Is the economy really twice as large as we thought?

GDP isn't perfect — but it's probably the best measure we have

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Since the mid-20th century, economists, governments, businesses, and just about everyone else has used gross domestic product (GDP) to measure the size of the economy. But is it the best metric for the job? Some economists are saying no.

GDP is a measure of the level of spending on finished goods in the economy. It is a measure of final production. If a pencil sells for 50 cents, it increases GDP by 50 cents. But a good deal more spending tends to occur in the process of making a pencil. At the very least, the manufacturer has to acquire resources to make the pencil — someone must harvest the wood, someone must harvest the rubber, someone must mine the graphite. Under GDP, that spending is not directly included. It is only counted implicitly when the finished pencil is produced and purchased by a consumer or business.

Some economists, such as Chapman University’s Mark Skousen, argue that the intermediate stages of production lower down the production chain should also be included in measurements of output. While they recognize that including them again explicitly can mean double counting or triple counting, they argue that there are "several reasons why double counting should not be ignored and is actually a necessary feature to understanding the overall economy." After all, lots of businesses deal solely in intermediate goods. Intermediate producers buy partial products, add a "bell and a whistle," and pass them on. At Forbes, Skousen argues that "no company can operate or expand on the basis of value added or profits only. They must raise the capital necessary to cover the gross expenses of the company — wages and salaries, rents, interest, capital tools and equipment, supplies, and goods-in-process." To Skousen that means that a measurement of output should take all this spending into account.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

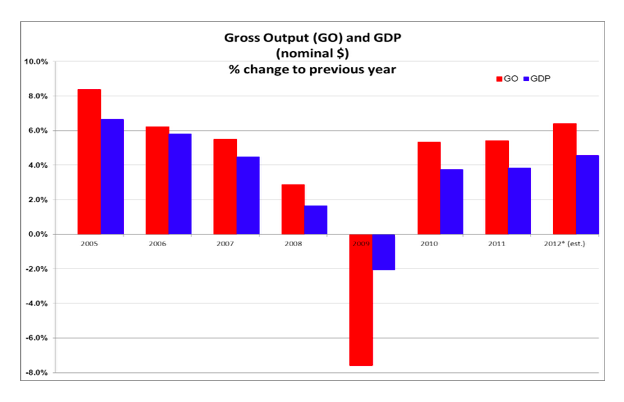

Perhaps taking heed of some of these arguments, the Bureau of Economic Analysis starting on April 25 will release each quarter a measure called gross output that includes total sales from the production of raw materials through intermediate producers to final wholesale and retail trade. The concept of gross output has been around since at least the 1930s. It was developed by the economist Wassily Leontieff, but he focused on individual industries, rather than the total output across the economy. Measured at more than $30 trillion at the end of 2013, it's almost double the size of GDP, and considerably more volatile. It fell far more than GDP during the crisis year of 2009, but has risen more strongly since, suggesting that the recovery may be stronger than it looks. In his article at Forbes, Mark Skousen has a really illustrative graph:

Skousen's advocacy for gross output as a measure is based on his view that GDP minimizes the importance of business investment and overplays the importance of consumer and government spending as a proportion of economic activity. He argues that "[g]ross output will correct the fallacy fostered by GDP that consumer spending drives the economy":

Although consumer spending accounts for about 70 percent of GDP, if you use gross output as a broader measure of total sales or spending, it represents less than 40 percent of the economy. The reality is that business outlays — adding capital investment and all business spending in intermediate stages of the supply chain — are substantially larger than consumer spending in the economy. They make up more than 50 percent of economic activity. [Wall Street Journal]

I think he is only partially correct. Gross output gives a wider picture of economic activity across the entire economy, including intermediate industries. But GDP — by avoiding double counting — gives a more exact measurement of total output, or in other words the total level of demand in the economy. While business outlays make up a higher percentage of gross output than of GDP, those additional business outlays are a means to the end of saleable finished products, not an end in themselves. Lots of businesses make a living selling intermediate goods, but without a final consumer, the rest of the supply chain is dead in the water. The customer, as they say, is king.

That doesn't mean GDP is perfect. It leaves out lots of important factors, including unpaid home work and illegal activities, because they are difficult to measure. It doesn't measure well-being or technological progress, and it ignores depletion of natural resources.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But gross output is not a new and better paradigm. It is an interesting addition, for sure. But ultimately it is very much a secondary figure to headline GDP.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

How the FCC’s ‘equal time’ rule works

How the FCC’s ‘equal time’ rule worksIn the Spotlight The law is at the heart of the Colbert-CBS conflict

-

What is the endgame in the DHS shutdown?

What is the endgame in the DHS shutdown?Today’s Big Question Democrats want to rein in ICE’s immigration crackdown

-

‘Poor time management isn’t just an inconvenience’

‘Poor time management isn’t just an inconvenience’Instant Opinion Opinion, comment and editorials of the day