The all-cash diet: How I turned my finances around

Three real people discovered paper beats plastic

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

At the start of every New Year, we all hear about friends and colleagues who've decided to go on one diet or another in an attempt to atone for too much indulging during the holidays.

But while most of them are eliminating carbs or swapping juicing recipes, others may be trying out a regimen designed to give their bank accounts a boost: The all-cash diet.

Instead of counting calories, this diet requires setting aside your credit cards and only relying on old-fashioned cash to cover day-to-day expenses. By limiting your spending to just what's in your wallet, goes the theory, you'll be more likely to stick to a budget — and less likely to make impulse purchases with plastic. In other words, you'll buy only what you need and less of what you simply want.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

And it can be a winning strategy.

According to the Federal Reserve, the average American household owes more than $15,000 in credit card debt. But people who have switched to all-cash lifestyles for a time say that forcing themselves to live only on what's in their wallets increases their ability to pay down debt — and live within their means.

Since we're deep into New Year dieting season, LearnVest scoured the country and found three all-cash dieters who were willing to share their stories of how they went from being buried under debt to flush with cash.

"I cash-dieted … and paid down over $100K of debt."

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

In 2005, Adrian Johnson was tired of juggling debt payments that were overwhelming the teacher's life. Between the mortgage on his Arlington, Texas, house, student loans, credit card debt and payments on a motorcycle, Johnson owed about $125,000.

"I decided that enough was enough," says Johnson, 36. "I was working for everyone but Adrian, and getting poorer while all of my creditors were getting richer. I was tired of being broke."

So Johnson made a bold move: He cut up his credit cards and switched to an all-cash lifestyle using the envelope system, made popular by financial motivational speaker Dave Ramsey. The idea is to budget a set amount of cash for monthly expenses and then divvy up the money into various envelopes earmarked for food, gas, clothing and entertainment. Once an envelope is empty, there's no more money for that expense until the next month.

Johnson figured that if he sacrificed a lot for a short amount of time, he could pay off his debts faster. "I used to give myself $10 a week [for discretionary spending] for things like a video rental," he says. "And that was it. But I was content because I knew my goal."

To supplement his teacher's salary, Johnson tutored students after school and on weekends. He also received a student loan repayment grant for becoming a certified teacher, allowing him to kick his debt repayments into high gear.

After two years of sticking to his all-cash diet, Johnson had repaid about $35,000 in credit card and student loan debt. "On my birthday that year, I wrote my last check for my student loans. It felt so good to get the bank off my back."

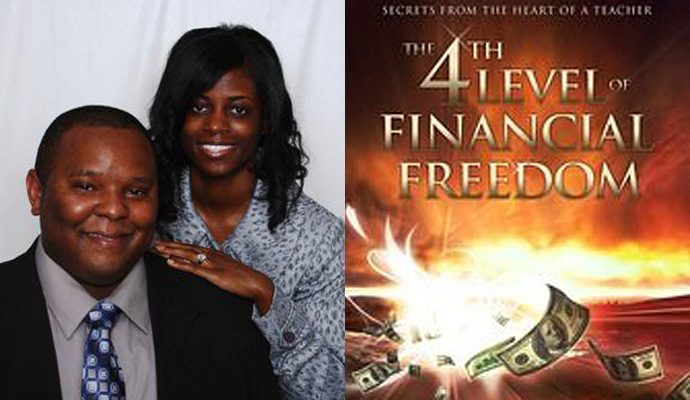

Around this time, he also married his wife, Quaneshala, 35, who didn't need much convincing on the merits of a no-credit lifestyle. "My parents lived paycheck to paycheck," she says. "I knew that wasn't the lifestyle that I wanted to live, so as a child I would save. I never wanted to be in debt or owe anyone anything."

Together, the couple set the lofty financial goal to own their house outright. While still living solely on cash, they began chipping away at their $90,000 mortgage — and paid off the remaining balance just a few weeks after celebrating their two-year anniversary. With that goal accomplished, they were completely debt-free.

News of the Johnsons' financial success story soon spread, and the couple began offering financial workshops to share their tips on credit-free living. In 2009 they launched Financial Counseling from the Heart of a Teacher, a consulting business geared toward counseling other families in debt. They even wrote a book, The 4th Level of Financial Freedom, about the principles behind their all-cash lifestyle, which they both still follow.

For Johnson, giving up credit cards helped to put needed limits on his spending, especially in the areas of his life where he tends to be tempted. "I'm bad about going to the grocery store," he says, adding that he often walks out with bags of impulse purchases. But with cash, "if I go in with $68, I'm going to come out with $68 worth of items."

