a measure of inflation, because it excludes highly-variable price changes in food and fuel. While this doesn't ignore changes to the price of food and fuel, it only includes them if they have a broader effect on other prices.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Last month, there were some preliminary signs that inflation may be picking up. Core inflation ticked up significantly last month, rising from 1.3 to 1.9 percent, just 0.1 percent below the Fed's target level of 2 percent. And this month, instead of rising any further, it stayed at that 1.9 percent:

(Federal Reserve Bank of St. Louis)

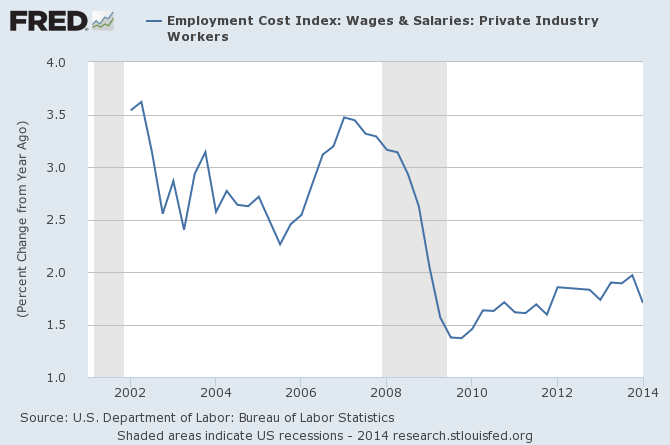

On the other hand, the other measure of inflation that the Fed is using — growth in wages — is still below that 2 percent level, and actually fell last month:

(Federal Reserve Bank of St. Louis)

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

So which will win out?

Well, ever since 2009 when the Fed dropped interest rates to unprecedented lows and began printing money to buy assets, a whole pantheon of predominantly conservative financial commentators have warned of soaring inflation, or even hyperinflation. But that hasn't happened: inflation didn't spike, and the dollar remains stable, too, even with all the Fed's money printing. And the so-called alternative inflation indexes, which claim that inflation is much higher than the government says, have been totally debunked.

Inflation seems to have stayed low because the Fed's money printing simply made up for the deflation and shrinkage in the money supply that occurred during the financial crisis.

The financial crisis of 2008 was a very deflationary event where prices of financial assets drastically fell and large quantities of financial assets were destroyed by default. This deflation seeped into the wider economy, manifesting in consumer price deflation. And the recovery has very much taken place in the shadow of that deflation with weak wage growth and relatively weak inflation.

The real danger was not that inflation would explode, but that the economy would fall into a multi-decade deflationary pit, like Japan did in the 1990s after its housing and stock market bubbles burst. Consumer prices in Japan were still in deflation as late as last year. That is because years of a weak economy and deflation changed people's expectations. Japanese people started to expect very low inflation and even deflation, creating the incentive to sit on cash — as Japanese firms and households have done — and wait for prices to fall or the economy to pick up, sucking demand out of the economy. This can make deflation a self-fulfilling prophesy.

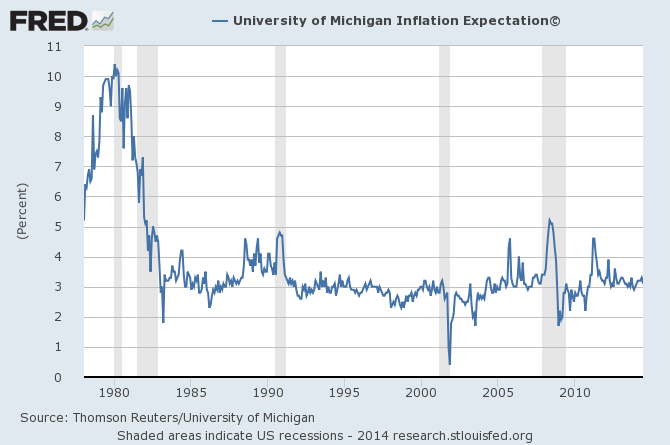

But the key difference in the Japanese and American experiences is that the U.S. never went all the way down this path. Yes, lots of American investors and businesses are sitting on big piles of cash, fearing the shape of the economy and the relatively slow (but now strengthening) recovery. But inflation expectations in the U.S. have remained strongly positive, above 3 percent:

(Federal Reserve Bank of St. Louis)

That alone strongly suggests that rising inflation is possible. (Still, the psychological incentives to sit on cash and wait for prices to fall are nowhere near as strong as in Japan.)

But I wouldn't expect that inflation to manifest this year. The economy is still too weak. 6.1 percent unemployment is better than 7 or 9 percent, but it's hardly a boom. There is still a great deal of slack in the economy. There are seven million people working part-time that want a full-time job. The worker quit rate is still far below its pre-recession level. Millions remain unemployed long-term. Capacity utilization is still below its pre-recession level.

The recovery, in other words, still has a long way to go before inflation becomes a problem.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.