The news at a glance

Apple and Yahoo post weak results; A&F splits chairman and CEO roles; U.S. eases disclosure rules for Internet firms; American earnings beat expectations; Feds bust Bitcoin exchange CEO

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

Tech: Apple and Yahoo post weak results

Apple missed its mark, said Daisuke Wakabayashi in The Wall Street Journal. The computer giant underwhelmed investors this week with its most recent quarterly earnings, which “fell short of analysts’ expectations” thanks to slipping iPhone sales. Overall, the company said it sold 51 million iPhones in the three months to Dec. 28, up 7 percent from the same period a year ago but 4 million shy of Wall Street’s predictions. Increased competition ate into Apple’s share of the smartphone market, which fell to 17.6 percent in the fourth quarter of 2013 from 22 percent a year earlier. The company’s stock price fell sharply on the news.

Yahoo joined Apple in the ranks of tech firms disappointing Wall Street this week, said Vindu Goel in The New York Times. Despite gaining traffic and rolling out new products in 2013, the company “is still falling further and further behind in the race for Internet advertising.” In its fourth-quarter earnings report, the company said revenue and operating profits declined during the tail end of 2013 “and would continue dropping in the first quarter of this year.” Yahoo’s fourth-quarter revenue dipped 6 percent, from $1.35 billion in the fourth quarter of 2012 to $1.27 billion last quarter.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Retail: A&F splits chairman and CEO roles

Teen-clothing retailer Abercrombie & Fitch is shaking things up, said Lindsey Rupp in Bloomberg.com. The company stripped CEO Mike Jeffries of his title as chairman this week, apparently yielding to pressure from activist investor Engaged Capital LLC, which owns less than 1 percent of A&F’s shares but has been a vocal critic of Jeffries. The company’s sales have declined for three straight quarters, and “Jeffries has been struggling to reconnect with the chain’s customers, who have become less enamored of its fashions and half-naked models.”

Data: U.S. eases disclosure rules for Internet firms

The Justice Department said it will allow tech companies “to publicize—in broad terms—how much customer information they must turn over to the government,” said Craig Timberg and Adam Goldman in The Washington Post. The new policy “amounts to a modest victory” for companies like Facebook, Google, LinkedIn, Microsoft, and Yahoo, which had been prohibited from disclosing “their obligations under government surveillance programs.” The companies will be allowed to report, to the nearest thousand, how many national security letters and Foreign Intelligence Surveillance Court orders they receive.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Airlines: American earnings beat expectations

American Airlines is soaring to profitability, said Karen Jacobs in Reuters.com. Now the world’s largest carrier since its merger with US Airways last year, American reported better-than-expected profits and revenues for the fourth quarter this week, thanks largely to rising fares and falling fuel costs. Excluding a $2.4 billion charge tied to its emergence from bankruptcy last year, the merged airline’s combined profit hit $436 million, compared with a loss of $42 million a year earlier.

Crime: Feds bust Bitcoin exchange CEO

The “founder of a prominent Bitcoin exchange company” is behind bars, said Gerry Smith in HuffingtonPost.com. Federal prosecutors in New York City last week arrested Charlie Shrem, the 24-year-old chief executive of BitInstant, on money laundering and related charges. BitInstant’s investors include Tyler and Cameron Winklevoss, “who are famous for claiming that Mark Zuckerberg stole their idea for Facebook.” Shrem is accused of scheming to sell more than $1 million in Bitcoins to customers on Silk Road, the defunct, Bitcoin-powered drug website that federal officials shut down in October.

-

The broken water companies failing England and Wales

The broken water companies failing England and WalesExplainer With rising bills, deteriorating river health and a lack of investment, regulators face an uphill battle to stabilise the industry

-

A thrilling foodie city in northern Japan

A thrilling foodie city in northern JapanThe Week Recommends The food scene here is ‘unspoilt’ and ‘fun’