Ultimately, says Johnson, it comes down to adopting and sticking to positive financial habits. With the all-cash diet, "you eliminate the need to overspend," he says. "So if your problem area is going out too often, then maybe you leave the money at home so you can't spend it. It's about building up good habits."

Ridding himself of debt and relying on cash has also been a boon to Johnson's marriage. "Debt is a top reason for divorce," he says. "Our biggest arguments now are over the thermostat."

"I cash-dieted … and launched a business."

After graduating from college with a degree in computer and information systems in 2003, Kevin Quigley had trouble landing a job in his field. So the St. Louis native dabbled in restaurant management, and lived with his parents for a time to save money, but he often had trouble making ends meet.

As a result, many of his expenses went on credit cards. "I didn't know how to budget that well or how to live under my means," says the 32-year-old Quigley. "Over time, little things rack up, like when you go out with friends and say, 'Oh, I'll buy this round.' "

After going back to school for massage therapy and cosmetology, Quigley found himself continuing to rely on credit cards as his new career got off the ground. "It takes three to five years to build a solid clientele in my industry, so I was always just getting by," he says.

By 2010 he had to take a hard look at his balances: He'd amassed $30,000 in credit card debt and another $28,000 in student loans.

Ready to make a change, he signed up for a debt management program, which consolidated his credit card debt into manageable monthly payments. And with the encouragement of his debt counselor, he went on an all-cash diet.

Opting to pay for everything with cash, says Quigley, finally taught him how to track — and cut back — his spending. "You have to get yourself in the mindset that even if you want premium cable, you need to think about all of the times when you worried about paying the bills," he says. "At one point I eliminated cable TV and just had Internet. You start not missing it as much."

Thanks to his all-cash experiment, Quigley is now down to his last $3,000 in debt payments. To maintain a healthy credit score, he keeps two credit cards open, but he uses them only to buy gas and other small, recurring expenses — and he always pays the bills off at the end of each month. The all-cash diet had another positive affect: Two years ago Quigley was feeling so confident about his financial future that he launched his own massage therapy business in St. Louis.

If you ask Quigley, the key to success with an all-cash lifestyle is to "eliminate things, but don't deprive yourself," he says. "And find creative ways to make more money. Have a garage sale, sell things on eBay — and then stop yourself from spending that extra money. You'll be amazed at how quickly your other debts start to go away."

"I cash-dieted … and won't go back."

Giulia Rozzi's bad credit habits began in college. But it wasn't until the Boston native moved to Los Angeles after graduating from college that her spending hit truly troubling levels.

"Everything went on the credit cards," says Rozzi, who's now in her early thirties. "It was dinner, getting my nails done, going on vacation, plane tickets, even coffees. I would put gas on my credit card, and then use my cash to go out drinking."

In 2004 her parents agreed to pay off her $5,000 in debt — but on the condition that she never get another credit card. Her parents are Italian immigrants, so they are incredibly frugal, Rozzi notes. "They will not go on vacations. And my mom cuts her own hair," she says. "They absolutely did not understand why I had debt. It was so upsetting to them."

So what did Rozzi do not long after her folks paid off her bills? "I got another credit card," she says.

Slowly but surely, the comedian and actress began to accumulate debt again. "I would think, 'But you really deserve that shirt.' And before I knew it, I was up to an amount that I was really upset about — around $18,000," she says. "The most upsetting thing was that I didn't even have a large purchase to show for it."

Three years ago, after getting professional credit advice and negotiating with her credit card companies to create a zero-interest payment plan, Rozzi cut up her cards for good.

"It's really made me conscious of how much is in my bank account," she says of her decision to go cold turkey on credit. "If I want to, say, rent a car, I have to make sure that I have enough in my bank account, so that when they take the $500 deposit, I'm covered."

As a result of the switch to an all-cash lifestyle, Rozzi is now down to her last $4,000 of debt. Without thousands of dollars of credit at her disposal, she spends a lot less, and items that she would have simply paid for using credit "have become a treat."

"There was this handbag that I wanted for years," she says. "Last summer I booked a bunch of shows, and had money. After I put some of it into savings and made a debt payment, I thought, 'You earned a $250 bag.' It felt so good to buy it in cash."

Her advice to someone considering a switch to an all-cash regimen? "Just do it," she says. "When you really think about it, it's not natural to buy things that you can't afford. It feels so much better if you use cash."

As for the future, Rozzi estimates that she has about six more months of payments before she is debt free, and she plans to get a new credit card only for occasional conveniences, like renting a car. Otherwise, she says, "It'll be in a vault."

More from LearnVest...