Yet another lame proposal for a $1 coin

The idea that the U.S. should begin minting a $1 coin and do away with the iconic dollar bill resurfaces every few years

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

You are now subscribed

Your newsletter sign-up was successful

The idea that the U.S. should begin minting a $1 coin and do away with the iconic dollar bill resurfaces every few years. People won't use it, and businesses hate the idea, but the dollar coin keeps coming back like…well…a bad penny.

In the 1970s it was the Susan B. Anthony Dollar. If they used them at all, people confused them for quarters, and any transaction involving them was bound to require explanations to both a cashier and, possibly, a store manager.

In 2000 it was the "golden dollar" with the image of Lewis and Clark's Shoshone guide Sacagawea. More recently, in 2007, new dollar coins were minted with the images of former presidents on the front.

The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Nobody used those, either.

In a white paper released this month researchers from the Federal Reserve were asked to study the viability of the dollar coin as a replacement for the dollar bill and their findings were as follows:

The overarching goal of this study is to provide an analytical framework for the public to better understand the effects, risks, and benefits of withdrawing the $1 Federal Reserve note from payment system circulation. This paper finds that under a broad range of assumptions the $1 Federal Reserve note is currently the more efficient payment instrument compared with the $1 coin. [Federal Reserve]

Roughly translated from Fed-speak, this means: "The dollar coin is a terrible idea. Please stop bothering us with it."

The researchers found that the use of dollar coins is "inherently inefficient" within the payments system. Because people use coins differently than notes, they found, the Mint would need to produce more than one dollar coin for every dollar bill taken out of circulation.

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Dollar coins are also not cost-effective, according to the study. They cost much more to make on a per-unit basis and the difference "is not offset by the longer life of the coin."

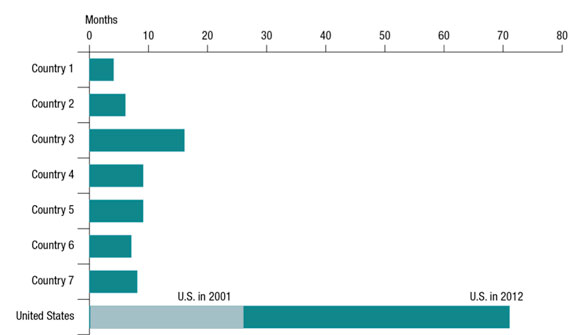

Turns out, the old dollar bill is the workhorse of the currency world. The Fed looked at a number of other countries that have replaced their lowest denomination notes with coins, and determined that the average life of the note being replaced was 10 months.

The dollar bill, by contrast, stays in circulation for an average 70 months. The difference is the cotton-linen blend of paper used by the U.S. Mint, which is far more durable than the cotton substrate used in other countries.

Low-denomination note life in various countries, 2001

Costs incurred by the private sector from switching to a dollar coin, which would include increased transportation costs related to the heavier coin and retrofitting of existing currency-handling equipment, they found, could run into the hundreds of millions of dollars.

The Government Accountability Office has been one of the primary drivers of the push to move to a dollar coin, releasing various studies over the years insisting that it would save the government money.

However, the Fed researchers argued that the GAO's assumptions — including an overly optimistic replacement rate for the coins — were so uncertain as to call the agency's findings into question.

The Fed's findings ought to be the final stake through the heart of the dollar coin, but it keeps turning up like a bad penny.

More from the Fiscal Times...

-

Quiz of The Week: 14 – 20 February

Quiz of The Week: 14 – 20 FebruaryQuiz Have you been paying attention to The Week’s news?

-

The Week Unwrapped: Do the Freemasons have too much sway in the police force?

The Week Unwrapped: Do the Freemasons have too much sway in the police force?Podcast Plus, what does the growing popularity of prediction markets mean for the future? And why are UK film and TV workers struggling?

-

Properties of the week: pretty thatched cottages

Properties of the week: pretty thatched cottagesThe Week Recommends Featuring homes in West Sussex, Dorset and Suffolk