No, this chart does not portend a financial apocalypse

Learning from the past is smart. But these supposed historical parallels are just dumb.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

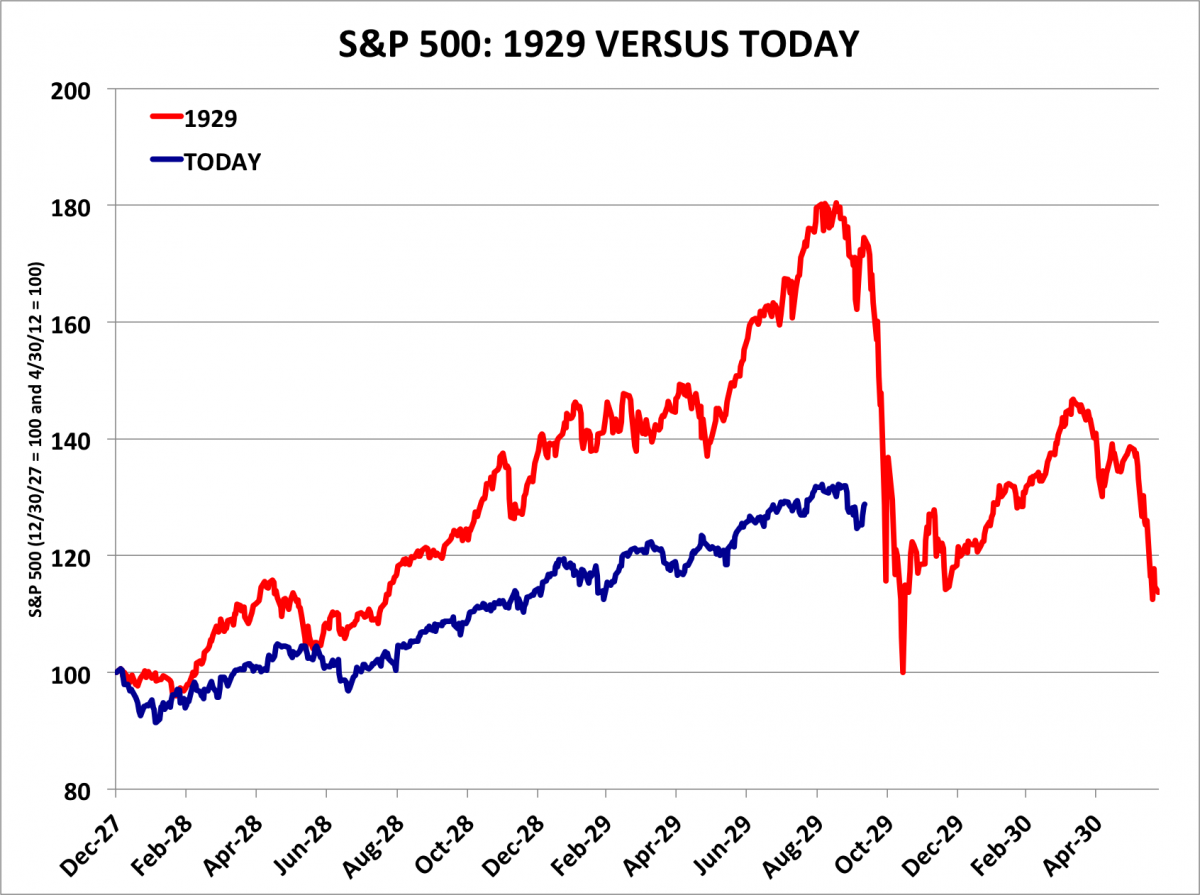

For the last three months, a scary-looking chart has been making the rounds on Wall Street. Its thesis? That the stock market in 2014 is shaping up like that of 1929, the year of a catastrophic crash:

Yet as Matthew Boesler and Andy Kiersz of Business Insider argue, when the markets are expressed in percentage terms, this apparent pattern completely falls apart:

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

[Business Insider]

This demonstrates an important principle. A the late economist Ronald Coase argued, if you torture the data for long enough, eventually you can make it confess.

And what would this correlation really tell us, even if it held up in percentage terms? That the stock market rose in the lead-up to 1929, and in the lead-up to 2014. But it wouldn't tell us anything about why the stock market crashed in 1929 that we could possibly apply to 2014.

Markets are large groups of people interacting, all with different and changing priorities, different ideas about how the world works, and ever-changing moods and sentiments. This process is fundamentally chaotic and unpredictable. Nobody actually knows when or where the next financial crash will arrive. It is possible to make a coherent argument that it will arrive sooner rather than later based on a number of factors — an over-exuberant technology sector, fear over the tapering of the Federal Reserve’s quantitative easing program, currency turmoil in emerging markets, and rising levels of leverage on Wall Street, among other things.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

But only time will tell whether such arguments are correct or not. A fudged correlation between the stock market in 1929 and 2014 adds nothing at all to the conversation.

John Aziz is the economics and business correspondent at TheWeek.com. He is also an associate editor at Pieria.co.uk. Previously his work has appeared on Business Insider, Zero Hedge, and Noahpinion.

-

5 thoroughly redacted cartoons about Pam Bondi protecting predators

5 thoroughly redacted cartoons about Pam Bondi protecting predatorsCartoons Artists take on the real victim, types of protection, and more

-

Palestine Action and the trouble with defining terrorism

Palestine Action and the trouble with defining terrorismIn the Spotlight The issues with proscribing the group ‘became apparent as soon as the police began putting it into practice’

-

Why is the Trump administration talking about ‘Western civilization’?

Why is the Trump administration talking about ‘Western civilization’?Talking Points Rubio says Europe, US bonded by religion and ancestry