-

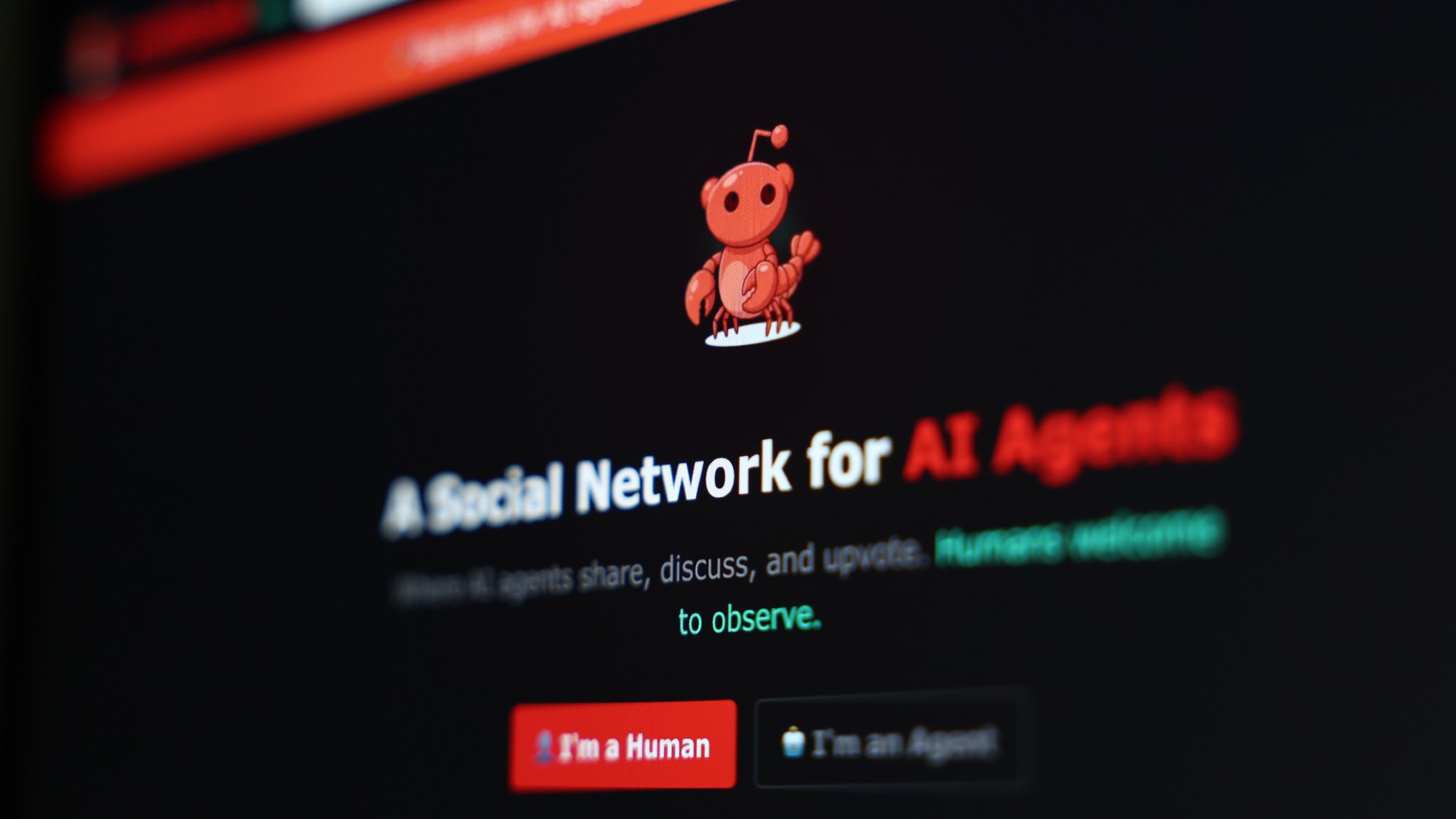

Are AI bots conspiring against us?

Are AI bots conspiring against us?Talking Point Moltbook, the AI social network where humans are banned, may be the tip of the iceberg

-

The news at a glance...International

feature International

-

The bottom line

feature Youthful startup founders; High salaries for anesthesiologists; The myth of too much homework; More mothers stay a home; Audiences are down, but box office revenue rises

-

The week at a glance...Americas

feature Americas

-

The news at a glance...United States

feature United States

-

The news at a glance

feature Comcast defends planned TWC merger; Toyota recalls 6.39 million vehicles; Takeda faces $6 billion in damages; American updates loyalty program; Regulators hike leverage ratio

-

The bottom line

feature The rising cost of graduate degrees; NSA surveillance affects tech profits; A glass ceiling for female chefs?; Bonding to a brand name; Generous Wall Street bonuses

-

The news at a glance

feature GM chief faces Congress; FBI targets high-frequency trading; Yellen confirms continued low rates; BofA settles mortgage claims for $9.3B; Apple and Samsung duke it out

-

The week at a glance...International

feature International